Trading recommendations for the EUR / USD pair on July 29

EUR / USD

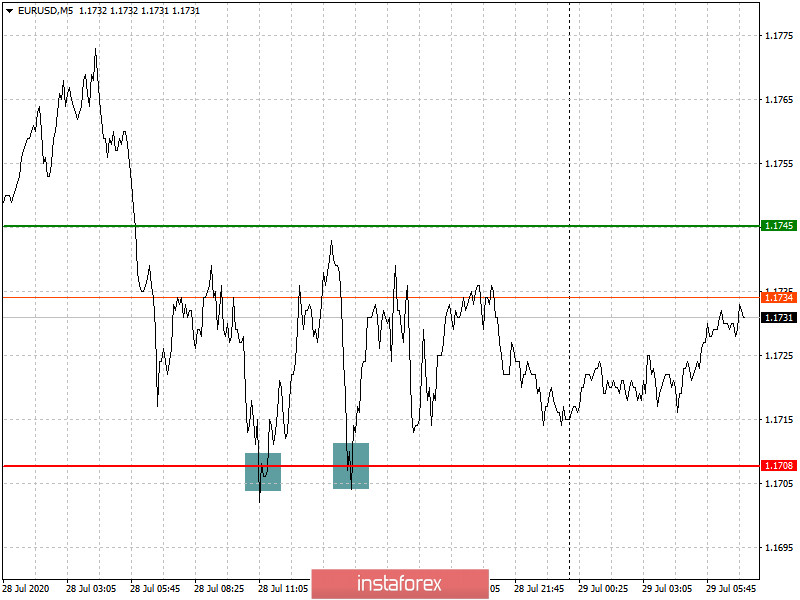

Analysis of transactions

Several attempts to sell the euro were made yesterday, but they all failed since the quote moved into a narrow range, which usually happens in the market before the release of important reports or before important economic events.

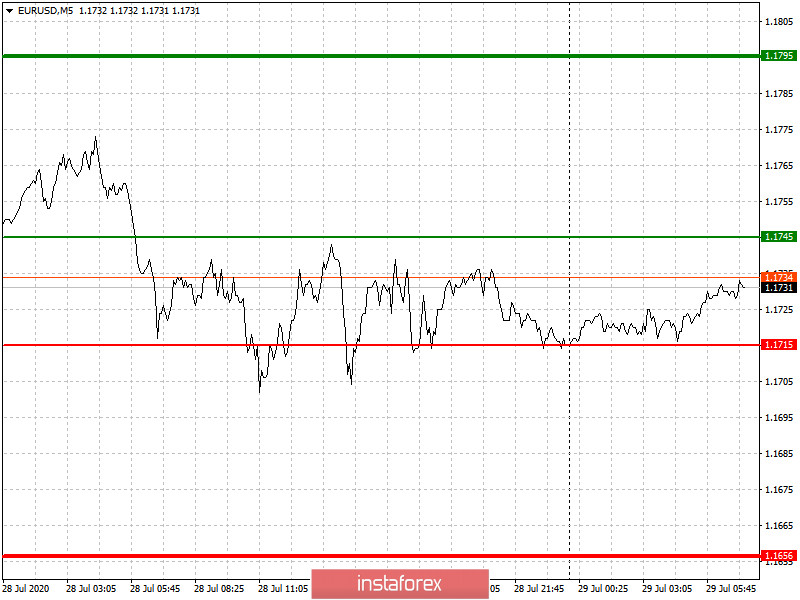

Today is the second day of the FOMC meeting, during which the members will make a number of decisions on the current monetary policy. In other words, the Fed will announce its decision on interest rates today. If the rates remain unchanged, no changes will occur in the pair since many economists are counting on such an event. Therefore, there is a risk that the pair will continue to remain in a narrow channel.

- Buy positions when the quote reaches the level of 1.1745 (green line on the chart), targeting a rise to the level of 1.1795. Exit the market at the value 1.1795.

- Sell positions after the quote reaches the level of 1.1715 (red line on the chart), targeting a drop to the level of 1.1656. However, such could occur only in the second half of the day, when the decision of the Fed on interest rates is finally published. Nevertheless, exiting the market at the level of 1.1656.

Trading recommendations for the GBP / USD pair on July 29

GBP / USD

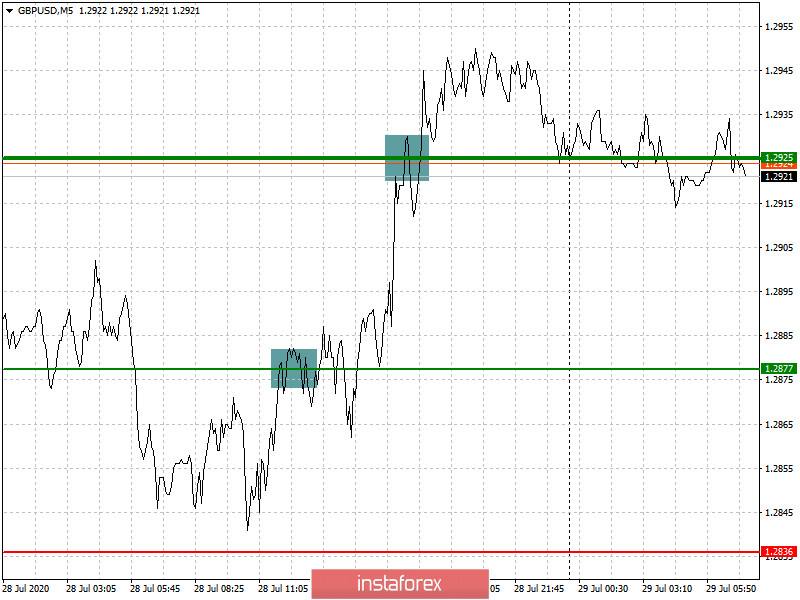

Analysis of transactions

A good "buy" signal was formed at the level of 1.2877 yesterday, which resulted in a profit of about 50 pips. The 5-minute chart shows that after reaching the level of 1.2877, the British pound continued to rise to the target level which is 1.2925, where it was necessary to exit the market to reduce the chance of losing profit.

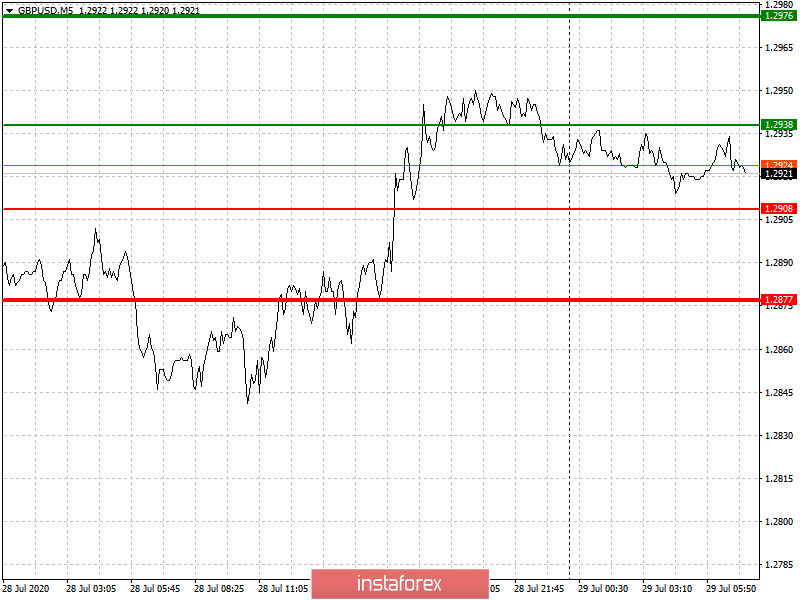

No important macroeconomic report in the United Kingdom is expected today, so the pound will only rise if the US dollar continues to decline today.

- Buy positions when the quote reaches the level of 1.2938 (green line on the chart), targeting a rise to the level of 1.2976 (thicker green line on the chart). Take profit at a value of 1.2976.

- Sell positions after the quote reaches the level of 1.2908 (red line on the chart), targeting a drop to the level of 1.2877. Any decisions of the Fed towards support for the US economy could reduce demand for the British pound, so it is best to exit the market at the level of 1.2877.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română