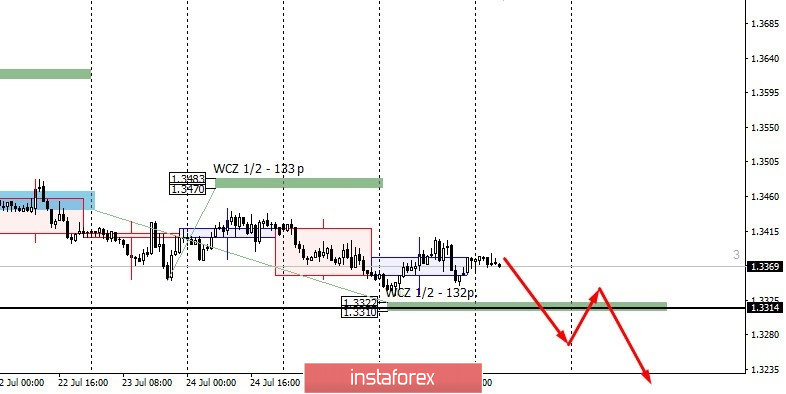

The fall of the pair is a priority, so keeping sales will be beneficial. The 1.3314 level is within the average daily move, which is the June low. A test of this level will increase the likelihood of a large demand.

It is important to note that the June low coincides with WCZ 1/2 1.3322-1.3310. This indicates the importance of the range for making trading decisions.

An alternative pattern of continuing the fall will develop if the close of today's trading occurs below 1.3314. This will increase the likelihood of the Canadian dollar strengthening even further

Daily CZ - daily control zone. The area formed by important data from the futures market, which changes several times a year.

Weekly CZ - weekly control zone. The zone formed by important marks of the futures market, which changes several times a year.

Monthly CZ - monthly control zone. The zone, which is a reflection of the average volatility over the past year.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română