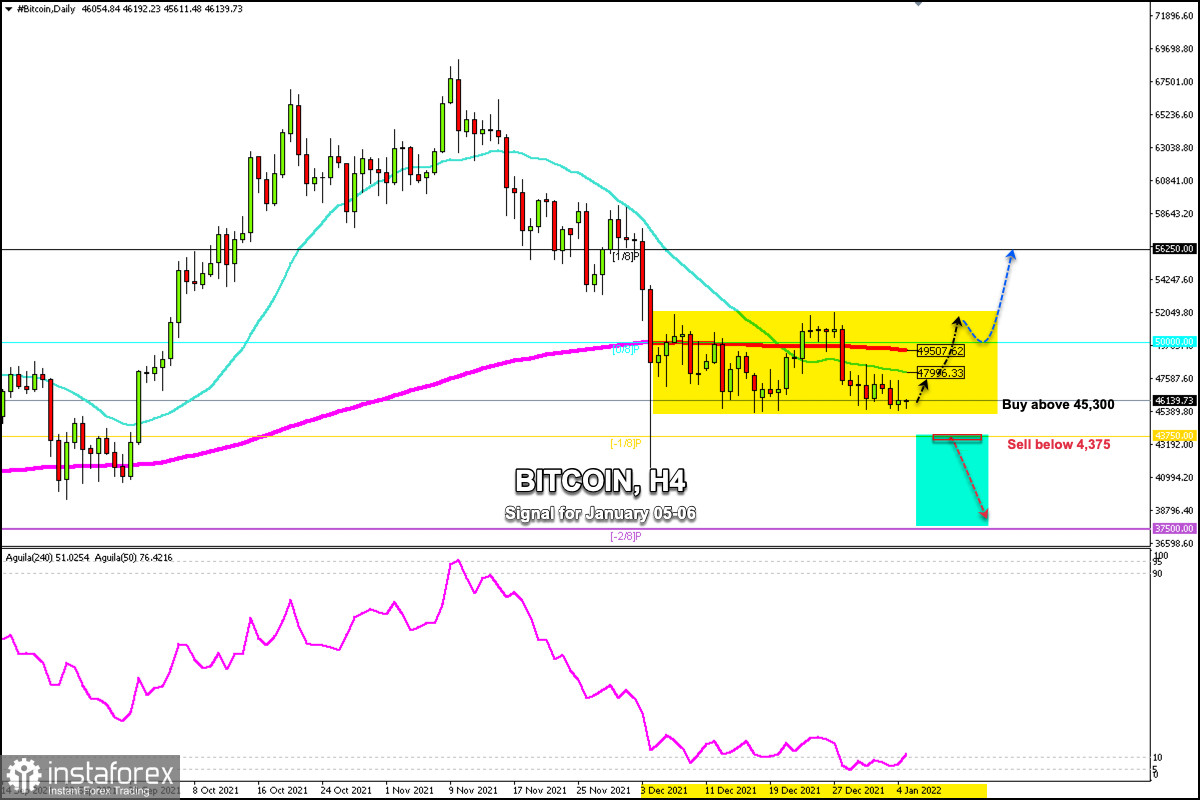

Since the sudden drop on December 3, the price of Bitcoin has stagnated oscillating inside the trading range between the two borders of 51,980 - 45,360. This consolidation around 45,000 is attracting the bulls for a long-term bullish move.

BTC is likely to retest the range high of this sideways move, around the 200 EMA at 51,980.

Bitcoin price bounced above the support of 45,580 for the eighth time and currently sits at 46,130, just below the 21 SMA and 200 EMA.

Despite the fact that the outlook is improving for the crypto, a break of the support of 45,300 will reveal weakness among buyers. This move will put pressure on BTC to test the low of December 3, 2021 at 41,672. So, the price fall to the psychological level of 40,000.

Conversely, a consolidation above the psychological level of $50,000 and above the 200 EMA could mean that market optimism is improving and BTC could rise to 1/8 of Murray at 56,250.

Since december 3, the eagle indicator is hovering above the oversold zone. A return above the 10-point level could give Bitcoin a chance to regain strength and challenge the psychological level of 50,000.

Our trading plan for the next few hours is to buy above the range zone of 45,300 with targets at 47,996 (21 SMA) and up to 49,507 (200 EMA). A breakout and consolidation above the psychological level of 50,000 could be the start of a new bullish sequence with targets at 56,250.

Support and Resistance Levels for January 05 - 06, 2022

Resistance (3) 48,329

Resistance (2) 47,223

Resistance (1) 43,317

----------------------------

Support (1) 45,224

Support (2) 44,318

Support (3) 43,225

***********************************************************

Scenario

Timeframe 4-hours

Recommendation: Buy

Entry Point 45,300

Take Profit 47,996, 49,507 (200 EMA)

Stop Loss 44,200

Murray Levels 50,000 (0/8), 56,250 (1/8), 62,500 (2/8)

***********************************************************

Alternative scenario

Recommendation: Sell

Entry Point 43,750

Take Profit 37,500

Stop Loss 44,250

Murray Levels 43,750 (-1/8) 37,500 (-2/8)

*********************************************************

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română