Buyers of the euro-dollar pair updated multi-month highs yesterday, but could not gain a foothold above the resistance level of 1.1750 (the lower limit of the Kumo cloud on the monthly chart). All other price barriers were literally demolished by EUR/USD bulls amid the general weakening of the US currency. Today, the dollar is trying to win back at least a small part of the lost positions, and in some cases it succeeds (for example, against the Canadian currency). As for the euro-dollar pair, we see a positional struggle between buyers and sellers. The pair has been trading within the 17th figure throughout the day: neither bulls or bears are able to make a price leap yet. The pair attracts sellers as soon as the price rises above the resistance level. And vice versa: the pair begins to be bought as soon as the price falls to the bottom of the 17th level. As a result, EUR/USD traders are stuck in the flat, although the pair is more willing to be sold on growth than be bought on declines.

The indecision of market participants is explained by the absence of a powerful "unipolar" news source. The economic calendar for Tuesday is almost empty, so traders have to once again chew on yesterday's topics, which have already been largely played by the market. For example, the topic of the coronavirus, which continues to exert background pressure on the dollar, has been dealt by the news that the American company Moderna has begun the final vaccine trials: a record number of volunteers - 30,000 people - will take part in the study. In addition, the daily increase in infected people slightly decreased on Monday relative to the previous days (+59,000, while the figure did not fall below the 60,000 mark over the past week). That is, on the one hand, the situation with the coronavirus remains difficult in the United States, but, on the other hand, the light that appeared at the end of the tunnel helped the dollar to stop its decline.

Macroeconomic reports are also controversial. Thus, the consumer confidence index from the Conference Board, which is based on a survey of Americans about the level of their confidence in the current state of the economy and future development, showed negative dynamics. If the indicator rose to 98 points in June, then it fell to 92 points in July, reflecting the increased fears of US residents about the second wave of the epidemic.

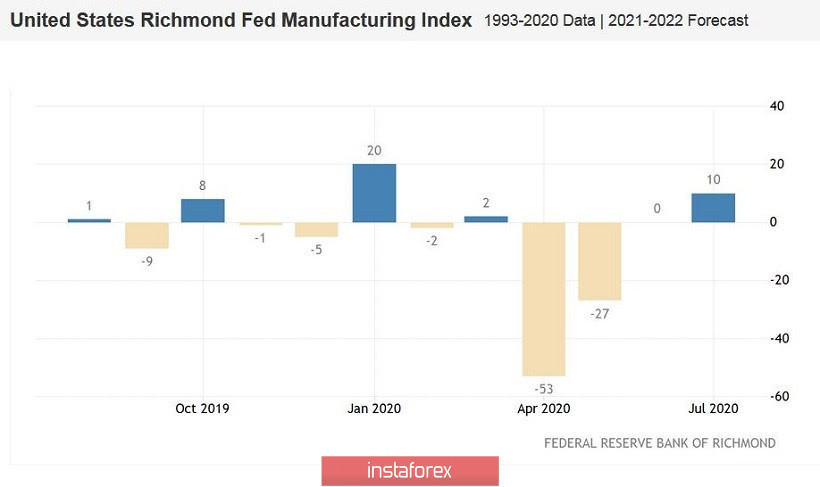

Meanwhile, the Richmond Fed Manufacturing Index (which is based on a survey of manufacturing companies in the region) unexpectedly showed strong growth. This indicator collapsed to -53 points in April, then began to gradually recover, although at a rather slow pace: it came out at -27 points in May, and at zero in June. Experts expected a modest increase to three points today, but the indicator jumped to 10.

But the positive effect of the release was offset by a message from the US Federal Reserve, which extended seven emergency lending programs. These programs were approved by the Fed at the height of the epidemic (in March and April), but they expired at the end of September. With today's decision, the Fed made it clear that it will take a soft and cautious position in the near future. It is also worth noting that the Fed's decision has been announced today, i.e. on the eve of the announcement of the July Fed meeting.

An uncertain situation is emerging with the new aid package for the US economy. A $1 trillion Republican bill is currently pending in the Senate. Senate minority leader - Democrat Chuck Schumer - just announced that the parties at this point are "too far away" for a consolidated decision. At the same time, he rather harshly criticized the bill: Schumer called the Republican initiative "completely inadequate", since it does not provide enough money for the safe opening of schools, does not protect Americans who find themselves in a difficult financial situation from the withdrawal of mortgaged housing, and tenants - from eviction.

In turn, House Speaker Nancy Pelosi (where Democrats control the majority) even suspected US President Donald Trump of personal gain in developing new stimulus measures. She suggested that Trump proposed to include an article on the costs of renovating the FBI headquarters in the new bill for personal gain. We are talking about the Trump Hotel, which is located opposite the Bureau's headquarters. According to Democrats, the head of the White House is interested in the security forces building being renovated (while the alternative is to move to another building), "so that no one can build a hotel on this attractive site for development" - on Pennsylvania Avenue in the very center of the US capital. This position of Pelosi suggests that it will be difficult for the Trump administration to get past the millstones of the Lower House of Congress.

Thus, the prospects for the dollar still look quite vague, despite the existence of reasons for corrective growth. Political battles in Congress, the coronavirus factor, conflicting macroeconomic statistics, the diplomatic war with China – all these factors continue to put pressure on the greenback. Therefore, selling the EUR/USD pair looks extremely risky now. But purchases can be considered after consolidating above the 1.1750 mark. This level of resistance was too tough for the pair's bulls yesterday, but buyers continue to besiege this price barrier. Once overcome, you can consider longs to the next resistance level of 1.1800. You are advised to place the stop loss at 1.1575 (the Tenkan-sen line on the D1 timeframe) – if the price goes below this level, the growth scenario will lose its relevance.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română