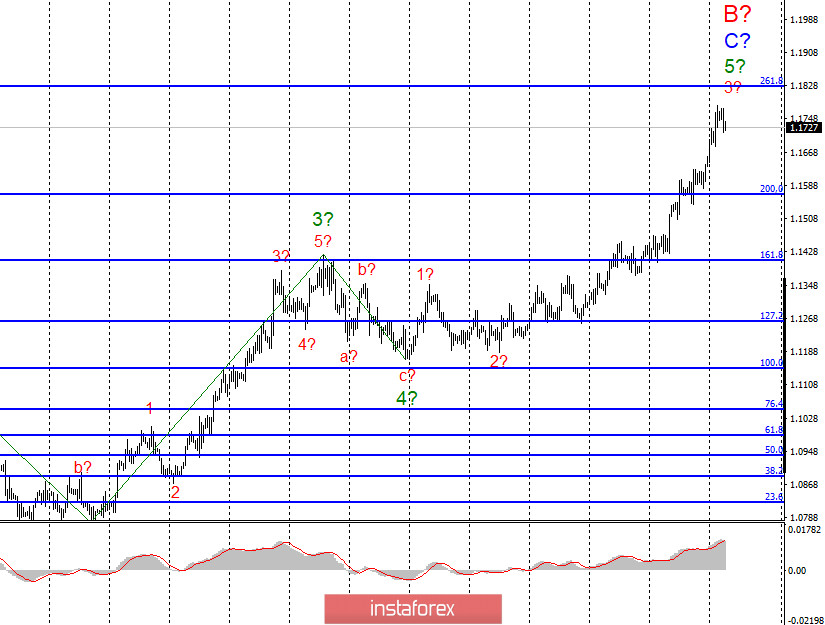

EUR/USD

On July 27, EUR/USD gained another 110 pips. Thus, the currency pair has been rising while wave 3 is being formed inside wave 5 inside C inside B. The wave itself looks rather extended. The current wave grid looks basically the same. It means that the pair is trading in the same fashion. After the current wave formation is over, I expect a minor retracement and another bounce anticipating wave 5 inside C inside B. A failed attempt of breaking 261.8% Fibonacci correction indicates that the market is ready to form a correctional wave.

Fundamental background

The single European currency is enjoying buoyant demand on Forex. Nevertheless, on Tuesday EUR/USD is retreating from the highs reached earlier. Meanwhile, the overall fundamental environment for EUR/USD is getting worse. The coronavirus pandemic is still raging across the US. Protesters in big US cities have been manifesting their anger in the streets for almost two months. The White House seems to know nothing how to deal with this havoc. Oddly enough, the authorities are turning a blind eye to rampant coronavirus rates. When it comes to protests, they deploy federal military forces to the most troublesome cities to crack down on rebels. In fact, this strategy has not proven its efficiency. For example, clashes between the civilians, the police, and federal law enforcement agents have been continuing for over a week in Portland, Oregon. The protesters claim they assemble entirely with peaceful purposes. However, the peaceful character of such meetings is out of the question. The Internet is flooded with photos of the literally ruined city. The rebels are going to set fire to the local court building with a view of venting their fury about the US legislation. Portland is not the only city stricken with this illness. Major cities in the US have been affected by the defiant mood.

Indeed, lingering violent clashes have been causing a headache to Donald Trump, complicate things for the whole US government, and worsen the pandemic rates across the country. Amid such developments, I guess the US dollar will find it hard to regain footing. Wave 5 inside C inside B is about to finish soon. However, in light of such news the completion of save 5 is getting more difficult. So, the whole wave structure could change. Meanwhile, I still hope for the integrity of the wave structure and its resilience.

Conclusions and trading tips

EUR/USD is likely to continue with the formation of the rising wave C inside B. Thus, I would recommend buying the currency pair with the target at 1.1827 that equals 261.8% fibonacci correction. Buy orders should be made upon every upward signal generated by the MACD indicator with prospects of a further formation of wave 5 inside C inside B.

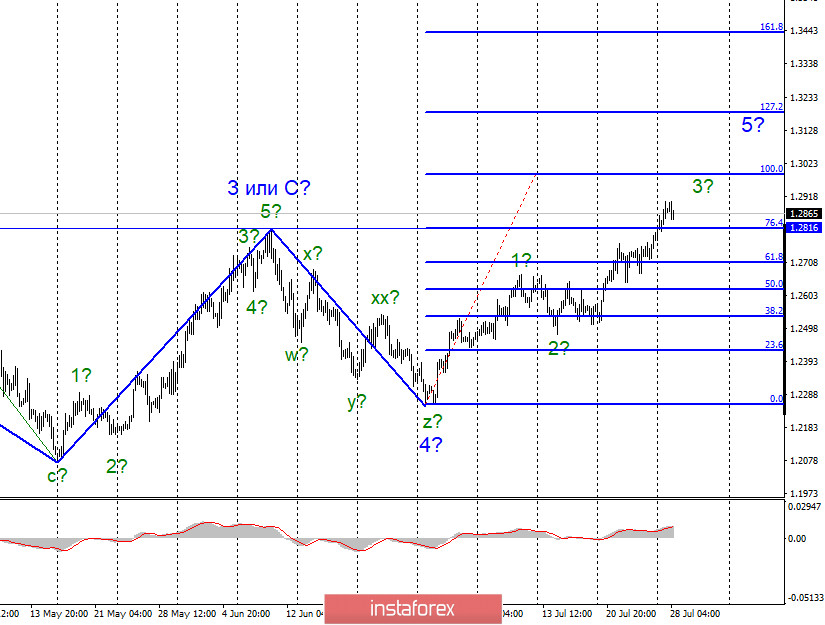

GBP/USD

Fundamental background

The UK did not release any important news on Monday. Nevertheless, demand for the pound sterling is still high. The report on US durable goods orders did not support the US currency but it did not weaken demand for the greenback. GBP/USD has been trading in the same manner as in the recent days. Tomorrow the policy meeting of the US Fed is on investors' radars. Experts do not foresee any changes in the Fed's monetary policy.

Conclusions and trading tips

GBP/USD complicated the ongoing wave structure which suggests the formation of a rising wave. At present, I would recommend long deals on GBP/USD upon every upward signal generated by the MACD indicator with the target at 1.2990 which equals 100.0% Fibonacci correction.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română