Good day, dear traders!

On the eve of the decision of the Federal Reserve System (FRS) of the USA on interest rates and the subsequent press conference of the chairman of this department Jerome Powell, the US dollar continues to suffer losses across the entire spectrum of the foreign exchange market. It is unlikely that the rhetoric of the head of the Fed will provide significant support for the US currency and radically change the situation. And if we take into account the disappointing forecasts for US GDP for the second quarter, which is reduced to minus 34.1%, the prospects for a further fall in the US currency look very likely.

Looking at today's economic calendar, you can note the retail sales index according to the Confederation of British Industrialists, which will be published at 11:00 London time. Later, at 14:00 (London time), the United States will submit a report on housing prices from S&P to investors, and at 15:00 (Moscow time), the consumer confidence index will be published.

Meanwhile, a new phase of COVID-19 vaccine development has been launched in the United States. In the UK, scientists from Oxford in the second phase of the study achieved positive results when testing a vaccine against a new type of coronavirus infection. The development of a vaccine from COVID-19 and the Russian Federation is progressing. However, while the essence of the matter, the United States holds the world's leading daily increase in the number of infected, and Europe is growing fears that the second wave of coronavirus can overwhelm the continent.

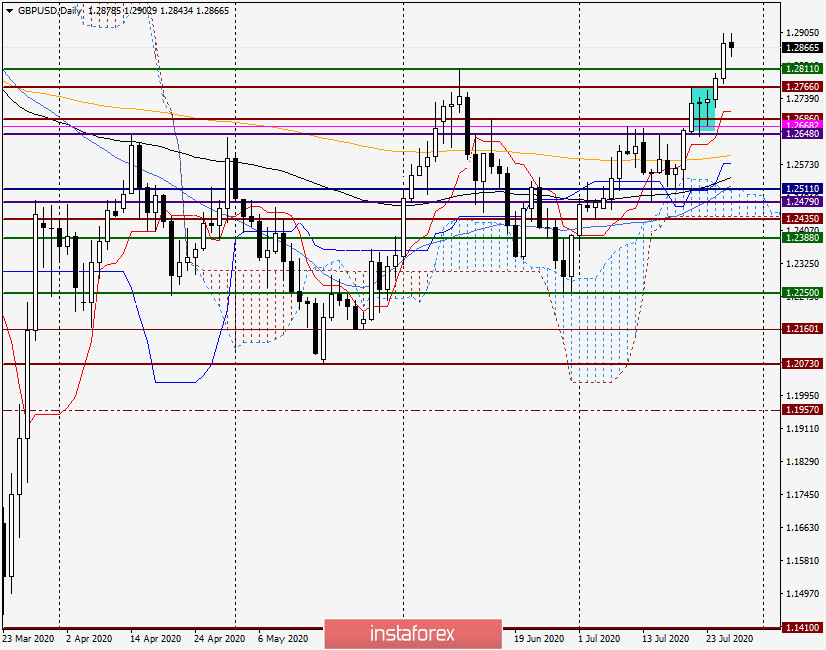

Daily

As a result of yesterday's fairly significant growth, the pound/dollar currency pair rose to a strong technical level of 1.2900, but Monday's trading ended under this mark, at 1.2877. However, looking at the chart, we see that the pair more than confidently overcame the resistance at 1.2811, which opens the way for further movement in the north direction.

At the moment of writing, the pound/dollar pair is trading with a slight decrease near 1.2861. If the rise continues and yesterday's maximum values are updated, the pair will test a strong price zone of 1.2930-1.2960. If this area is passed, the pound/dollar will rush to the equally significant psychological and technical area of 1.3000-1.3050. It is clear that in this situation, the main trading recommendation is to consider purchases that are better to open not at the peak of the market, but after corrective pullbacks.

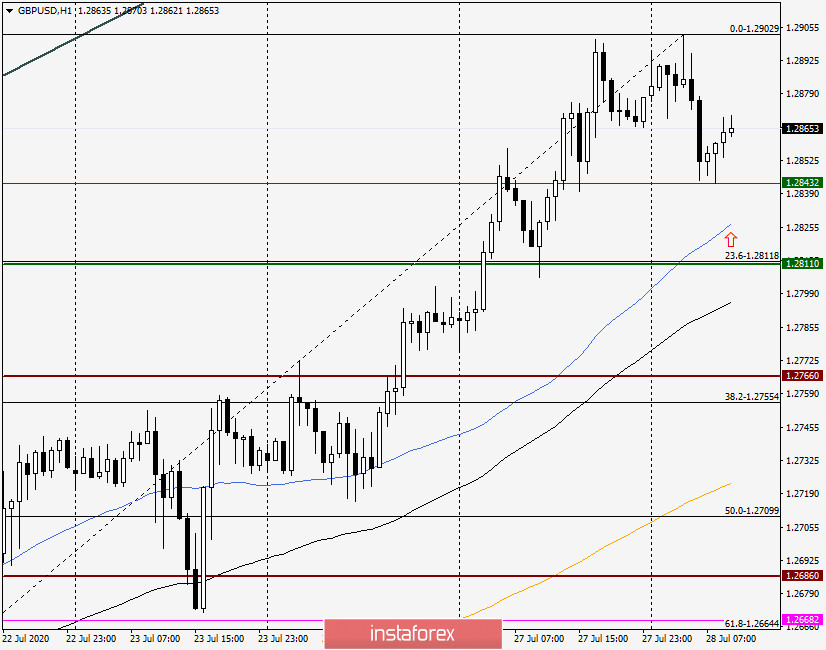

H1

Today's attempts of the pair to break through the significant level of 1.2900 were not successful. From 1.2902, a corrective pullback took place, which ended at 1.2843, after which the pair turned up and demonstrated its intention to try its luck once again on the passage of the 29th figure.

So, the main trading recommendation is to buy. It is risky and aggressive to try to buy sterling from the current prices, near 1.2863. Less risky and at more favorable prices, I suggest considering opening long positions on GBP/USD after a short-term decline in the price zone of 1.2825-1.2800. At the same time, if the quote is fixed below the level of 1.2800, there will be some doubts about the further ability of the pound to move in the north direction.

Given the strength of the levels of 1.2900, 1.2930 and 1.2960, the appearance of bearish candle patterns near these marks can be used to open sales with small goals in the area of 1.2860-1.2820. The idea is risky since it is against the current upward trend.

I wish you successful trading!

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română