To be honest, it is already tiring to write about a long overdue correction and overheating of the currency market for the second week in a row. Logically, everything is so. But something goes wrong every time. Then, amid an empty macroeconomic calendar, various politicians come to the fore with their brilliant ideas, from which they get goosebumps. On the other hand, the statistics come out completely different than expected. In general, sheer confusion and uncertainty. So yesterday, when it seems like everyone had to follow only orders for durable goods, data on which were published in the United States, American politicians broke into the measured life of the market. And they made a show of it. At the beginning of last week, everyone watched with bated breath the multi-part drama as European politicians try to find a way to save the European economy, and this helped to strengthen the single European currency. So much so that it also dragged other currencies with it. So far, a similar initiative of the American people's representatives is yielding diametrically opposite results. The dollar continued its cheerful weakening. For this, only one paragraph of the wonderful project drawn up by Donald Trump and his team was enough. Of course, the project to save America impresses with its generosity, since it is much more than its European counterpart. The White House suggests spending as much as $ 1 trillion on all good against all bad, only where this money causes slight confusion. It seems like the economy needs to be recovered from the consequences of the coronavirus epidemic, and it is completely incomprehensible how funding for the construction of a new FBI office is combined with this. Is the FBI now the largest concentration of epidemiologists and economists in the world? Or does the White House intend to fight not with economic problems, but with all kinds of Chinese and Russian spies? In short, there are quite a few questions. And they are clearly not in the plane of the recovery of a badly damaged economy. And rest assured that there are plenty of such items in this wonderful project. In general, the Congress is expected to have a heated debate, and the adoption of at least some measures to restore the economy will take a long time. So it is not surprising that the dollar will weaken further. With this approach, the dollar will repeatedly update local lows. That is, the single European currency with the pound may well climb higher.

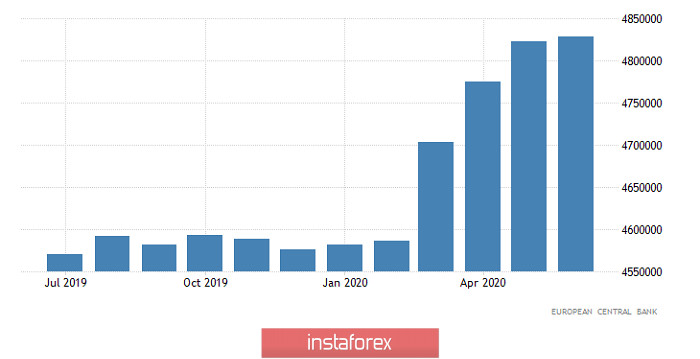

At the same time, European statistics were not optimistic yesterday but rather the opposite. The growth rate of consumer lending remained unchanged, while the growth rate of lending to the corporate sector slowed down from 7.3% to 7.1%. But they were expecting an acceleration of growth rates to 7.6%, although this was offset by the fact that the growth rate of consumer lending should have slowed down to 2.3%, they remained unchanged. Generally, the decline in lending to companies indicates that the pace of recovery of the European economy will be somewhat slower than expected. Nevertheless, these data are not so significant, so in any case, they could not have a significant impact on the market.

Lending to the corporate sector (Europe):

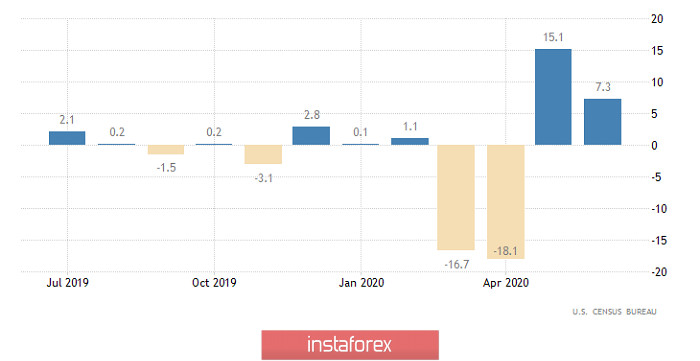

As for orders for durable goods, it did not rise by 5.0% and not even 7.0%, as the most inveterate optimists predicted. Their growth was as much as 7.3%, which is very impressive. But the brilliant initiatives of American politicians put an end to all prospects of the long-awaited correction.

Durable Goods Orders (United States):

It is clear that the focus at the moment is on the very same plan to support the American economy, so everything depends on how heated the debates in Congress will be, which will certainly won't be easy. After all, the project was drawn up by the Republican Party, and the majority in Congress belongs to the Democrats, who hate Donald Trump so much that they cannot eat. Therefore, with the correction in the currency market, it will probably have to wait a little longer. They will not argue there for a long time, since the situation in the economy really does not tolerate delay. So, they will exchange accusations for a couple of days, especially on the TV camera, since the elections are coming soon. And then, joining hands together, they will show the world the most ambitious and large-scale project to save the native economy. So for macroeconomic statistics, no one will watch at least today. Moreover, there is no particular one. Only S&P/CaseShiller publishes its house price index. An indicator that does not have much weight. Nevertheless, it can be noted that the rate of growth in house prices may accelerate from 4.0% to 4.1%.

S&P/CaseShiller House Price Index (United States):

The euro/dollar pair adheres to an upward development, as a result of which one-year highs were updated, and the quote managed to touch the coordinates of 1.1780. It can be assumed that if the current pullback manages to evolve into a correction, focusing below the level of 1.1700, then updating the current high of 1.1780 will not take a long time.

The pound/dollar pair adheres to the tactics of weakening the US dollar, during which important price levels were broken, and the quote was fixed in the area of this spring 1.2850/1.2900. It can be assumed that if the correction does not come, and the quote manages to consolidate above the level of 1.2910, then the movement to the psychological level of 1.3000 will be a very realistic scenario for the market development in the coming days.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română