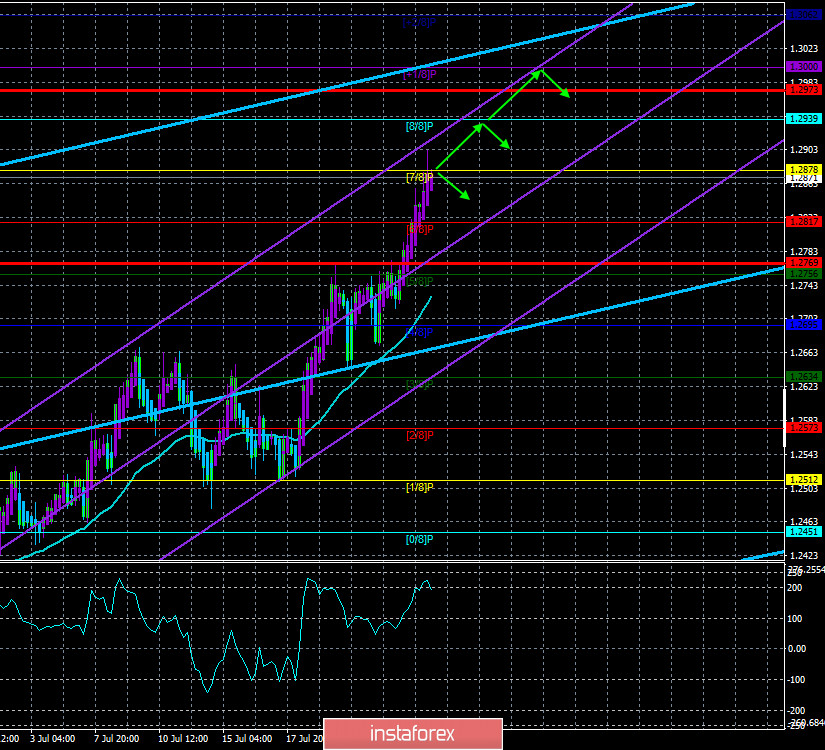

4-hour timeframe

Technical details:

Higher linear regression channel: direction - upward.

Lower linear regression channel: direction - upward.

Moving average (20; smoothed) - upward.

CCI: 190.3118

We would like to start this article with "but the British pound is more expensive because...", but the British pound is not expensive, it depreciates the US dollar. It is getting cheaper on all fronts of the currency market. Even gold, which is now trading around 2000 per troy ounce, has increased in price in part because the US currency has fallen in price. Thus, we can't say anything remarkable for the British currency at the end of Monday. No macroeconomic publications were scheduled for this day in the UK. The only macroeconomic report from the US was ignored by traders. No important events occurred on this day. Everything still revolves around the "coronavirus" epidemic in the US, around mass riots and absolutely inexplicable actions of the US government. It is completely unclear what Donald Trump and his subordinates are going to do with so many people infected with COVID-2019. It is not clear why Trump does not listen to the advice of doctors and Anthony Fauci personally in a situation when it is the doctors who should be asked for advice. It is absolutely unknown what will happen to the country if the rate of virus spread continues to remain at 60-70 thousand per day. After all, even if all this is explained by Trump's desire to restore the economy, it will not recover if half the country becomes ill. People will not lead an active life, will not go to work, will not take part in the economic recovery. They will only receive unemployment benefits and wait for the epidemic to end. Thus, from our point of view, the presidential administration is digging a hole for itself. And the main contender for the post of President in the 2020 election, Joe Biden, does not even need to comment on anything. Trump's ratings continue to fall, not only Democrats are criticizing him, but the public's confidence in Biden is growing.

An interesting opinion poll was conducted by the NORC Research Center in the USA. According to this poll, an absolute majority of Americans, 100 days before the presidential election, believe that the country is going in absolutely the wrong direction. Only 32% of respondents are satisfied with how the current presidential administration is coping with the pandemic, only 38% of respondents believe that the country's economy is in good condition, and 80% of respondents believe the current political course is wrong. By and large, this is another sociological study that shows that Trump will not be re-elected in November.

The economist periodical made an even broader and deeper analysis, according to which, the probability of winning the election of Joe Biden is 91%. This forecasting model takes into account not only social opinion, but also the situation with the epidemic in each state. According to the same study, Biden is 99% likely to win the majority of American votes in the election. However, given the peculiarities of the American electoral system, in which the winner is not the candidate who will get the most votes, but the one who will get the most "electoral votes", this indicator is not too important. Trump may not get a majority of American votes, but still win the election if the most "important" states give a large number of "electoral votes" for him. However, the forecast model of the economist also says that Biden will get about 250-415 electoral votes, while 270 will be enough to win. Thus, Biden's chances of winning the election are 91%. The prediction model also allows you to predict what the results of voting for individual states will be. So Biden is highly likely to win in 25 states, and Trump - in 20.5 more states are called "controversial" and the results for them are unpredictable.

But for traders of the pound/dollar pair, the question remains extremely important:when will the market "remember" that the situation in the UK is no better? If things are relatively calm in the European Union, they are not in the UK. The fact that the prospects for the UK economy are vague and this applies not only to this year, but also to the next, and 2022, has not been written or spoken about yet except by a lazy person. There were no trade agreements with the European Union and the United States. The economy is already weakened by two blows, Brexit itself and the "coronavirus crisis". Thus, in the situation with the pound, we can draw a conclusion with 100% probability: the pound is growing only because the dollar is falling. There is no reason to strengthen the British currency now and there can not be. Even positive and optimistic rumors about the negotiations for Brexit now, and it is on them that the pound has repeatedly shown growth in the period 2016-2019. But now there is not even this, because the government of Boris Johnson puts almost ultimatums in negotiations with Brussels. And the European Union does not follow London's lead. Who will lose the most from this will become clear in 2021.

No major publications are scheduled for Tuesday, July 28 in the UK and America. However, traders do not need statistics right now. There are enough reports that things are still bad in America for the dollar to keep getting cheaper. Thus, we recommend that market participants continue to trade "on the trend", without trying to predict a downward turn. The end of the upward trend can happen tomorrow, or in two weeks. There are no technical signs of the end of the upward trend at the moment, neither on the lower timeframes nor on the higher ones.

During this week, at least two important events will occur for the US currency. Publication of GDP for the second quarter in the US, as well as summing up the results of the Fed meeting. On the one hand, these two events can "finish off" the US dollar, and on the other hand, it is unlikely that traders will pay attention to the economic problems of the dollar and sell it even more. Thus, it is absolutely possible that both of these very high-profile events will simply be ignored by the markets, but the US currency will still continue to fall. In any case, we will know this on Wednesday, when the Fed's meeting results and Jerome Powell's press conference will take place.

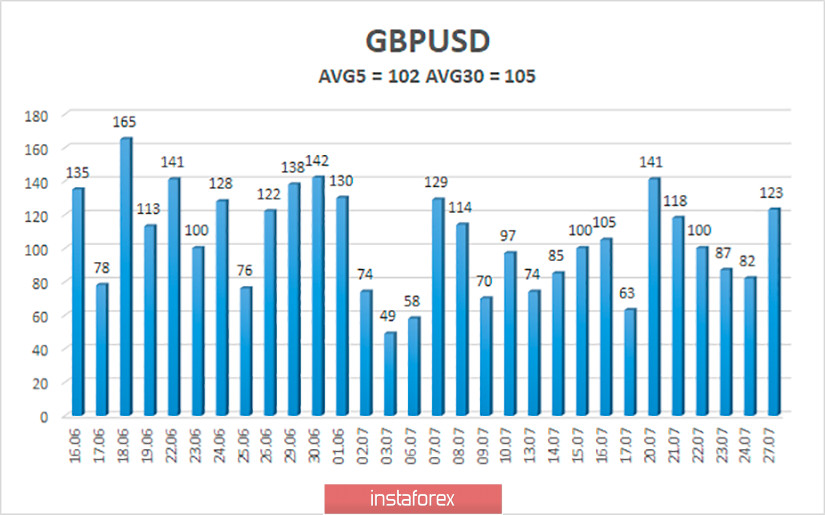

The average volatility of the GBP/USD pair continues to remain stable and is currently 102 points per day. For the pound/dollar pair, this value is "average". On Tuesday, July 28, thus, we expect movement within the channel, limited by the levels of 1.2769 and 1.2973. A downward turn of the Heiken Ashi indicator will indicate a downward correction.

Nearest support levels:

S1 – 1.2817

S2 – 1.2756

S3 – 1.2695

Nearest resistance levels:

R1 – 1.2878

R2 – 1.2939

R3 – 1.3000

Trading recommendations:

The GBP/USD pair continues to move up on the 4-hour timeframe. Thus, it is recommended to continue trading for an increase with the goals of 1.2939 and 1.2973 (the level of volatility on Tuesday), until the Heiken Ashi indicator turns down. Short positions can be considered after fixing the price below the moving average with the goals of 1.2695 and 1.2634.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română