Latest COT report (Commitments of Traders). Weekly outlook for EUR/USD

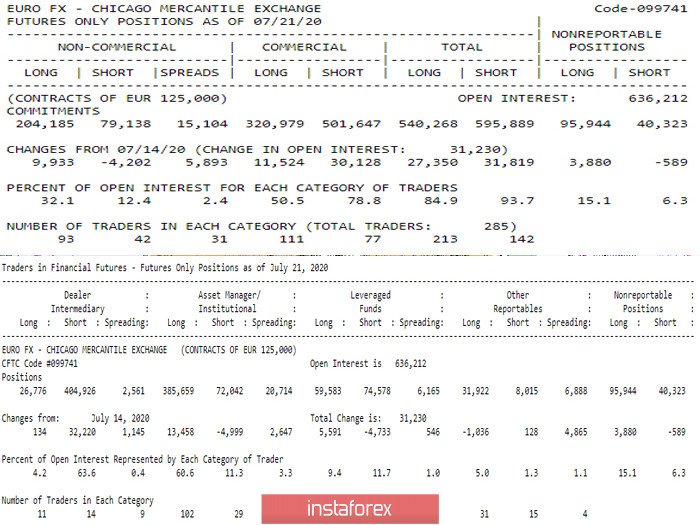

Over the last reporting period, open interest in the euro not only increased, but increased by an impressive amount for the latest reports. The increase amounted to 31,230 contracts, as a result, according to the COT report (Commitments of Traders on 07.21.20), the open interest in the euro is 636212. It can be noted that the major players have chosen the tactics of active investment (total +27350 long positions and +31,819 short positions) this time, significantly increasing their net positions. The dominance of the bullish direction in the Non-Commercial group is now 19.7%, the advantage of the bears in the Commercial group is 28.3%, the gap between long and short positions in Dealer Intermediary is close to 60% (59.4). Due to the fact that the key players in charge of the current trend were so effective, the upward trend returned to the daily and weekly charts.

The main conclusion

The activity and the amount of investment growth, as well as the priority outlined in the previous report, allowed the players to achieve significant results and prospects for growth. At the moment, the trend continues.

Technical picture

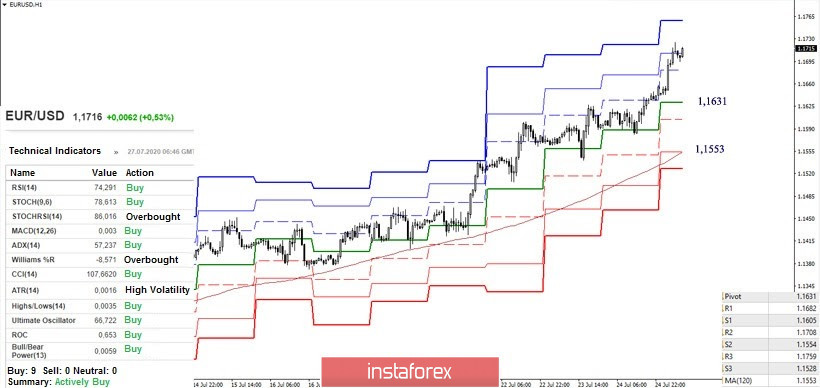

Technical analysis only confirms the current superiority of players to increase. The bullish traders had previously worked out the upward daily target for the breakout of the Ichimoku cloud, indicating significant slowdown when testing its first target reference. Further, the rise was continued and its main reference point was the weekly target for the breakdown of the cloud (1.1695 - 1.1813). We are now witnessing the testing of the first target reference point of the weekly target. The target is strengthened by the influence of the monthly resistance (1.1740 lower border of the monthly cloud). Since a fairly strong resistance has been met, we can expect another slowdown in the near future. Changes in the pair's mood will contribute to the emergence of a new downward correction, the depth of which will depend on the priorities of the major players.

An upward trend dominates in the lower halves. All analyzed technical instruments on H1 support the players to rise. Today, the pair has already completed the second resistance of the classic pivot levels (1.1708), R3 (1.1759) remains as an upward reference point within the day. The key support for the lower halves is now located at 1.1631 (central pivot level) and 1.1553 (weekly long-term trend).

Ichimoku Kinko Hyo (9.26.52), Pivot Points (Classic), Moving Average (120)

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română