The CFTC report published on Friday confirmed the trends of the previous weeks – prices move on the currency and commodity markets in full accordance with the positions of speculators. The largest increase is in the euro and gold, and if the euro just broke through the March peak, rushing further upwards, then gold futures went above the 2011 high, which may indicate serious problems for the entire global monetary system.

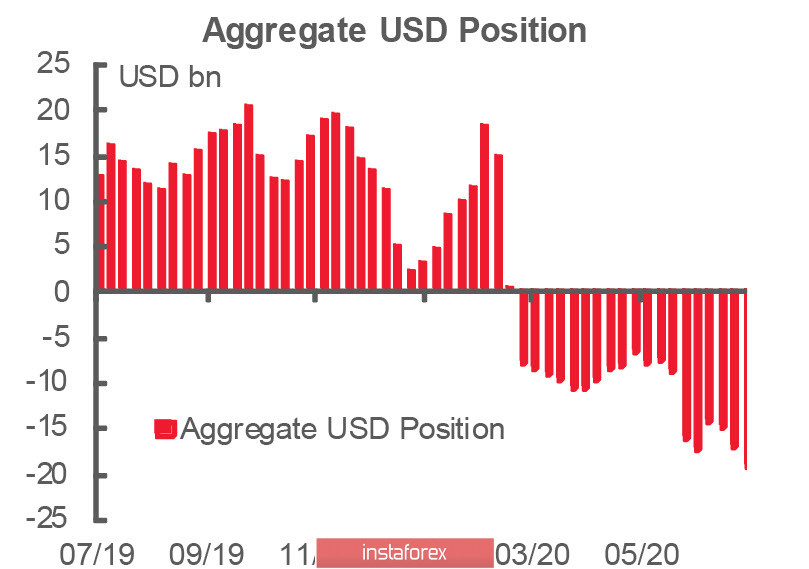

The net short position in the US dollar rose 2.201 billion to 19.195 billion, the largest dollar short since 2018.

This is too much against the dollar. While business activity in most countries is recovering steadily, the PMI Markit in the services sector in July unexpectedly showed only 49.6 points instead of rising to 51p, which indicates huge problems in the main economic sector. The growth of initial unemployment claims resumed, and on Wednesday, when Fed Chairman Powell appears in front of reporters at a press conference at the Fed meeting, he will have to be very resourceful to calm the markets.

GDP data for the second quarter are due on Thursday, with an unprecedented 34% decline is expected. US Treasury Secretary, Steven Mnuchin, said on Sunday that Republicans have finalized their latest anti-coronavirus legislation, which is expected to cost $ 1 trillion, due to be presented today. The weekly $600 unemployment benefit ended this weekend and the week will be marked by a struggle in Congress, which is unlikely to support the dollar.

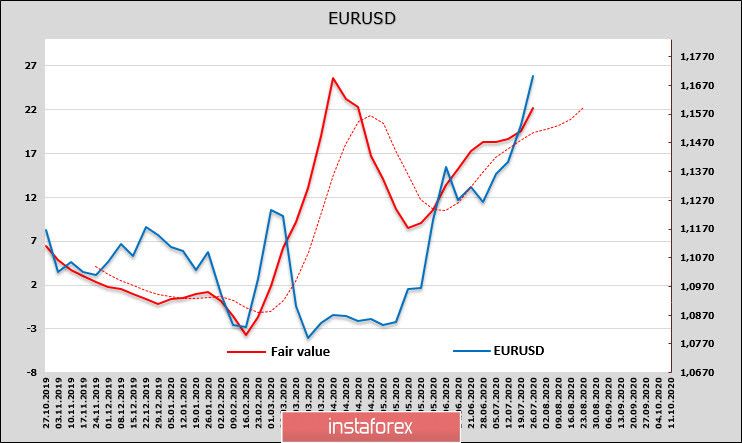

EUR/USD

The euro long position reached $ 18.018 billion, the highest since spring 2018. The target price is still upward and shows no signs of a reversal, increasing the chances of a continuation of the bullish trend.

The growth of the euro is supported by several factors at once. The Markit report on the Eurozone PMI in July showed a significant excess of forecasts, the composite index consolidated in the expansion zone at 54.8p. It is obvious that the change in business sentiment will be confirmed by similar studies from Sentix and Ifo, since the decision to create a recovery fund was received by investors extremely positively. For the first time in history, the money of the surplus northern countries will be directed to support the southern countries, which is regarded as a serious step in favor of issuing Eurobonds, in fact, in favor of creating a powerful mechanism for attracting foreign capital to the EU.

In connection to this, the EUR/USD is growing steadily without correction, which from a technical point of view increases the chances of a pullback, but fundamentally, there is no reason for a reversal. The recommendation is the same - buying on pullbacks and adding to positions when the maximum is renewed, a weak resistance zone is forming at 1.1810/30, which can serve as a short-term reference.

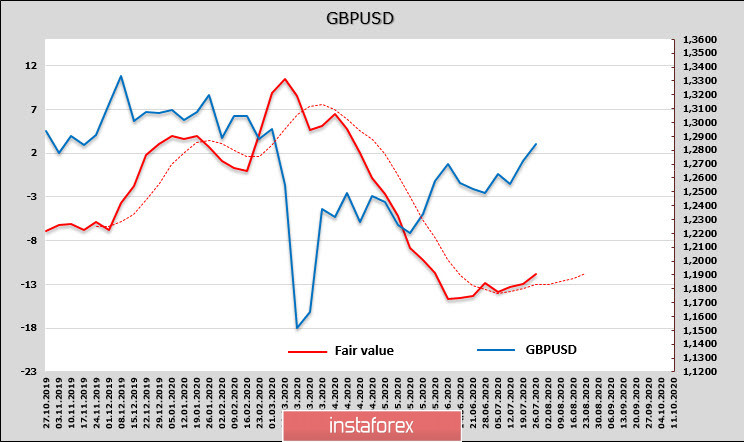

GBP/USD

The pound rose following the global trend towards the weakening of the dollar, but still does not have its own driver for growth. The net short position on CME is up 134 million, the estimated price is directed upwards, but barely exceeds the level of the long-term average, so the current growth is unstable and will end the moment the dollar sell-off stops.

Friday brought conflicting news for the pound again. Macroeconomic indicators look confident - retail sales in June grew by 13.9%, the annual decline in sales declined to only 1.6%, that is, consumer demand has essentially recovered completely. Services PMI climbed to 56.6p, which is higher than in the Eurozone and even more so than in the US.

At the same time, the Brexit situation continues to put strong pressure on the pound. The next round of negotiations ended essentially with nothing, the negotiator from Britain Frost said that Johnson's attempt to achieve a result in July failed and now all hopes for September. In turn, the EU negotiator, Barnier, spoke out more harshly, accusing Britain of trying to ignore the interests of the EU, and with this approach, in his opinion, an agreement is unlikely.

The current impulse of GBP/USD can get further development, it is likely to reach the resistance zone 1.2920/40 (the upper border of the channel), but the driver for growth has no internal strength, so the growth will be weak. It is possible to move into a sideways range or a corrective decline to 1.2550/70 at any moment.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română