To open long positions on GBPUSD, you need:

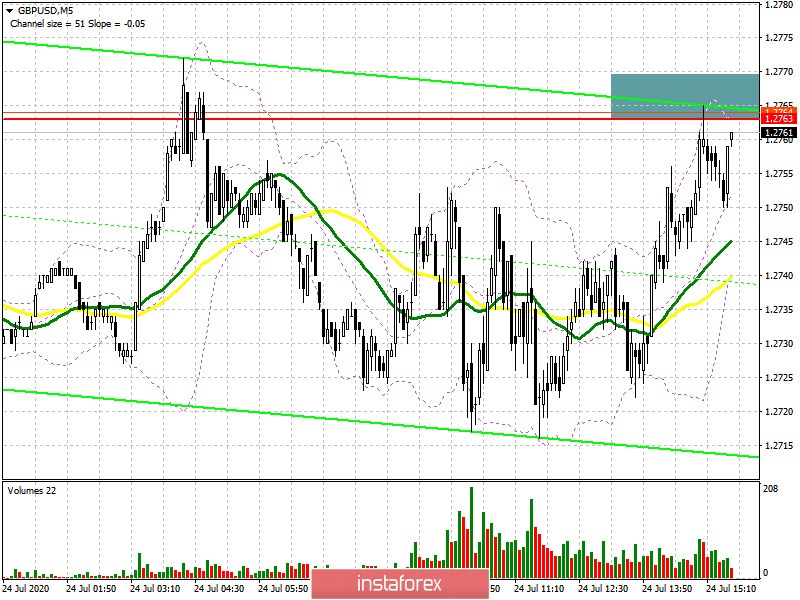

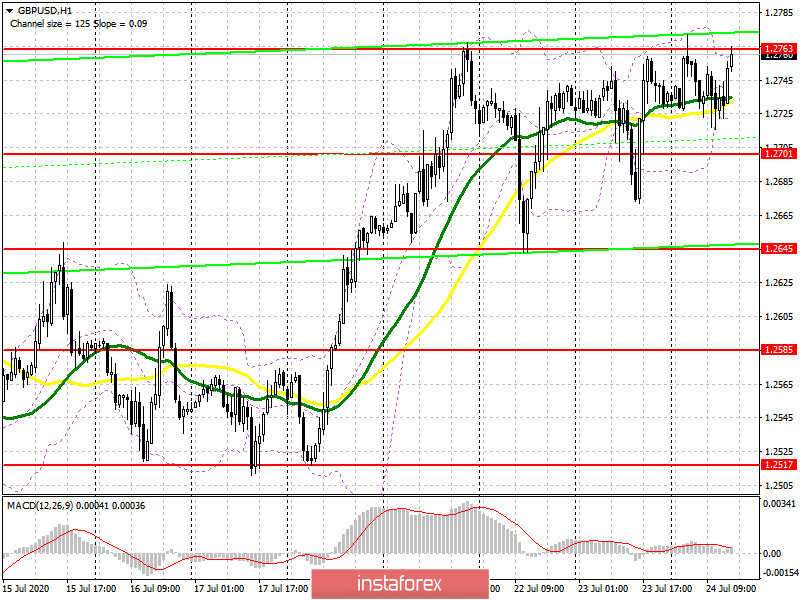

In the first half of the day, nothing changed on the background of low market volatility, even after the release of such good fundamental data on the services sector and the UK manufacturing sector. This suggests that in general, the fundamentals, given their constant jumps due to the coronavirus pandemic, are not yet very exciting for traders. As a result, there were no signals for entering the market at the European session. If you look at the 5-minute chart, you will see how the bulls came close to the resistance of 1.2763, which remains their main target for the second half of the day. However, only a break and consolidation above the maximum of this week forms a signal to buy the pound with continued growth in the area of 1.2809 and 1.2906, where I recommend fixing the profits. Data on activity in the US, which is released this afternoon, may help buyers of the pound. If the pair declines and there is no activity in the resistance area of 1.2763, it is best to postpone long positions until the update of the minimum of 1.2701 or buy the pound immediately on the rebound from the support of 1.2645 in the expectation of a correction of 30-40 points within the day.

To open short positions on GBPUSD, you need:

Sellers have a great chance to return to the market, but you need to try. First of all, you need to prevent a breakout of the resistance of 1.2763 and form a false breakout on it, which is what the bears are trying to do now. However, you can be sure of a more accurate sell signal only after the release of data on activity in the US services and manufacturing sectors. The nearest target of sellers is also the support of 1.2701, fixing below which will only increase the pressure on the pound, which will lead to a complete overlap of yesterday's growth and update the minimum of 1.2645, where I recommend fixing the profits. The longer-term goal of sellers remains support for 1.2585. If the GBP/USD rises above the resistance of 1.2763 in the second half of the day, I recommend that you postpone short positions until the maximum of 1.2809 is updated or sell the pound immediately for a rebound from the resistance of 1.2906 in the expectation of a correction of 30-40 points by the end of the day.

Signals of indicators:

Moving averages

Trading is just above the 30 and 50 daily averages, which indicates the sideways nature of the market.

Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1.

Bollinger Bands

Volatility has decreased, which does not give signals for entering the market.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence / divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română