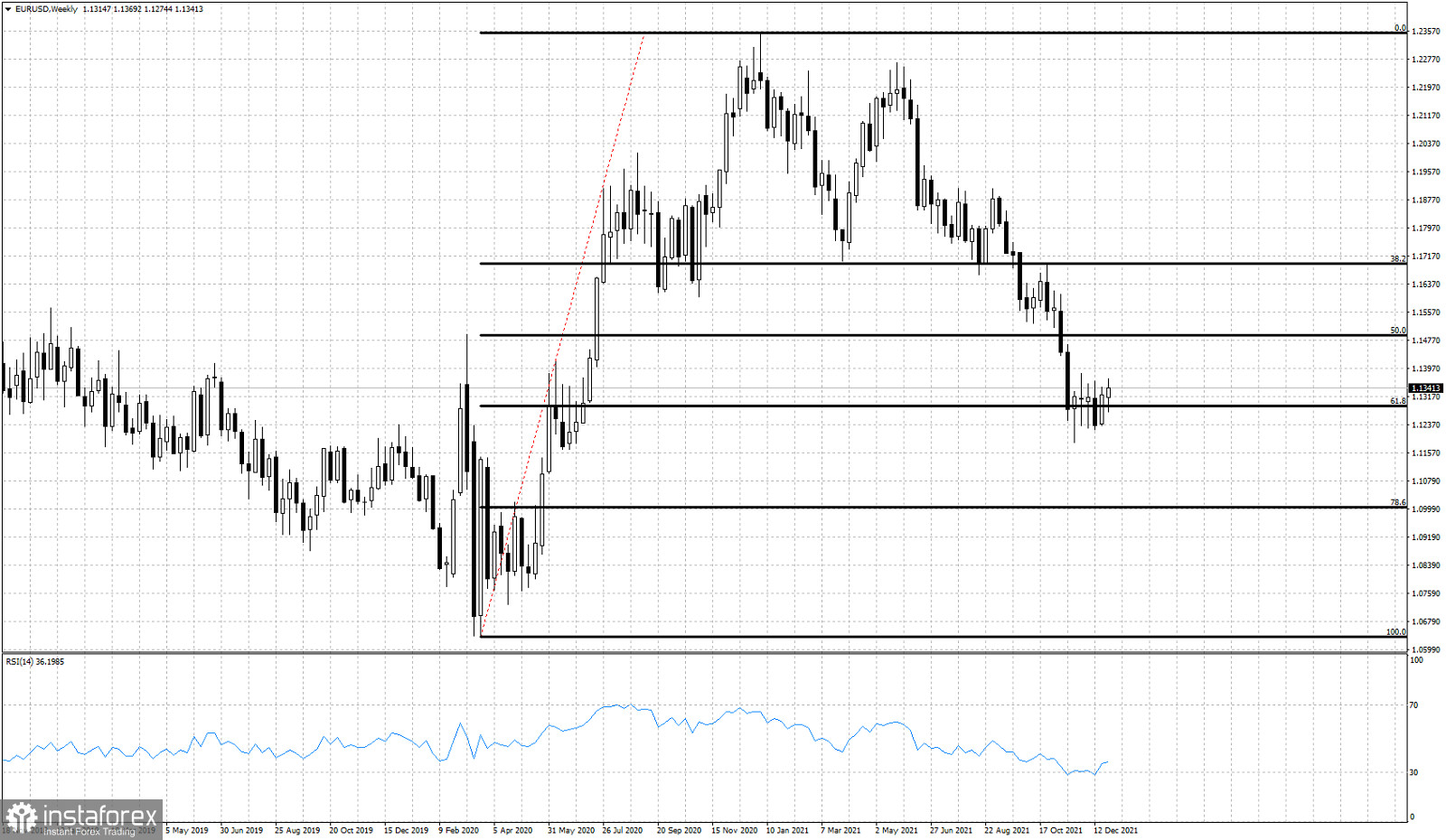

The end of the year finds EURUSD near 1.13 nearly 900 pips below from where we started back in January 2021. Price has retraced 61.8% of the entire upward move from 2020 lows to 1.2350 2021 high. The decline has stopped at a key Fibonacci retracement level and we anticipate the new year with increased interest.

At 61.8% retracement level we usually see trend reversals. The RSI in the weekly chart is turning higher from oversold levels. Price has stopped the decline right on top of the 61.8% Fibonacci level. There are increased chances that 2022 will find EURUSD is a bullish trend and price move closer towards 1.17 or even higher. Even a move above 1.2350 for 2022 is in the cards specially if a higher low has been formed at recent lows. EURUSD has the potential for a major reversal from current levels and to make new highs towards 1.25-1.30. The first step towards this direction would be for bulls to make a reversal from current levels and start making higher highs and higher lows. Previous support is now resistance, so the 38% Fibonacci retracement at 1.17 is now key resistance. Breaking above it will increase the chances that a new upward move has started. Over the coming weeks we will revisit this bullish scenario according to what new information the price has given to us.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română