The recent weakening of the dollar escalates speculations that it will continue to fall into the abyss. It is difficult to dispute such forecasts now, the greenback really has enough negative factors that can push it further down.

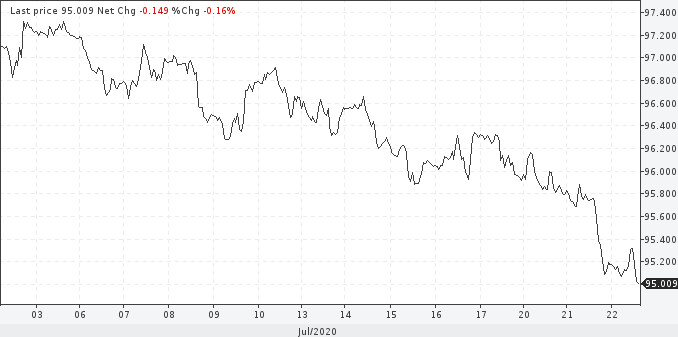

From the maximum levels reached in March in the region of 103 points, the dollar index fell to 95 points. In terms of technical analysis, it may decline to last year's lows around 94.6. But is the dollar really so hopeless?

In the short term, yes, but if you look into a more distant perspective, the picture will appear in a different light. A fall in the dollar is always accompanied by a rise in other currencies, whose export-oriented countries will sooner or later face this problem. The higher the exchange rate, the more difficult it will be for them to sell goods and, consequently, restore the economy. Time will come when governments and central banks of countries such as Canada, Great Britain, and Australia, will begin to unanimously oppose the strengthening of national currencies.

The US struggle with the coronavirus pandemic won't last forever either. Sooner or later, perhaps in the near future, this factor will come to naught. Farms in the United States will begin to recover. It is worth noting that this sector is already taking a good hit, even better than in countries whose currencies are doing well now, showing growth against the dollar.

There is another important point to keep in mind. The United States has a negative trade balance, imports are more than exports. In this regard, the American authorities are less interested in the weakness of their currency than their partners. In addition, treasury rates, even when they decline, remain higher than those of most major European or Asian peers.

Do not discount the possible continuation of the US-China tariff wars and a second wave of the pandemic in countries that are successfully coping with the first. This can worsen risk appetite and increase demand for the US dollar, which will start growing again due to its protective functions.

All this can limit the current decline in the dollar, especially since the dollar negative for the most part has already been worked out. Strong support levels for the USDX are in the 94.60-95.00 region. The fall may stop there, and the market will start pushing it towards the resistances of 97.50–98.00.

USDX

Meanwhile, the current weakening of the dollar made such currencies as the euro and the Swiss franc more attractive in the eyes of traders. Against the franc, the dollar retreated to a 4-month low despite intervention by the Swiss National Bank last week. The NBS now prefers to stay on the sidelines, since the growth of the national currency is associated with the weakening of the dollar.

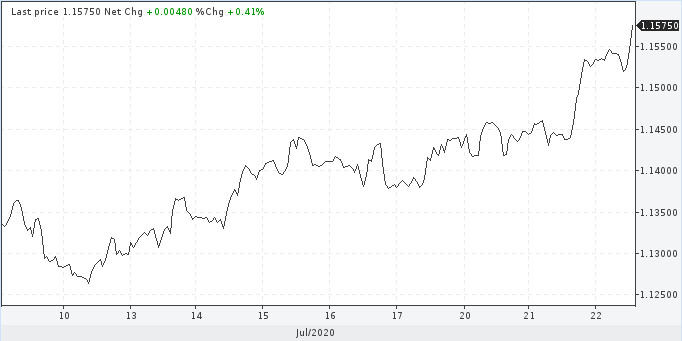

The EUR / USD pair managed to exceed the peak values of March, reach 18-month highs at 1.1540 and move further.

EUR / USD

EU leaders gave a go signal to the European bulls, and investors jumped at the idea. Major analytical companies are hastily rewriting forecasts. Now you can find a wide variety of numbers, depending on the mood and positioning of banks. Experts are serious and unanimous in predicting that the euro will grow. On average, the EUR / USD pair, judging by the forecasts of authoritative foreign experts, will gain a foothold in the next three months around the 1.1600 mark.

Note that after the 2008 crisis, the dollar rose in price against the euro for 8 years, then in 2016 this trend stalled and turned into a sideways trend. The growth of the greenback and the subsequent flat did not prevent America from bypassing Europe and Asia. Now there are more and more signs that the dollar may turn around, clearing the way for the euro upward. The weakening of the greenback is likely to occur in parallel with the lag of the US markets from foreign ones.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română