What reasons are not given by market experts to explain the rapid rally of XAU/USD and the readiness of gold to rewrite historical highs: the deterioration of the epidemiological situation in the United States, the growing risks of a W-shaped recovery of the American economy, the tension in relations between Washington and Beijing, the weakness of the dollar, low rates of the global debt market, and record capital inflows to ETFs... In my opinion, the first-order factors are financial repression and huge liquidity.

The precious metal is sensitive to the dynamics of the real yield of US Treasury bonds, which has recently fallen due to the growth of inflation expectations. Rates on ordinary debt remain unchanged, while rates on inflation-protected debt continue to fall. The bond market behaves as if the Fed is already targeting the yield curve. This is what it did in the post-war period, which was then called financial repression. Both stocks and gold benefit from the current situation.

The dynamics of bond yields and gold

A potentially large-scale bond issue, driven by fiscal stimulus and a growing budget deficit, should lead to secondary market sales and higher yields. However, the Fed is wary and will certainly not allow debt rates to rise. Investors are seriously afraid of financial reprisals, and this is good news for the "bulls" for XAU/USD.

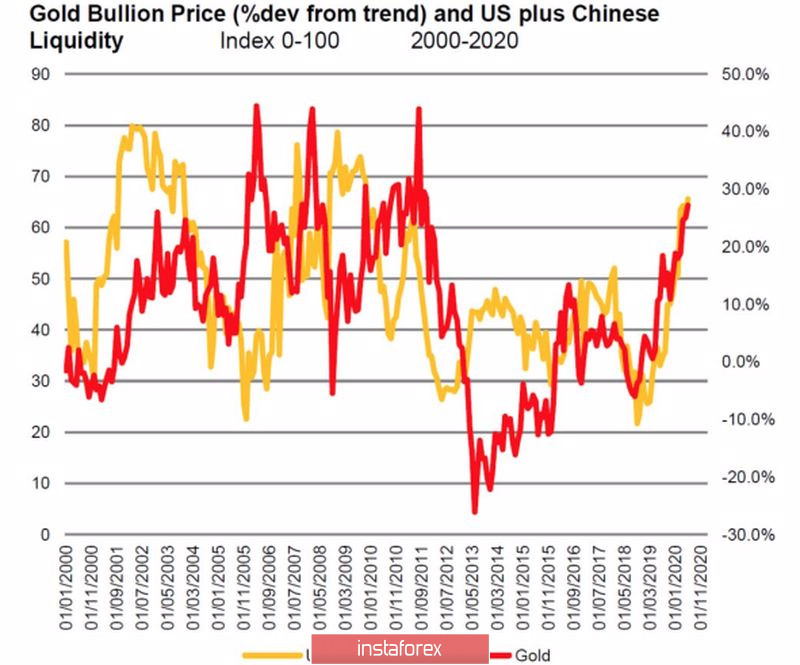

For some, the simultaneous rally of precious metals and US stock indices looks strange, because the first asset is protective, and the second grows when the global risk appetite increases. However, in the ocean of liquidity that central banks have created, both gold and the S&P 500 can go north at the same time. Moreover, the historical connection between bags of money and the analyzed asset proves that the potential of the XAU/USD rally is far from exhausted.

Dynamics of liquidity and gold

Due to ultra-soft monetary policy, the main world currencies are weakening. For most of the G10 currency units, the precious metal has already broken historical highs, and their update on the US dollar is on the agenda. "American" is experiencing problems both because of the complex epidemiological situation in the United States, which increases the risks of a W-shaped economic recovery, and because of contradictions between Democrats and Republicans about further fiscal stimulus. Opponents differ both on the amount ($ 3.5 trillion versus $ 1 trillion) and on the issue of reducing taxes paid from wages.

In contrast to the US, the EU quickly found a common language in the area of fiscal assistance. The approval of the € 1.8 trillion program is evidence of a united Europe and should accelerate the recovery of the Eurozone's GDP. The euro feels like a king, the dollar is retreating, and gold is growing.

Technically, the precious metal reached a target of 200% for the AB=CD pattern, which increases the risks of correction. It is unlikely that it will fall below the nearest pivot levels at $ 1815 and $ 1820, so the long positions formed from them should be held and increased on pullbacks. The next target is $ 1920 per ounce.

Gold, the daily chart

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română