The Canadian dollar, paired with the US dollar, continues to take advantage from the current market situation. The commodity market is growing, the dollar has been steadily declining for the third week, and the Bank of Canada is showing a wait-and-see attitude, providing background support for the CAD. And today, the downward movement of USD/CAD may increase if Canada's inflation indicators come out at least at the level of forecasts.

To highlight the importance of today's release, let's go back to the results of the last meeting of the Canadian regulator, which took place last July 15. In general, this meeting was only skipped through, but some of its arguments should be highlighted in a separate line. Thus, the Central Bank announced that it is ready to adjust its programs, "if the need arises." This wording, on the one hand, is already standard, but on the other hand, before the July meeting, rumors were actively circulated in the market that the Central Bank might consider the option of expanding QE. Therefore, the first reaction of the market to the results of the July meeting was negative. However, the subsequent comments of the head of the Bank of Canada, Tiff Macklem, who recently took office, reassured investors and allowed the USD/CAD bears to take over the pair.

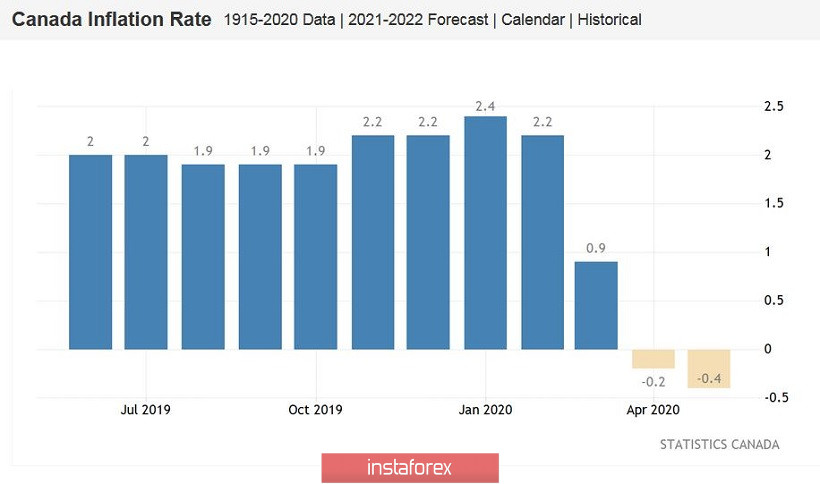

First, he said that the Canadian economy, apparently, reached its bottom in April, after which the key macroeconomic indicators began to gradually recover. Secondly, he reiterated his rhetoric that the economic downturn in the country turned out to be much weaker than assumed earlier scenarios (first of all, we are talking about the April report on monetary policy). Thirdly, Tiff Maclem outlined the conditions under which the regulator will consider raising the interest rate. According to him, rates will remain at current levels until inflation reaches the target of two percent, and does not consolidate in this area. In other words, he emphasized the importance of inflation indicators, linking the dynamics of their growth with the prospects for tightening monetary policy.

This is why today's release is so important for this pair's traders. It is worth noting here that we will find out the data for June today, while Canada began to gradually come out of quarantine back in May. In particular, the authorities of Canada's most populated province of Ontario in late spring allowed the resumption of construction work, as well as allowed certain seasonal businesses to open, subject to the requirements of social distancing and increased hygiene. Other provinces of the country also made similar indulgences to one degree or another. Taking this factor into account, experts expect to see an increase in inflation indicators.

According to the general forecast, the CPI on a monthly basis should demonstrate positive dynamics, rising to the level of 0.4%. In annual terms, the CPI should leave the negative area (where the indicator was throughout April and May), reaching 0.3%. Of course, this result is weak and too far from the 2% target. But the trend itself is important here - if it is upward, the Canadian dollar will receive significant support and the USD/CAD bears will be another reason for a downward push.

If we consider the USD/CAD in the longer term then the dynamics of the incidence of coronavirus in Canada is also important. At the same meeting in July, Maclem warned that a second wave of the virus could begin in the country, which would require the application of more widespread restrictive measures. He added that in this case, the base scenario of the Canadian regulator will be "neutralized", and the Canadian economy will require additional monetary stimulus.

In general, the rate of spread of COVID-19 in Canada is gradually slowing down. If more than a thousand cases a day were registered every day in May, then since the beginning of summer, the daily increase has been steadily below 600. However, there was a surge in the incidence yesterday: 873 new cases were registered per day. If this indicator continues to grow and exceed the thousandth mark, then the Canadian currency may be under pressure.

On the other hand, if we talk about the medium term, then inflation will be the focus here. If today's events exceed the expectations of traders, the CAD will continue its downward trend. From a technical point of view, the pair on the daily chart is on the lower line of the Bollinger Bands indicator, which also indicates the priority of the downward movement. The pair is showing a pronounced bearish trend, which is confirmed by the main trend indicators - Bollinger Bands and Ichimoku. The latter has formed its strongest bearish signal "Parade of Lines" - all indicator lines on D1 are above the price chart, thereby showing pressure on the pair. To determine the main target of the downward movement, let's switch to the weekly time frame: here, we focus on the lower Bollinger Bands line, which corresponds to the level of 1.3330.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română