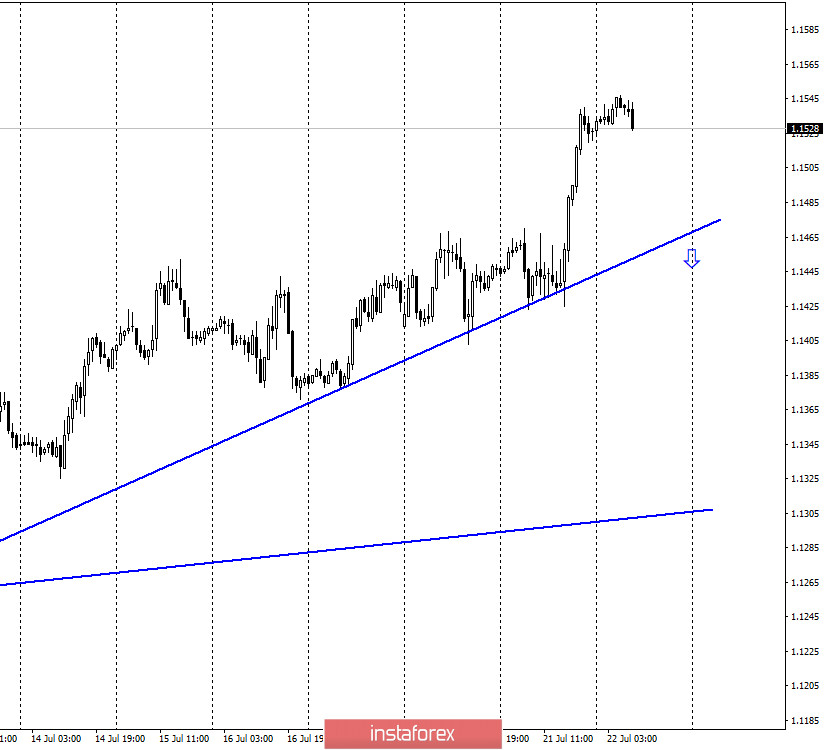

EUR/USD – 1H.

Hello, traders! The EUR/USD pair performed a new rebound from the upward trend line on July 21 and resumed the growth process. At the same time, the "bullish" mood of traders continues to persist, and there are generally two upward trend lines. Thus, the euro currency has an excellent chance of continuing growth, and traders can only guess what exactly caused such a strong growth of the euro? For example, at the beginning of the week, all the attention of traders was drawn to the results of the EU summit, which were announced only yesterday morning. But there was no market reaction to these results. The euro currency continued to trade calmly. However, in the second half of the day, a strong growth started abruptly. What is the reason for this? With the entry of Americans into the market, who started selling the dollar and buying euros? Or is the outcome of the summit nothing to do with it? In America, a similar stimulus package of at least one trillion dollars may be adopted and approved by the end of this month. Will there be such a reaction to it? There is no other news, except daily updated data on the number of coronavirus diseases in the United States.

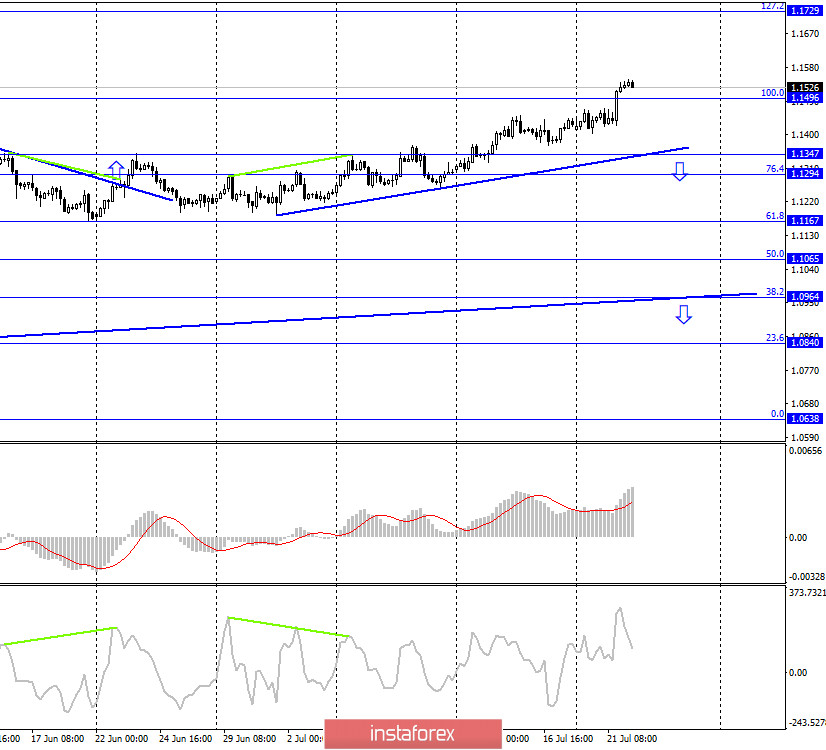

EUR/USD – 4H.

On the 4-hour chart, the quotes of the EUR/USD pair closed above the corrective level of 100.0% (1.1496), which now allows traders to expect continued growth in the direction of the next Fibo level of 127.2% (1.1729). The upward trend line on the current chart also keeps the current mood of traders "bullish". Fixing the pair's exchange rate below the Fibo level of 100.0% will work in favor of the US dollar and some fall in the direction of the trend line. Today, the divergence is not observed in any indicator.

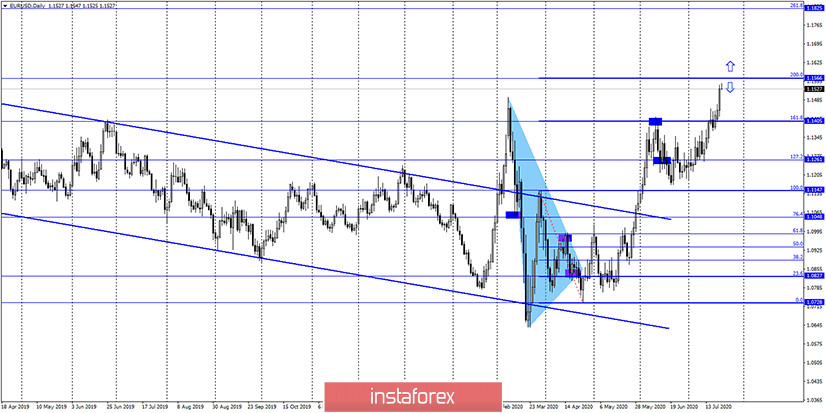

EUR/USD – Daily.

On the daily chart, the EUR/USD pair made a consolidation above the corrective level of 161.8% (1.1405) and came close to the Fibo level of 200.0% (1.1566). The pair's rebound from this level will work in favor of the US currency and resume falling in the direction of the corrective level of 161.8%.

EUR/USD – Weekly.

On the weekly chart, the EUR/USD pair, after rebounding from the lower line of the "narrowing triangle", still continues the growth process in the direction of the 1.1600 level (the upper line of the "triangle"). There are only a few dozen points left before this level, and then you will need to see whether it will be possible to close above the upper line of the "triangle". If so, the growth process will continue.

Overview of fundamentals:

On July 21, there were no economic reports or events in the European Union or the United States, except for the EU summit, which I wrote about earlier. Thus, the information background was rather weak.

News calendar for the United States and the European Union:

EU - ECB President Christine Lagarde will deliver a speech (13:15 GMT).

EU - ECB Vice President Luis de Guindos will deliver a speech (15:00 GMT).

On July 22, the news calendar of the US is again completely empty. The European Union will hold two important speeches at once, the President and Vice-President of the ECB.

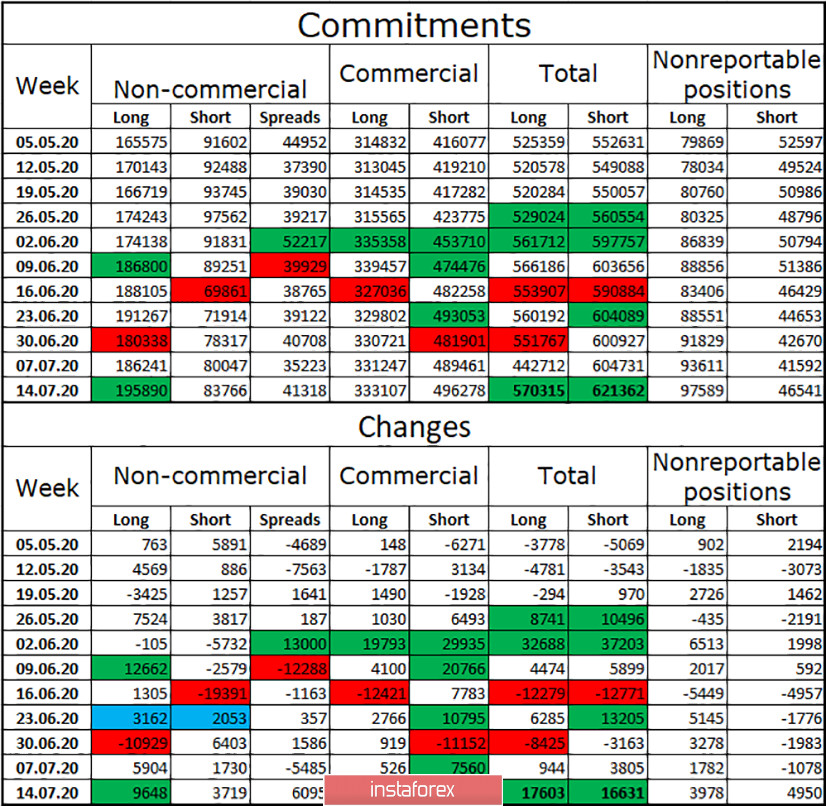

COT (Commitments of Traders) report:

The latest COT report showed a sharp increase in the number of long-term contracts in the hands of the "Non-commercial" group. This means that the most important major market players during the reporting week (July 8-14) looked only in the direction of purchases. Several thousand short contracts were also opened, but much less than long. Thus, it is not surprising that the euro currency grew all the previous week and continues to do so at the beginning of the new week. The COT report tells us now about a persistent bullish trend, as for the second week in a row, speculators are actively increasing long-contracts. The results of the EU summit, by the way, can make the "bullish" mood of speculators even stronger. However, it is possible that the results of the summit are already taken into account in current prices. After all, the euro currency has continued to grow in recent days. The trend lines on the hourly and 4-hour charts will help you understand this issue.

Forecast for EUR/USD and recommendations for traders:

Today, I recommend continuing to stay in the pair's purchases with a target of 1.1729. If the pair closes at 1.1496, then purchases can be closed until new signals are bought. I recommend selling the pair if the quotes close below the trend line on the hourly chart with the goal of 1.1347.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency, not for speculative profit, but to ensure current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română