Players tend to view the development of the market situation in a positive way, even despite the threat of an even more widespread spread of the coronavirus. The main driver of growth is the EU, whose leaders have agreed to create a recovery fund, which is planned to attract 750 billion euros in financial markets on behalf of the European Union.

The euro and commodity currencies are among the leaders of growth, but it is also necessary to note the dollar's decline on all fronts, which has another reason at its core. Another aid package in the amount of 1 trillion was supposed to be passed this week, the promotion of the bill is provided by the Republicans, who are a minority in Congress, and therefore, the chances of passing are reduced - the Democrats have put forward a number of counter conditions, the discussion of which may be delayed.

The US exclusivity has been undermined by a global fall in interest rates, which has diminished the yield advantage of the dollar, while the pace of the US economic recovery is inconclusive and investors will continue to seek out-of-state yields.

On Wednesday, the dollar will continue to weaken, the favorite is primarily gold, oil also has a chance of continued growth even against the background of a sharp increase in US inventories.

USD/CAD

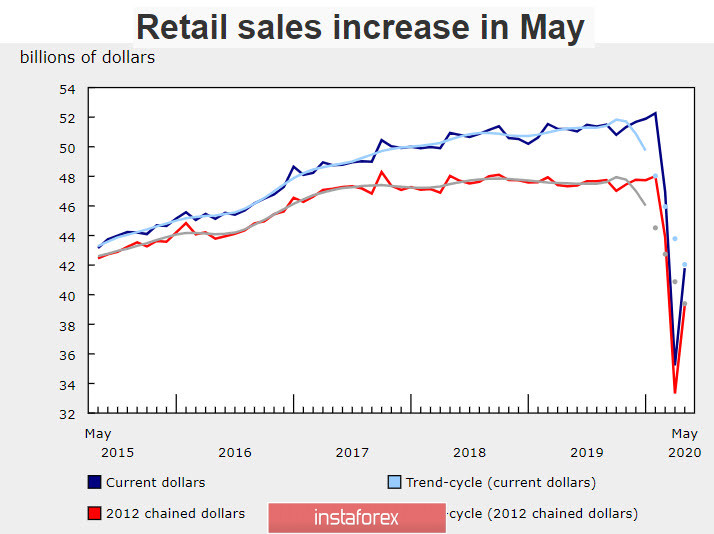

The report on retail sales in May was better than expected, adding arguments in favor of CAD growth.

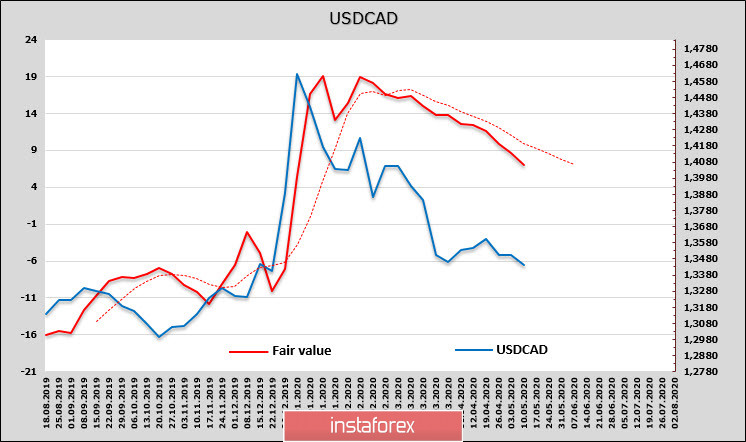

The estimated fair price is still noticeably higher than the spot price, which gives reason to expect corrective growth, but its direction is confidently downwards, that is, the loonie is in line with the general trend of demand for risk.

The Canadian dollar has broken through the support 1.3480/90, and now a movement to the June low of 1.3310 looks more than likely. At the same time, the CAD is more vulnerable relative to other commodity currencies, as it will be under pressure from the growing risks in the US, and therefore, one should not expect a strong decline in USD/CAD.

USD/JPY

Core inflation remained unchanged in June, which is a positive signal for assessing the pace of consumer demand recovery, as a decline was predicted. The Bank of Japan notes that if many companies reduced prices to stimulate demand in the past, now, this technique is used less and less, for a number of objective reasons. First of all, this is government support for households against the backdrop of a pandemic, and of course a general decline in productivity (the service sector experiences an outflow of clients and therefore does not have the opportunity to reduce prices, and export-oriented sectors of the economy are losing competition to China).

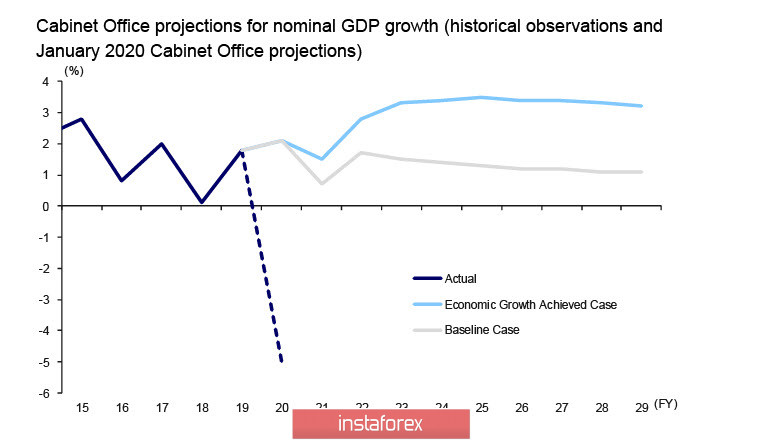

The Abe Cabinet of Ministers approved on July 17 the "Basic Policy in the field of economic and financial management and reform for 2020". New forecasts are expected. According to preliminary data, GDP growth will become negative at the level of about 5% this year, and the ratio of public debt to GDP will sharply increase instead of the expected decline.

There is also no chance of reaching a budget surplus in the coming years, moreover, the total primary deficit of the central and local governments, the deficit by the end of the year, may reach 12.2%, which leaves no chances for a change in monetary policy.

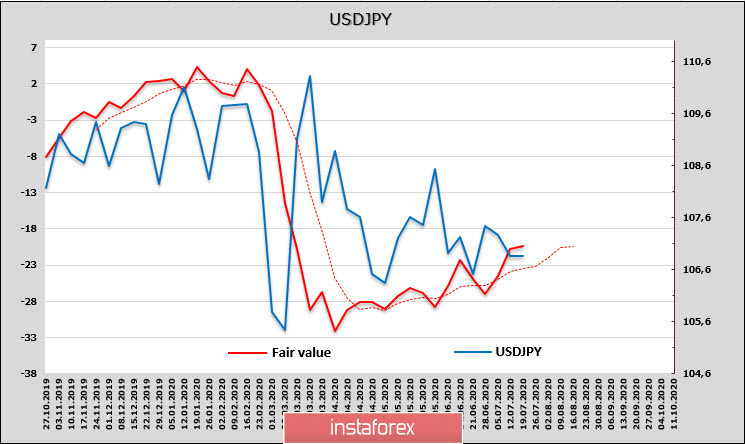

The yen is close to the fair level, which reflects the objective demand for the Japanese currency, and does not have a pronounced direction. On the CFTC, the long yen position has increased, which gives reason to expect a decline in USD/JPY, while the target price is directed upward, indicating a decline in demand. In terms of the combination of factors, the situation is still similar to a range without direction.

The support is located at 106.60/70, while resistance is at 107.40/50. Trading is justified in a range with a slight upward trend, which gives a chance to exit the range up, but there should be additional grounds for this.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română