Technical analysis recommendations for EUR/USD and GBP/USD on July 21

EUR / USD

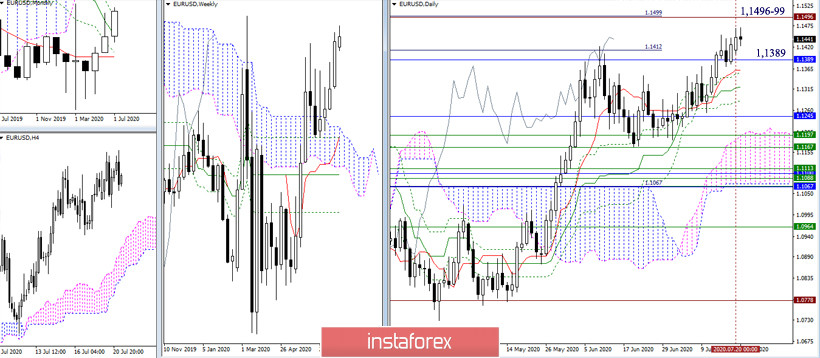

The pair closed last week above the closing line of the monthly Ichimoku cross (1.1389). With the beginning of the new working week, the bulls managed to continue their upward movement. This time, we will close both the week and the month at the end of the week, so the expected result will be more indicative and significant. In the current situation, the nearest upward reference is now located in the area of 1.1496-99 (100% completion of the target for the breakdown of the daily cloud + the maximum extremum of the March high Wave). The supports can be designated at 1.1389 (monthly Fibo Kijun) - 1.1362 - 1.1319 - 1.1283 (daily cross levels) - 1.1245 (monthly Kijun).

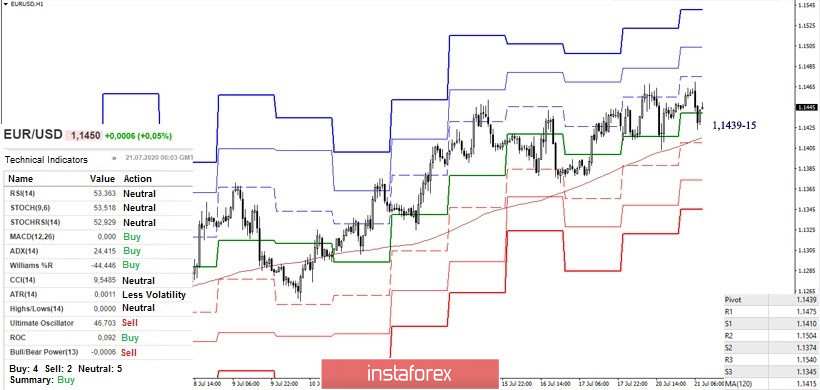

Despite being in the zone of a downward correction at the moment, the advantage remains on the side of upward traders in the lower time intervals. The resistance of the classic Pivot levels 1.1475 - 1.1504 - 1.1540 remains as upward guidance within the day. The key supports have joined forces today at 1.1439-15 (central Pivot level + weekly long-term trend). A reliable consolidation below and a reversal of moving averages can lead to a change in the current balance of forces on H1, but for more reliable and lasting changes, it will be important to break through the supports of the upper halves 1.1389 - 1.1362 - 1.1319, etc.

GBP / USD

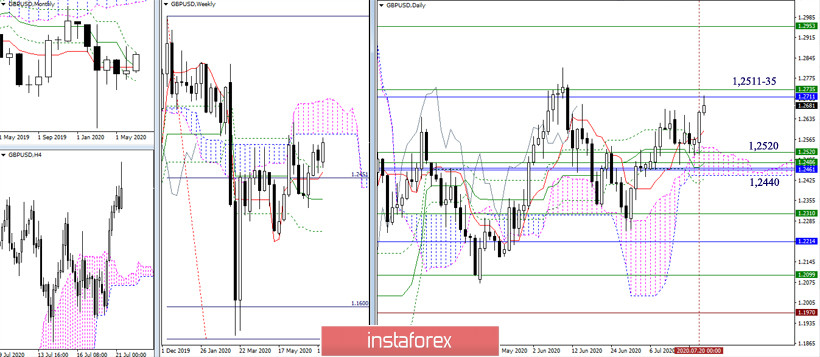

With the closing of last week above the key levels of this section, the pound managed to maintain the advantage on the side of the players to increase. At the moment, the pair is testing the nearest resistances of 1.2711-35 (monthly Fibo Kijun + weekly Senkou Span B). Further prospects will depend on the result of the interaction. Breaking through which will allow updating the June maximum (1.2812) and a rise to the upper border of the weekly cloud (1.2953) can be considered. The formation of a rebound from the encountered resistances and the loss of the daily short-term, today the Tenkan is located at 1.2597, will return the pair to the accumulation of strong and significant supports of 1.2520 - 1.2440 (daily cloud + daily Kijun + weekly Tenkan + monthly cross). The support data determines the current long-term advantage.

The resistance R1 of the classic Pivot levels (1.2709) is currently being tested on H1. It is reinforced by the resistances of the higher halves (1.2711-35), so the result will determine the balance of forces not only on H1. In the event of the emergence and development of a downward correction, the main value for the current movement of the lower halves will be supported by 1.2613 - 1.2579 (central pivot level of the day + weekly long-term trend). Today, these significant H1 supports are also strengthened from the upper halves (daily Tenkan 1.2597). As a result, it can be concluded that the upper and lower time intervals are solidary today and form key reference points together - for upside players it is 1.2709-35, for an opponent it is the zone of influence of the daily short-term 1.2597.

Ichimoku Kinko Hyo (9.26.52), Pivot Points (Classic), Moving Average (120)

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română