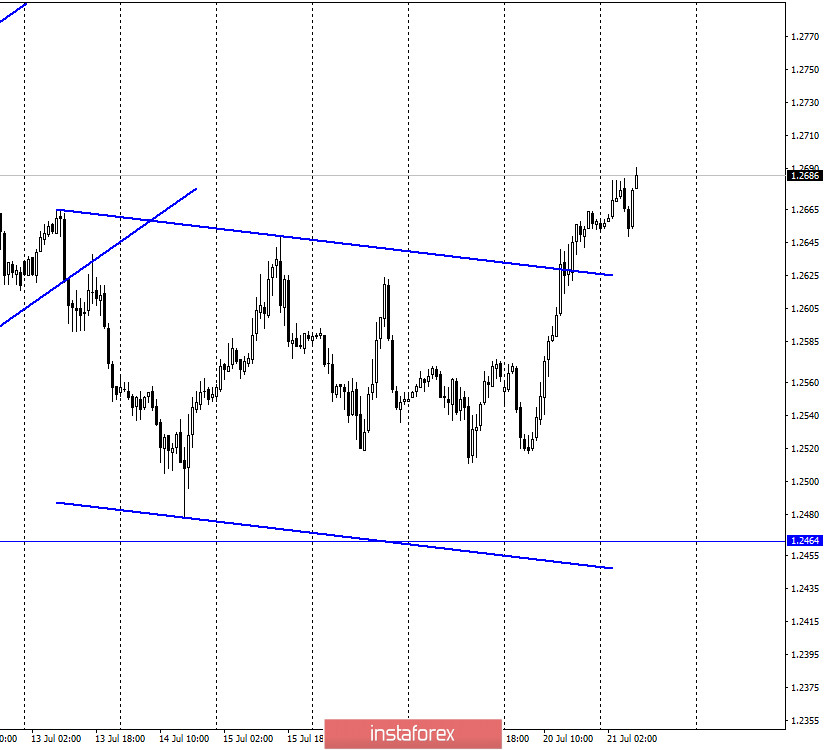

GBP/USD – 1H.

Hello, traders! According to the hourly chart, the quotes of the GBP/USD pair performed a new reversal in favor of the British currency and resumed the growth process, simultaneously completing the closing and over the downward trend corridor. Thus, the mood of traders has now changed to "bullish". Although the EU summit and the decisions taken at it had nothing to do with the UK and the British pound, this currency also showed impressive growth in trading on Monday. Given that there was no important news from either the UK or the US on this day, the reasons why the British dollar rose along with the euro remain unclear. Perhaps everything is banal and simple. Bear traders did not want to continue selling the pair, which led to the opposite effect. After all, to buy a dollar, you also need reasons. However, they are now even less than for purchases by the British. The coronavirus in the US continues to gain momentum and threatens to reach 100,000 infections a day, as predicted earlier by Anthony Fauci, the country's chief medical epidemiologist. I have already said that such high rates of morbidity cannot but affect the country's economy. The US Congress, together with the Treasury Department, are currently developing their package of assistance to the American economy, but you need to understand that as a result of these multi-trillion-dollar injections, the country's national debt is greatly increasing, which is already 26 trillion, and may grow to 30 in 2020.

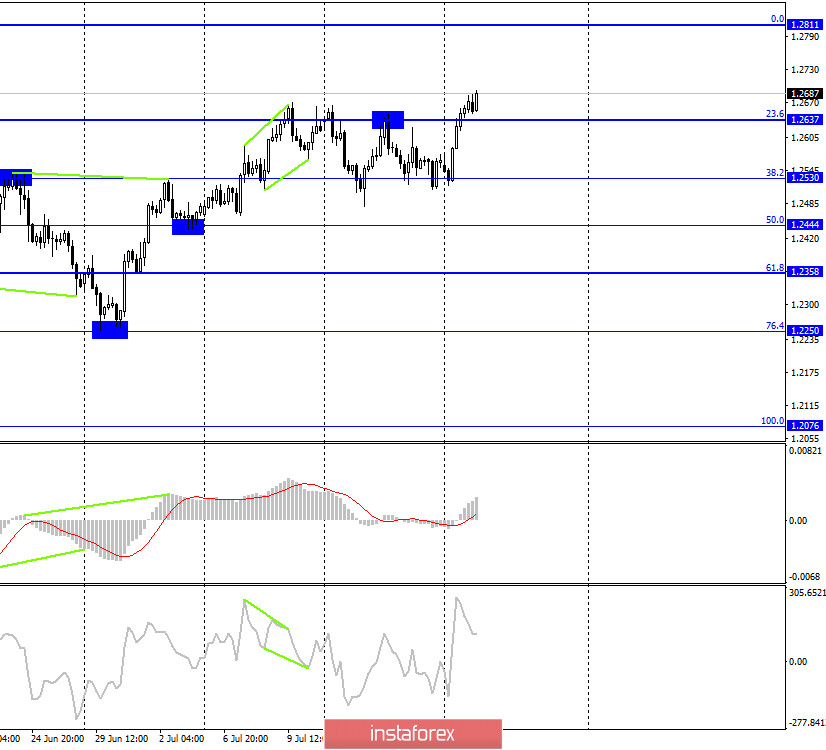

GBP/USD – 4H.

On the 4-hour chart, the GBP/USD pair made several unsuccessful attempts to gain a foothold below the level of 38.2% (1.2530), after which it performed a reversal in favor of the English currency and resumed the growth process, simultaneously completing a close above the Fibo level of 23.6% (1.2637). Thus, the growth can now be continued in the direction of the corrective level of 0.0% (1.2811). Today, the divergence is not observed in any indicator.

GBP/USD – Daily.

On the daily chart, the pair's quotes secured above the corrective level of 61.8% (1.2516). And after the rebound from this level, the growth process can be continued in the direction of the Fibo level of 76.4% (1.2776).

GBP/USD – Weekly.

On the weekly chart, the pound/dollar pair performed a false breakdown of the lower trend line and rebound from it. Thus, until the pair's quotes are fixed under this line, there is a high probability of growth in the direction of two downward trend lines.

Overview of fundamentals:

Nothing interesting happened in the UK on Monday. However, traders still found reasons to continue the process of buying English currency. The difficult epidemiological situation in America continues to reduce the demand for the dollar.

News calendar for the US and UK:

No reports or events are scheduled for July 21 in the UK and the US. There will be no background information today. At least, according to the news calendar.

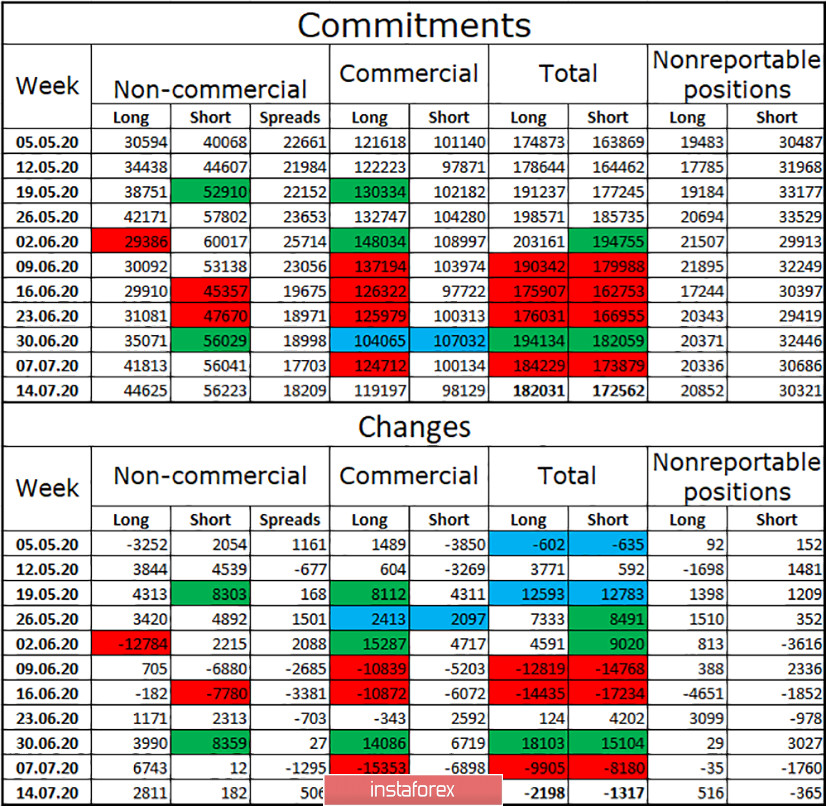

COT (Commitments of Traders) report:

The latest COT report again showed an increase in the number of long contracts among the "Non-commercial" group. However, this time the growth was small, which means a slight drop in interest among speculators in the British. Over the past 4 weeks, the Non-commercial group has been increasing its long-term contracts. For the last two weeks, I haven't opened any short contracts. Thus, the group of speculators has no interest in selling the pound. There is interest in the purchases of the Briton, however, it is declining. In general, the group of speculators has more short contracts on their hands, but the difference has been decreasing in recent weeks. I still believe that the prospects for continued growth for the British are there, and since bull traders managed to gain a foothold over the downward trend corridor on the hourly chart, the chances of continued growth for the British are increasing.

Forecast for GBP/USD and recommendations to traders:

I recommend selling the pound with a target of 1.2530 if the close is made below the level of 1.2637 on the 4-hour chart. I recommend supporting the pair's purchases with the goal of 1.2811 since the close was made above the level of 1.2637.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency, not for speculative profit, but to ensure current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română