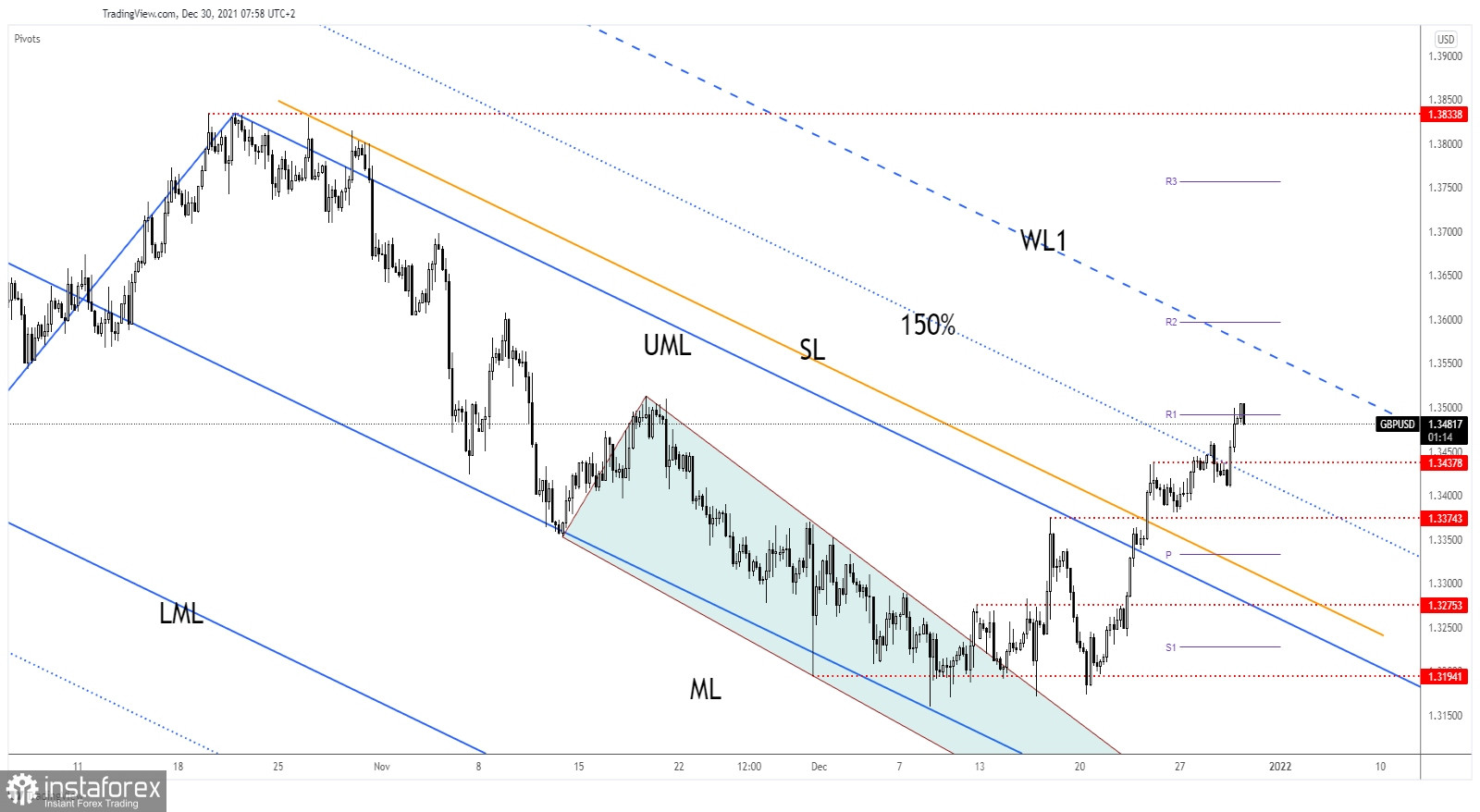

The GBP/USD pair is declining at the time of writing after failing to stabilize above the 1.3500 psychological level. After its amazing rally, a temporary decline is natural. The pair could come back to test and retest the immediate downside obstacles before resuming its swing higher.

The price is falling only because the US dollar Index has managed to rebound. Fundamentally, the UK Nationwide HPI registered a 1.0% growth versus 0.5% expected and compared to 0.9% growth in the previous reporting period.

The current drop could be only a temporary one. besides, its trajectory depends on initial jobless claims data and by the Chicago PMI.

GBP/USD Minor Retreat

GBP/USD failed to stabilize above the 1.35 and above the weekly R1 (1.3492). A temporary decline is in cards. 1.3437 stands as static support as long as it stays above it. The pair could still resume its leg higher.

I have told you in the previous analysis that GBP/USD could extend its upwards movement if it comes back above the 1.3437 and above the 150% Fibonacci line. A minor decline could help the buyers to catch a new bullish momentum.

GBP/USD Outlook!

The minor retreat could bring new long opportunities. This could be only a temporary one. A minor consolidation above the 1.3461 -1.3437 could attract more buyers and more bullish energy.

Also, coming back and stabilizing above the weekly R1 (1.3492) could confirm further growth ahead. The first warning line (WL1) of the descending pitchfork stands as a potential upside target.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română