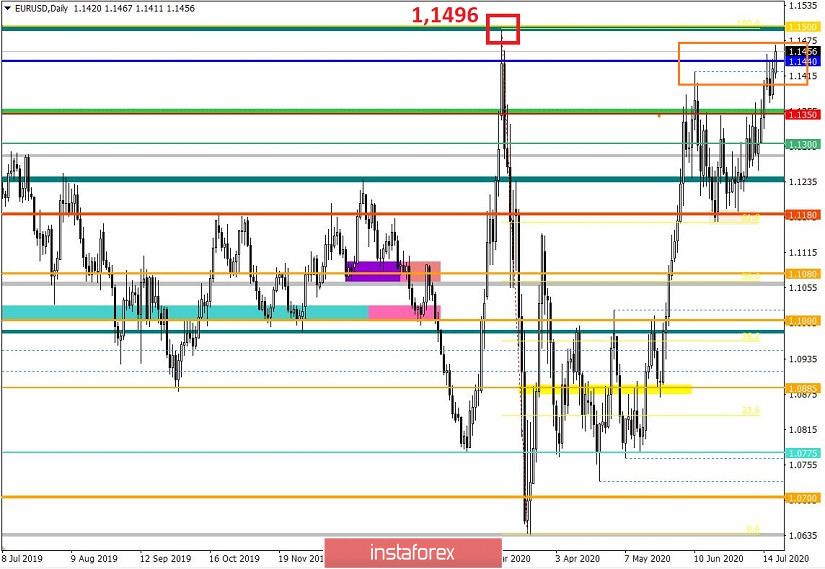

The previous trading week had an upward spiral, on the basis of which the quote successfully reached the value of 1.1440. In addition, the quote managed to go above it for the first time in a long time, which is a big step for the bulls and an even bigger failure for the bears. Now, the most important thing is to prevent a consolidation above 1.1496, because such a scenario will turn the trend upward.

Despite this, traders, especially the bears, should not panic, as the market is still under a high influence of emotional mood, which means that speculators are still present and can change everything very quickly.

Thus, analyzing the trading last Friday in detail, we can see that the main activity took place in the first half of the European session, where the quote rebounded from the level of 1.1380 and headed towards the value of 1.1440. Afterwards at American session, trading forces concentrated at the level of 1.1440.

As discussed in the previous review, market participants opened long positions in the level of 1.1440, which led to a slowdown and subsequent rollback in the market.

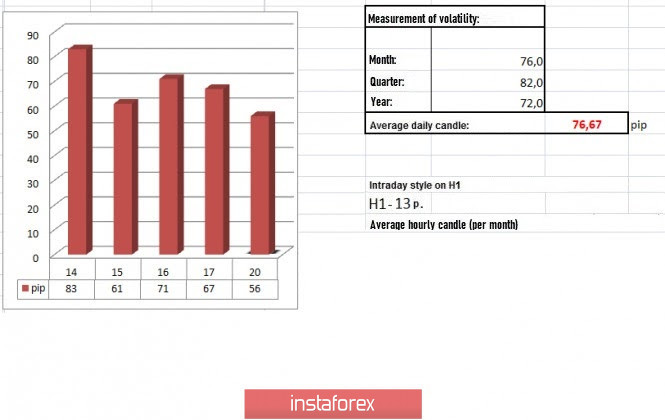

It resulted in a volatility slightly different from the average daily value, which is surprisingly not clearly seen when analyzing the time frames. Thus, in the first half of July, volatility is lower than the record from the previous month.

Analyzing the trading chart in general terms (the daily period), we can see that the euro overheated, although lower in comparison with the price spike in March, but this factor is still present on the market and should not be excluded from the analysis.

As for news, the report published last Friday included data on the construction sector of the United States, which came out not so bad, as the record on construction of new houses increased from 8.2% to 17.3%, and the total number of construction projects jumped from 1,011 thousand to 1,186 thousand. However, building permits turned out to be slightly worse than the forecast, but still rose by 2.1% in June.

Market reaction to such statistics though was literally absent, as the market went into a slowdown, completing growth.

Meanwhile, the European Union held a summit last weekend, during which EU leaders had major disagreements on the seven-year budget and recovery plan after the coronavirus pandemic.

"We have not yet been able to agree on a specific budget size and distribution of anti-crisis funds: how much money will be allocated in the form of grants, and how much in the form of loans. Although over the past two days we have made significant progress on a number of issues," said Micheal Martin, Prime Minister of Ireland.

The EU summit was supposed to be a two-day meeting, but negotiations have been ongoing for four days since a consensus has not been found yet.

"I think these are really very difficult negotiations. This is not only about big money, but, in essence, about changing the contours of the European Monetary Union. For the first time, the EU is borrowing money to give their countries as grants. Thus, it will indeed change the rules of the game by which the monetary union and the European Union have operated. I think that it is, in a sense, a question of dividing sovereignty, which is why it is so complicated," said Guntram Wolff, director of the Bruegel Institute.

Meanwhile, today, no significant news is expected, but the EU summit still has a background, in which it has already become known that the parties have come to some compromise and at the moment are talking about creating a fund of almost € 390 billion. Representatives of France, the second largest economy of the eurozone, immediately announced that now, they see the possibility of reaching a full and larger agreement, which supported the European currency to rise. Since the macroeconomic background is completely absent, investors will be guided only by the background of ongoing negotiations.

Further development

Analyzing the current trading chart, we can see that the quote consolidated at the range 1.1440 / 1.1467, but tremendous pressure was felt, which led to a reduction in long positions and market stagnation. The main limit remains to be the current year's high which is 1.1496, a breakout from which will indicate instability of the medium-term trend. The current fluctuation is within the area where trade forces interact, at which speculation erupts.

Thus, it is assumed that the most optimal tactic would be to exit the area and rebound from it, where, in the first case, a movement from 1.1470 to the direction of 1.1496 could occur. A reversal may be in the form of a rebound from the area of interaction of trade forces, when the quote consolidates lower than 1.1410, in the direction of 1.1380-1.1350.

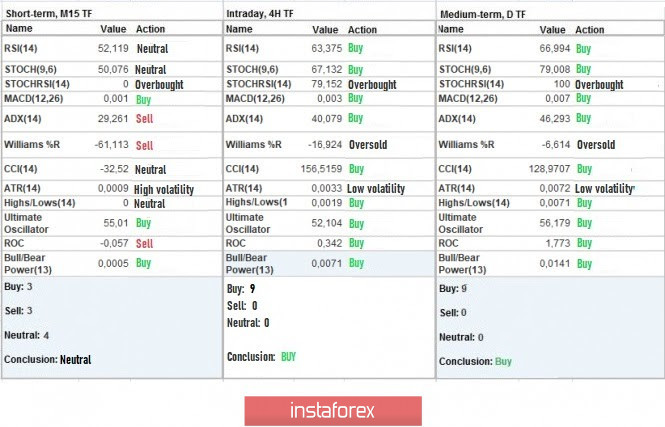

Indicator analysis

Analyzing the different sectors of time frames (TF), we can see that the indicators of technical instruments in the minute intervals have already changed into neutral, which signals high pressure. Hourly intervals, meanwhile, are working for an increase, but if the quote consolidates lower than 1.1410, everything may change. Nevertheless, the overall trend is still upward.

Volatility per week / Measurement of volatility: Month; Quarter; Year

The measurement of volatility reflects the average daily fluctuation calculated by Month / Quarter / Year.

(20 July was built, taking into account the time the article is published)

The volatility at this current time is 56 points, which is 26% below the daily average. It is assumed that volatility may still increase, if a good news comes out of the EU summit.

Key levels

Resistance zones: 1.1440 / 1.1500; 1.1650 *; 1.1720 **; 1.1850 **; 1.2100

Support Areas: 1.1350; 1.1250 *; 1.1.180 **; 1.1080; 1.1000 ***; 1.0850 **; 1.0775 *; 1.0650 (1.0636); 1.0500 ***; 1.0350 **; 1.0000 ***.

* Periodic level

** Range Level

*** Psychological level

Also check the hot forecast and trading recommendation for the GBP/USD pair here, or the brief trading recommendations for both the EUR/USD and GBP/USD pairs here.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română