Hello!

At the trading on July 13-17, the USD/CHF currency pair continued its movement in the south direction, losing 0.24%. Recently, market participants do not favor the US currency with their attention, and the US dollar is under selling pressure across a wide range of the market. However, at the trading of the past five days, the main currency pairs showed mixed dynamics, however, this review will deal directly with the Swiss franc paired with the US dollar.

So, I will start with an interesting fact that is associated with the spread of the COVID-19 pandemic around the world. If in the United States of America the coronavirus is rampant in such states as Florida, Texas, and California, and in general the epidemiological situation, to put it mildly, leaves much to be desired, then in safe and neutral Switzerland, the situation regarding COVID-19 is completely different. Now I will not dig and give the numbers of daily infections and deaths, but they are negligible in Switzerland compared to countries where the focus of infection is raging.

As you know, almost all countries have introduced restrictions to stop the spread of a new type of coronavirus infection. It was necessary and the right decision. Why is the situation with the spread of coronavirus completely different in different states? The answer is simple. Where restrictive measures are clearly and responsibly implemented, the number of infections and deaths from the insidious COVID-19 infection is significantly lower. For example, in countries such as Italy, the United Kingdom, the United States of America, and several other countries, the restrictions were initially ignored by the population. Simply put, people just gave up on them. Not believing in a deadly epidemic, the people continued their usual way of life, gathering in large companies and not using means of protection, and so on. The result of such an extremely frivolous attitude to the emerging threat is known, and it is very sad.

Now, what did Switzerland do in terms of implementing the restrictions? This was told to me by a good friend of mine who was there at the height of the pandemic. The Swiss authorities approached the issue of restrictions in the following way. Those who stay at home, in self-isolation, and do not go to work, the state pays 5 thousand francs a month. In other words, the picture is as follows: please stay at home, we will pay you for it. For those who don't have five thousand dollars and want to go to work, no problem, go. In case of infection, you will be provided with medical services. What do you think? About 90% of Swiss people chose to stay at home, receive the promised amount, and not risk their health and the health of their loved ones. This is an interesting and unusual approach of the authorities, as well as the consciousness of the citizens of this country. For example, the situation with COVID-19 in Switzerland is not comparable to neighboring Belgium, where the pandemic caused significant damage to the economy and took a disproportionately large number of lives.

Here's the deal. And it's time for us to move on to the technical picture of the dollar/franc currency pair, and let's start with the weekly timeframe.

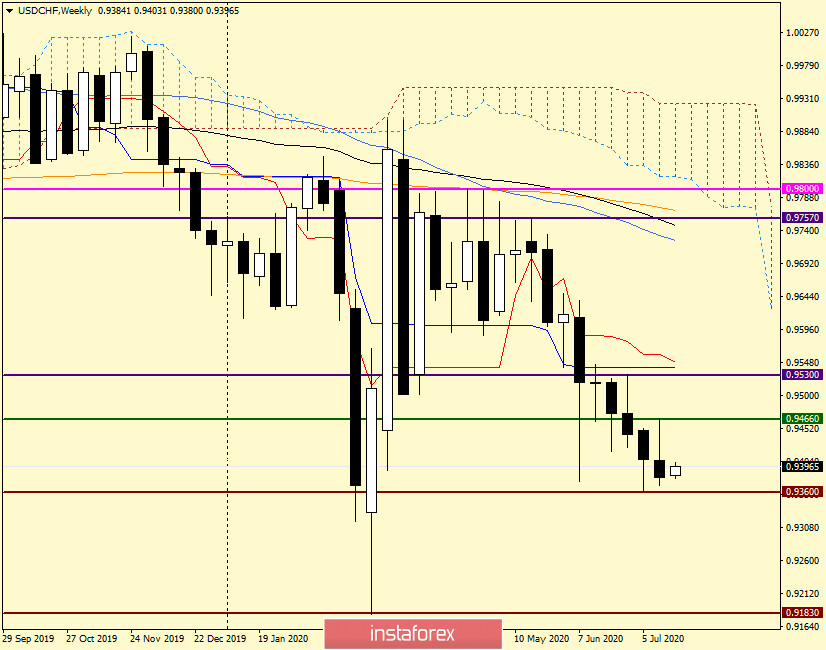

Weekly

As already noted at the beginning of the article, last week the decline in the quote continued. After the initial rise, the pair met strong resistance at 0.9466, then turned to decline, closing the weekly trading at 0.9369. In the price zone of 0.9370-0.9360, there is strong support, the breakdown of which will open the way to even lower prices. In the case of continued downward momentum, the next target will be the level of 0.9317. If this mark is passed, the USD/CHF risks falling to the area of 0.9183, where the minimum values of March this year were shown.

To reverse the situation, the bulls on the instrument need to update the previous highs at 0.9466, then raise the rate above the important psychological and technical level of 0.9500, and then break through the resistance of sellers at 0.9530 and pass the Kijun and Tenkan lines of the Ichimoku indicator. The task is very difficult, and to solve it, market sentiment must change dramatically in favor of the US dollar.

However, I have repeatedly noticed that after the appearance of such candles as the last one, the rate often rises. We'll see what happens this time. In my personal opinion, USD/CHF has a better chance of breaking 0.9360, after which the implementation of the bearish scenario will continue.

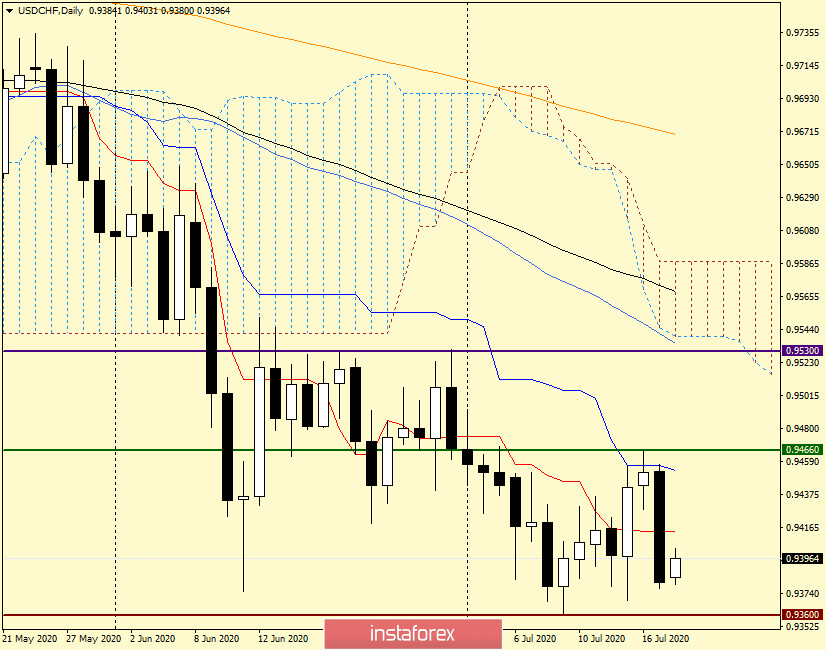

Daily

And the daily chart clearly shows how strong resistance to growth attempts is provided by the Kijun line. After the formation of the "Top" candle under this line, there was a strong drop in the price on Friday. There is nothing more to add to the daily schedule. The goals and objectives of the warring parties are the same as indicated in the description of the weekly timeframe.

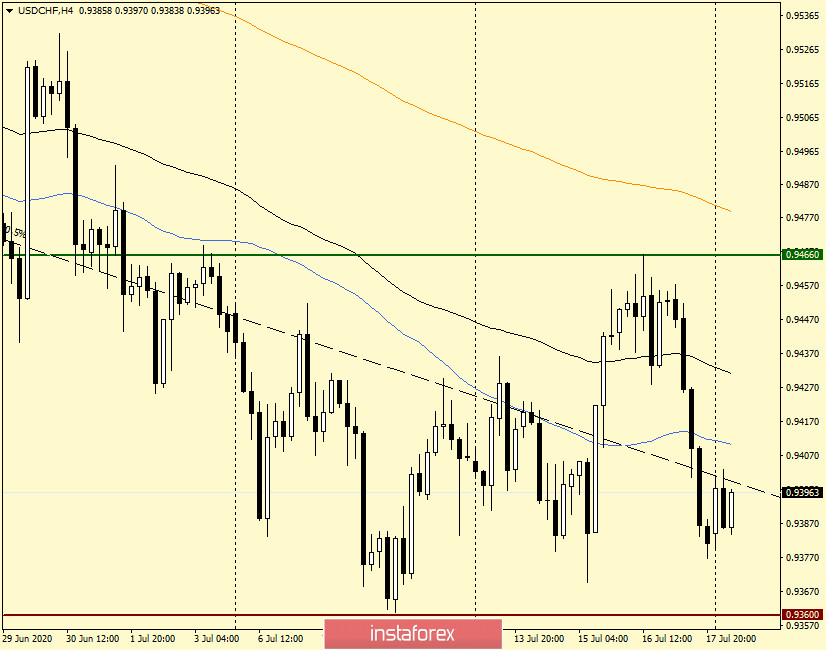

H4

During this period, the USD/CHF currency pair is trading under the used moving averages (50 MA, 89 EMA, and 200 EMA), each of which can provide decent resistance in the event of a rise to 0.9410, 0.9435 and 0.9480.

Also built a descending channel with parameters: 0.9757-0.9726 (resistance line) and 0.9375 (support line). As you can see, the pair is trading under the middle line (dotted) of this channel, which means in the lower part of it. We have already described the value of the middle channel line, which, depending on the situation, can serve as support or resistance. In this case, the middle line of the channel represents the resistance for the pair.

If we sum up everything we have seen and considered on the charts of USD/CHF, I have a bearish view on this pair. I recommend considering the nearest sales from the price zone of 0.9400-0.9415. Above, you can look at the opening of short positions after the quote rises to the area of 0.9460-0.9480. When using both options, it would be good to enlist the support of bearish candles that will appear in the designated areas, and then open deals for sale.

Good luck!

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română