The CFTC report showed that speculative positioning in major currencies is not in favor of the dollar again, the short position on which increased to 16.995 billion, almost reaching a recent high of 17.35 billion. Most experts attribute the decline in interest in the dollar to increased risks due to the growth of COVID-19 infections. 19 infections in the South and West of the United States, but perhaps the reason is different - that the dollar is gradually losing its status as a protective currency.

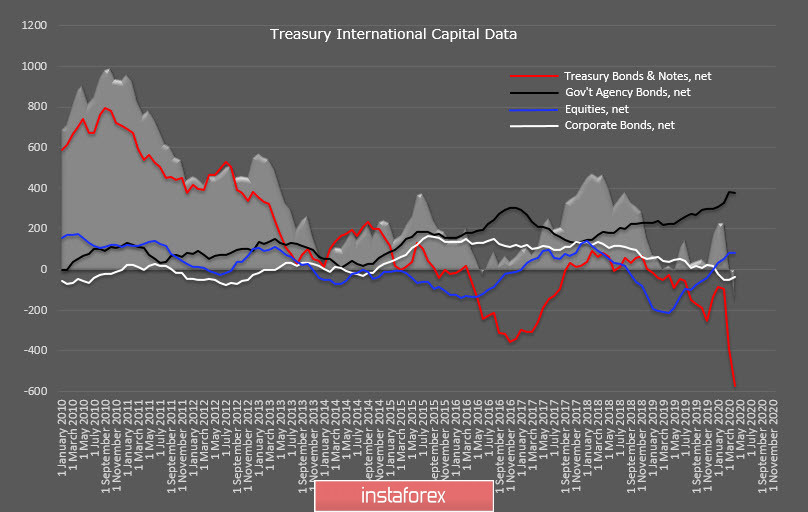

On Friday, the Treasury released a report on the inflow of foreign capital into securities, this report is interesting because it contains data for March and especially for April - the month when the coronavirus hysteria reached its climax. For three of the four groups of securities, the situation remained relatively stable – there was an inflow of capital to the stock market, this is a consequence of a large-scale pumping of liquidity markets, a small outflow from the corporate bond market was compensated by an increase in demand for securities of state agencies.

But in terms of the key indicator, the demand for American Treasuries, there was a strong failure. The total position for 12 months on Treasury Bonds & Notes reached the absolute minimum for the entire history of observations in April - $ 573.5 billion.

That is, foreign investors quickly got rid of, and obviously continue to get rid of, us government securities, which is an obvious criterion for the fundamental weakness of the dollar.

The consumer confidence index of the University of Michigan in July declined to 73.2p instead of the expected growth, actually to the levels of April-May, that is, consumers are quite pessimistic about their future. This pessimism will be reflected in the growth of gold, which clearly intends to update the maximum of 2011.

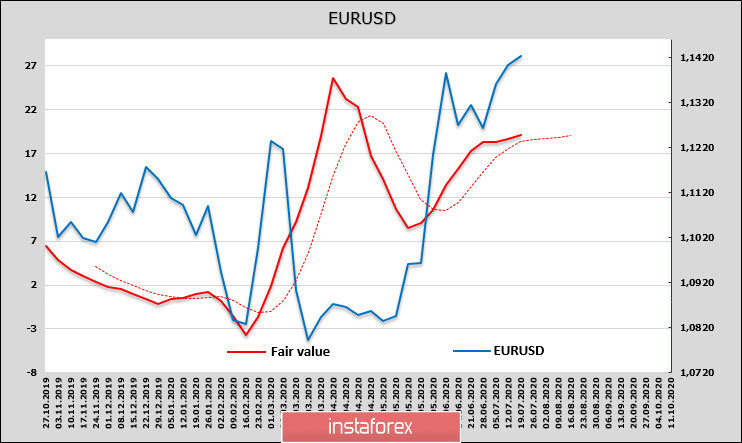

EUR/USD

After three days of discussions on the size and shape of the European Recovery Plan, EU leaders have been unable to reach an agreement, but the euro has not reacted in any way, as the probability of a compromise remains high. The main contentious issues remain regarding the mix of loans and grants (the latest proposal is € 400 in grants and € 350 in loans) and the degree of oversight of spending, but despite some harsh comments, EU leaders are solidary and willing to have a recovery fund in that or some other form, which increases the chances of a final result.

The net long position in the euro increased by 1.206 billion to 15.8 billion, the target price is confidently looking up, which means that the bullish trend for the euro is stable.

The EUR/USD pair hit a fresh 4-month high on Monday, obviously targeting 1.1494. The passage seems almost inevitable, the momentum is strong, and the euro can reach 1.18 without a significant correction. Therefore, it is recommended to keep, add on breaks to longs.

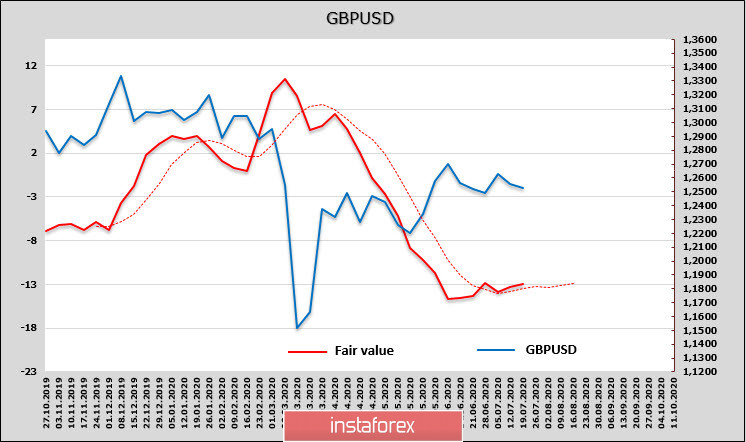

GBP/USD

Despite the fact that the labor market report exceeded forecasts, the pound cannot take advantage of the positive growth, since it is clearly not enough to outweigh the risks from Brexit without a deal.

Bank of England Governor, Andrew Bailey, said on Friday that the UK economy is starting to recover, but certain sectors remain weak and the long-term outlook for the economy is unclear. Accordingly, the position of the Bank of England on possible changes in monetary policy is still unclear.

The total short position on the pound slightly declined to 1.066 billion, however, the estimated level of the fair price is still significantly below the spot, and there is practically no positive dynamics.

The pound is trading in a range and there is no reason to exit from which. At the top, the pound is limited by the area of 1.2640/60, the lower border is 1.2540/50, the most logical strategy in the current conditions is trading from the borders and waiting for new data.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română