Hello, dear colleagues!

Following the results of the last five days of trading, the single European currency significantly strengthened against the US dollar. One of the factors that fueled the demand for the euro was the summit of the heads of the European Union countries, which was supposed to decide the issue of the recovery fund, whose function was to free the European Union economy from the shackles of recession, which it fell into due to the COVID-19 pandemic.

Briefly about the background of the restoration fund. Its creation was initiated by countries with two leading European economies, namely Germany and France. These states have proposed to adopt a seven-year EU budget for 2021-2027, which will include 1.074 trillion euros, where the economic recovery fund, according to the European Commission bill, should be 750 billion euros. Together, the budget amounts to 1.8 trillion euros. The figure, as you know, is considerable. Germany and France have offered interest-free subsidies to countries most affected by the coronavirus epidemic. Prominent representatives of such states are Italy and Spain, which are categorically in favor of creating an economic recovery fund and providing them with vital assistance. However, their northern friends-neighbors, namely the Netherlands, Denmark, Sweden, and Austria, do not agree with this campaign and the desire of the southern European countries to receive the necessary assistance. These countries have no desire to share money and help their EU partners.

Another important and characteristic moment for the current EU. At the summit, it was proposed to refuse subsidies to countries where democracy is not sufficiently developed. However, who and how this will be determined was not announced. Initially, the EU summit was supposed to last for two days, on July 17-18, but since no consensus was reached in the allotted time, we decided to continue discussions on the third day. The result is the same - zero. The agreement was not reached, and in general, the EU summit expected by many turned out to be a normal passing one. Who would doubt it?! When it comes to this kind of money, it's always a difficult decision to make.

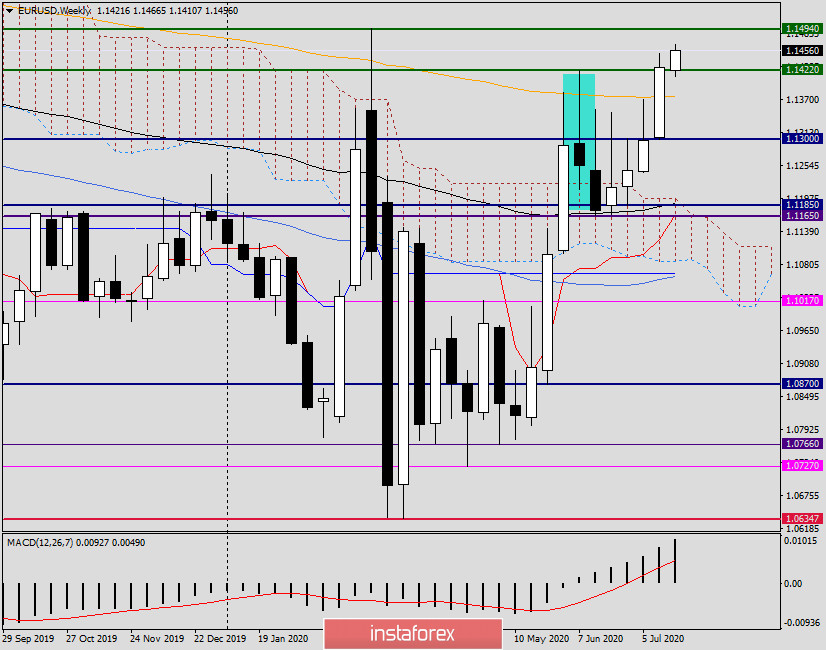

Weekly

As noted at the beginning of the article, the EUR/USD currency pair finished trading on July 13-17 with strong growth, strengthening by 1.22%. If we take into account that the dynamics of the main currency pairs were mixed, then among those currencies that rose against the US dollar, the euro became the undisputed favorite.

A large white candle, with a closing price of 1.1426, indicates further growth potential for the single currency. If so, the pair is doomed to meet the most important psychological and technical level of 1.1500, which will determine the prospects of the euro/dollar price movement. However, do not forget about such strong levels as 1.1460 and 1.1480, which can suspend the expected rise and send the quote to a corrective pullback.

Technically, there are two points to note. First, the euro/dollar pair has confidently passed up the exponential moving average. Secondly, the trading closed above the strong resistance level of sellers at 1.1422, which most likely means a break of this mark. It is also worth paying attention to the relatively small upper shadow of the last weekly candle, which indicates the strength of the upward dynamics.

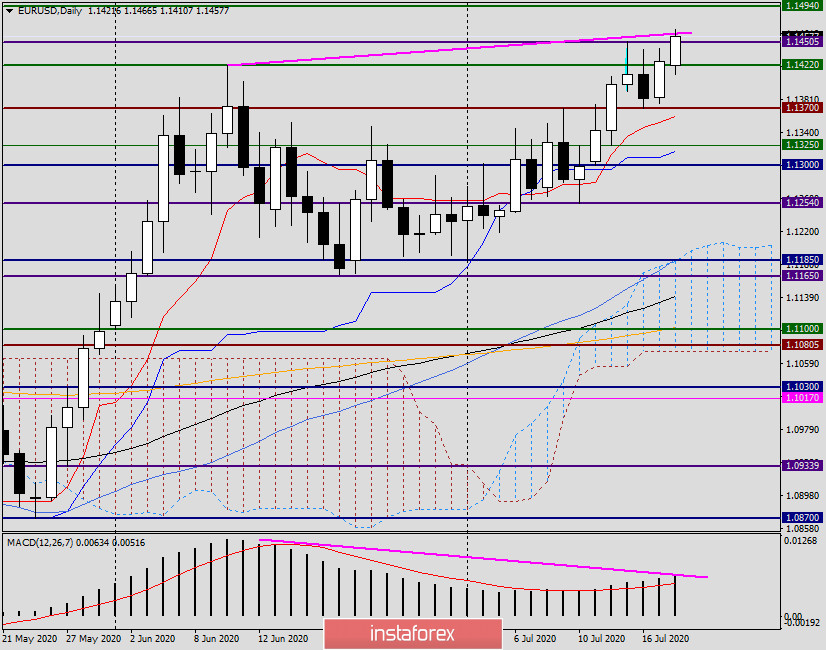

Daily

Today's trading, the main currency pair of the Forex market started positively, and at the moment of completion of the article, it is trading near 1.1452. The continuing bearish divergence of the MACD indicator is still ignored by market participants, but trading has just begun, so it is impossible to completely exclude changes in market sentiment and the price dynamics of the euro/dollar.

Conclusion and recommendations for EUR/USD:

Taking into account the technical picture on the higher timeframes, the main scenario looks like an ascending one. However, the pair is currently testing the resistance of 1.1452 for a breakout, where the highs were shown on July 15. Buying right here and now, in my personal opinion, is not worth it, it is too risky. To open long positions, it is better to wait for a pullback to the area of the broken resistance of 1.1422 and then consider opening buy deals, especially after the appearance of bullish candle analysis models in this area. At the same time, we define targets in the area of 1.1450-1.1480, and a further profit can be set on the approach to the level of 1.1500.

Given the bearish divergence on the daily chart, we can conclude that the pair is overbought. If the breakout of the resistance of 1.1452 is unsuccessful, and bearish candlestick patterns appear on the daily or smaller timeframes, you can try neat sales with goals in the area of 1.1430-1.1400.

Tomorrow we will look at smaller timeframes and, if necessary, adjust the points for entering the market.

Good luck!

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română