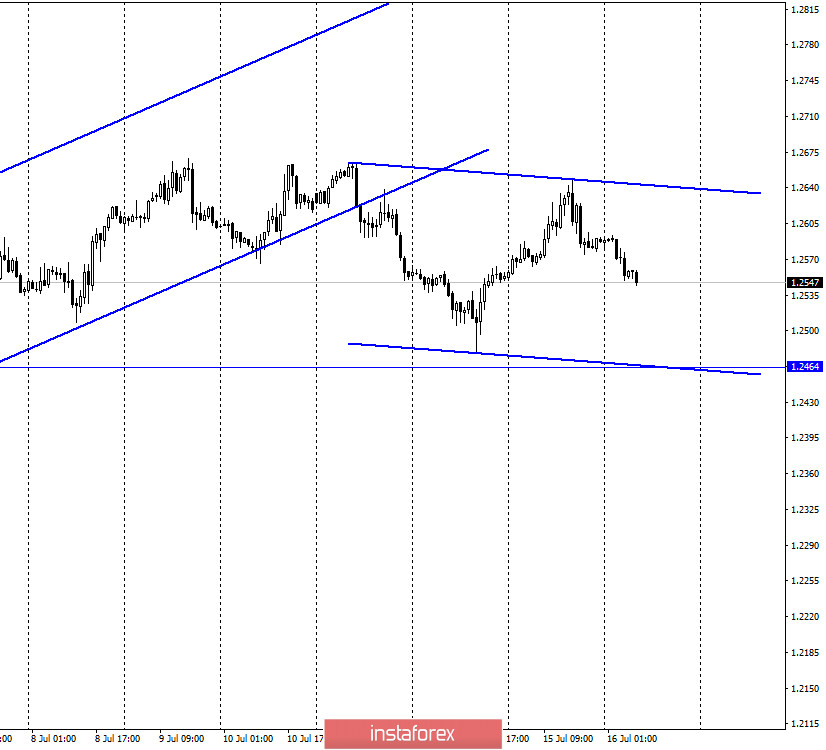

GBP/USD – 1H.

Hello, traders! According to the hourly chart, the quotes of the GBP/USD pair performed a new reversal in favor of the US currency and began the process of falling. I put a new downward trend corridor on the chart, which characterizes the current mood of traders as "bearish". I now expect the quotes to fall at least to the lower line of the channel, that is, approximately to the level of 1.2464. The latest economic plan news from the UK was rather weak. First of all, this concerns the GDP for May. However, industrial production was also at a super-low level. But today, reports on unemployment and applications for unemployment benefits showed some positivity. The first remained unchanged - 3.9%, the second showed - 28.1 thousand applications for benefits, although traders' expectations were +250,000. Thus, the reports showed that the labor market in the UK was almost not affected by the pandemic, which gives hope that the recovery will be faster than, for example, in the US, where unemployment peaked at almost 20%, and the developing COVID-2019 pandemic continues to keep Americans at bay, clearly not increasing their desire to go to work.

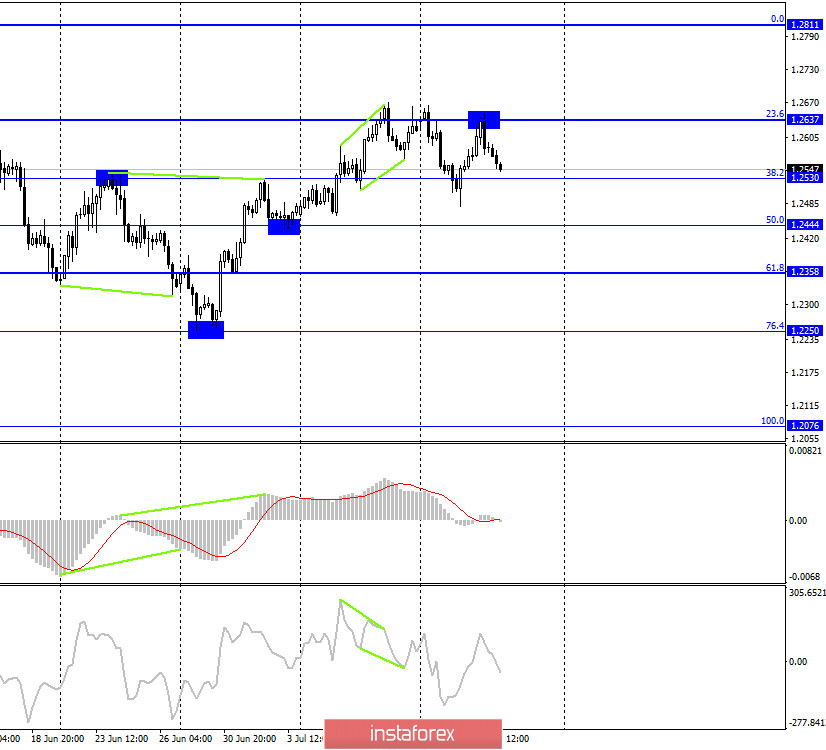

GBP/USD – 4H.

On the 4-hour chart, the GBP/USD pair rebounded from the corrective level of 23.6% (1.2637), turned in favor of the US dollar and fell to the corrective level of 38.2% (1.2530). Closing the pair's exchange rate below this level will work in favor of continuing the fall of quotes in the direction of the next Fibo level of 50.0% (1.2444), and further to 61.8% (1.2358). Today, the divergence is not observed in any indicator.

GBP/USD – Daily.

On the daily chart, the pair's quotes secured above the corrective level of 61.8% (1.2516). Thus, the growth process can be continued in the direction of the Fibo level of 76.4% (1.2776). However, this option no longer supports the hourly chart.

GBP/USD – Weekly.

On the weekly chart, the pound/dollar pair performed a false breakdown of the lower trend line and rebound from it. Thus, until the pair's quotes are fixed under this line, there is a high probability of growth in the direction of two downward trend lines.

Overview of fundamentals:

On Wednesday, the UK released a report on inflation, which did not leave any imprint on the chart of the currency pair. Inflation is low, less than 1% y/y, but inflation figures are now falling around the world due to falling oil prices and the crisis caused by the pandemic.

News calendar for the US and UK:

UK - change in the number of applications for unemployment benefits (06:00 GMT).

UK - unemployment rate (06:00 GMT).

UK - change in average earnings (06:00 GMT).

UK - Bank of England Governor Andrew Bailey will deliver a speech (11:15 GMT).

US - change in retail trade volume (12:30 GMT).

US - number of initial and repeated applications for unemployment benefits (12:30 GMT).

On July 16, in the UK, in addition to the already released reports on unemployment and wages, there will be an important speech by the Governor of the Bank of England. American reports, especially on retail sales, will also attract the interest of traders.

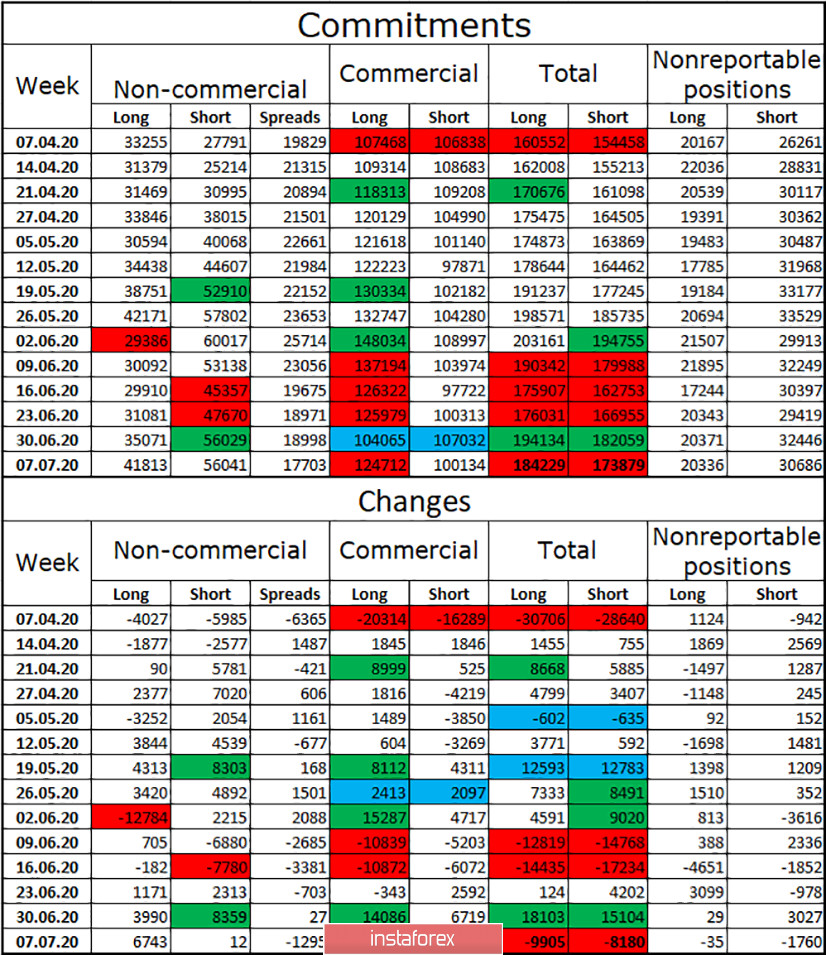

COT (Commitments of Traders) report:

The latest COT report again showed an increase in the number of long contracts among the "Non-commercial" group. However, if the last report also showed a strong increase in short contracts, the report for July 7 showed that speculators opened only 12 short contracts in a week. Thus, if you try to track the trend, since the beginning of June, speculators are increasing long, but the number of short-contracts in their hands has decreased over the same period of time by 4 thousand. On the face of the "bullish" trend, which completely coincides with what is happening in the market. At the same time, the total number of both groups of contracts for the reporting week decreased by 18 thousand, mainly due to the "Non-commercial" group, which actively got rid of both groups of contracts.

Forecast for GBP/USD and recommendations to traders:

I recommend selling the pound again with a target of 1.2444, if the close is made below the level of 1.2530 on the 4-hour chart. I recommend opening purchases of the pair with the goal of 1.2637, if the rebound from the level of 1.2530 is made.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency, not for speculative profit, but to ensure current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română