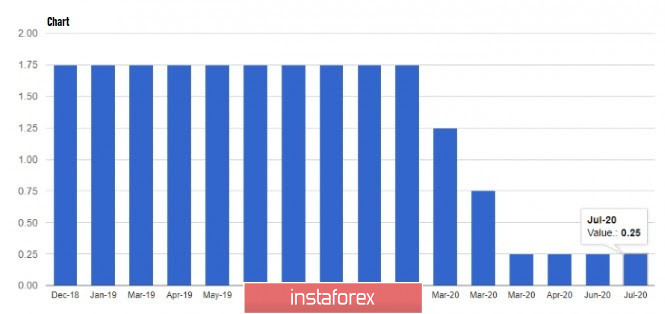

The Canadian dollar arose after the Bank of Canada left its key rate unchanged at 0.25%. In addition, the bank noted improvements in economic prospects after the country decided to lift the quarantine restrictions.

At its meeting, the Bank of Canada noted that it will continue the current program of quantitative easing at the same level, since the future prospects of the global and Canadian economies are extremely uncertain. Already, it is obvious that the timing and pace of recovery vary by region, and another surge in coronavirus infections can complicate the pace of economic recovery, which has barely recovered from the first wave.

The regulator also drew attention to the fact that global economic activity is accelerating amid the removal of quarantine restrictions, at which the prices for most commodities, including oil, rose from the low levels that were recorded in the middle of the pandemic. The report indicates that economic activity in the 2nd quarter of this year is 15% lower than at the end of 2019, and measures to contain the virus have led to the deepest and sharpest economic downturn since the Great Depression.

Thus, if necessary, the Bank of Canada is ready to provide further monetary stimulus, and the current interest rate, which is now the most effective, will remain at the same levels until the weakness of the economy is eliminated.

As for the future prospects for economic recovery, the regulator expects sharp growth in the 3rd and 4th quarter, which will then be replaced by a longer and more uneven one. The main scenario assumes a drop in GDP in the 2nd quarter by 43% per annum compared with the 1st quarter, and a partial recovery in the 3rd quarter by 31.3% per annum.

With regards to macroeconomic statistics, good support to the Canadian dollar was also provided by the report on the manufacturing sector of Canada, which significantly recovered in May after declining sharply in April this year. According to the data published by the National Bureau of Statistics of Canada, supplies in the manufacturing sector increased by 10.7% in May, and settled to 40.19 billion Canadian dollars. Economists expected the supply to grow by only 9%. Compared to the same period last year, production supplies fell by almost 32% in May.

Meanwhile, at a press conference after the meeting, Bank of Canada governor Tiff Macklem also stated that the greatest source of uncertainty was the unknown direction of the coronavirus. According to average estimates, the pandemic will not be stopped until mid-2022. Thus, the economy will undergo a short-term growth at the end of this year, followed by a slower uneven recovery phase. Macklem also highlighted the state of the labor market as a separate problem, which could weaken if schools cannot fully open due to new outbreaks of infection.

During the meeting, issues on the control of yield curve were also discussed, in which the need for leading indicators was kept, while maintaining an adequate asset buy-back program. According to Macklem, the current monetary policy is fully focused on achieving the target inflation of 2%, and the current QE volumes will help in this.

As for the current technical picture of the USD / CAD pair, the bears have every chance to get beyond the side channel and also break below the large support area of 1.3490. Such will increase pressure on the trading instrument, which will push it into the area of new lows at 1.3360 and 1.3310. As before, the growth of the pair is limited by the resistance level of 1.3700, beyond which the quote will be able to return to the 200-day moving average, which now coincides with the level of 1.3825.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română