As expected, European stock markets opened with growth, supporting the positive mood of yesterday. September Brent futures fixed above $ 43 per barrel, while markets are waiting for the results of today's virtual meeting of OPEC +, which will very likely confirm a steady recovery in demand and decide to increase production.

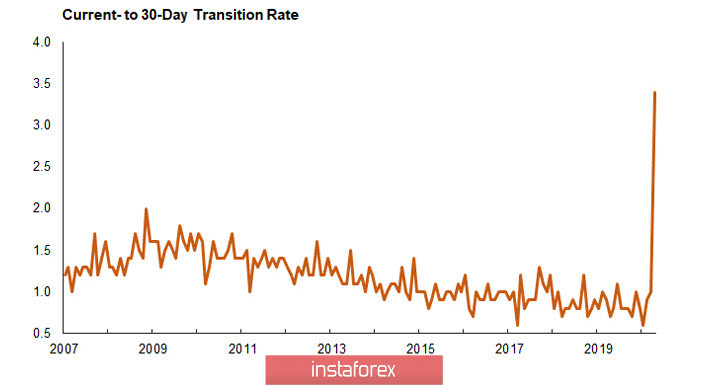

The current assessment of market mood is positive, which will give support to risky assets. On the other hand, long-term trends remain negative, in particular, delays in mortgages in the USA, as follows from the Loan Performance Insights Report published yesterday, which already exceeded the record of November 2008.

If that crisis was called a mortgage and announced its decisive contribution to the global financial crisis, then a deeper failure this year can only talk about one thing - the main consequences are still ahead, and the current growth of optimism is unlikely to be prolonged.

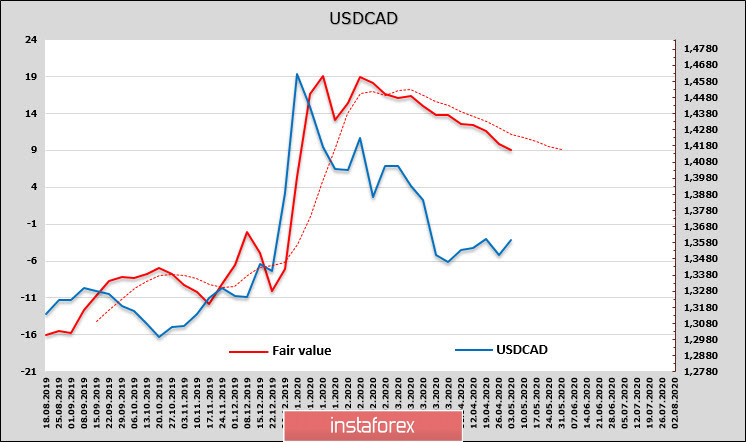

USD/CAD

The Canadian dollar is the only G10 currency that lost value against the dollar in June. Investors ignore generally positive macroeconomic data (the June labor market report was generally better than expected, the construction industry is showing signs of recovery, and the Ivei business activity index in June is significantly higher than expected).

The growth of the indicated currency is held back by stronger fears about the spread of COVID, the main negativity comes from the proximity of the United States, which puts Canada in a losing position against other commodity countries, in particular, against Australia.

The net short position declined again, by 275 million this time. The trend is positive and the estimated price of USD/CAD is reduced, which gives some reason to rely on the loonie's strengthening, but it remains much higher than the spot price. Together, these factors act in the opposite way and do not allow you to confidently see the direction.

A meeting of the Bank of Canada will take place today, the first under the chairmanship of Macklem. It is expected that the rate will remain at the level of 0.25%, surprises may come to light after the publication of updated macroeconomic forecasts, as they are likely to differ from those presented in January. Most likely, the assessment of the balance of risks will be inclined downward; new decisions are possible regarding plans to recover bonds. All this together can add volatility to the CAD, and if forecasts are implemented, the loonie will weaken by the end of the day. Hence, the bullish reaction of USD/CAD to the outcome of the BoC meeting is slightly more likely. The target is 1.3670/80.

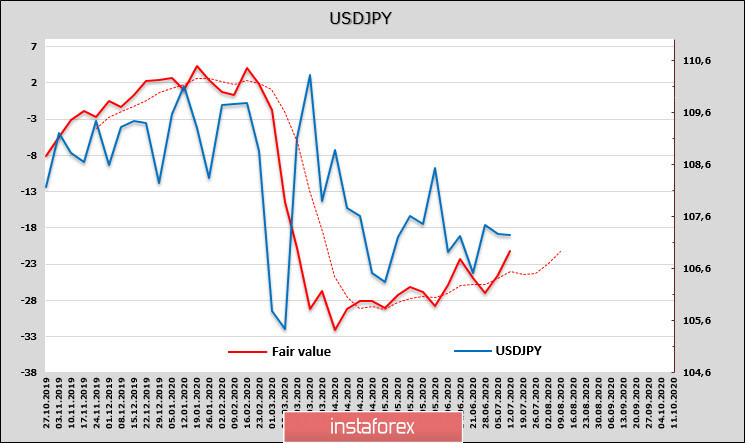

USD/JPY

The Bank of Japan, following a meeting that ended on Wednesday morning, left the monetary policy unchanged. The accompanying statement notes that "...the Japanese economy is in an extremely difficult situation with the impact of COVID-19, although economic activity has gradually resumed." As for the forecasts, they are also disappointing. It is predicted that the Japanese economy with the resumption of economic activity is likely to gradually improve from the second half of this year due to materialization of pent-up demand and support from the government and easing financial conditions, but the pace of improvement will be moderate.

According to BoJ, the risk balance is inclined downward. Real GDP will be lower than expected, and core inflation has no chance of even approaching the target level of %. It is not surprising – even despite the relatively stable situation in the labor market, export-oriented industries are under tremendous pressure, with industrial production falling by 26.3% yoy in May.

The estimated fair price is not far from the current spot price level. There is still no direction and trading in the range continues.

Due to the extremely low profitability, Japanese assets do not attract the investors. Their growth is possible only in the event of a sharp increase in tension, which will lead to a decline in the price of raw materials. Only in this case, the demand for the yen may increase, since nobody but Japanese banks has been buying bonds for a long time.

The USD/JPY pair has no direction. Trading in the range is likely to continue. The lower limit of the range is 106.55/75, the upper 107.60/80, and the exit from the range is slightly more likely to go up.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română