The Australian dollar paired with the US currency is testing a key resistance level of 0.7000 again amid the general weakening of the dollar. Yesterday, the dollar index declined to the border of 95 points, but it was adjusted to 96.12 points during the Asian session on Wednesday. Let me remind you that traders of AUD/USD have already stormed this target several times over the past month and a half, and reached the middle of the 70th figure even in some cases. But subsequently, the Australian dollar returned to the range of 0.67-0.69, demonstrating an inability to consolidate above 0.7000.

Today's growth of AUD/USD is due solely to the weakness of the US currency. In other cross-pairs, the Australian currency behaves much more modestly, and in some cases (for example, paired with the Norwegian krone) is completely under pressure. Therefore, it is necessary to treat the current upward impulse with great caution, especially before tomorrow's data on the labor market in Australia and on the growth of the PRC economy. In addition, do not forget about the Australian-Chinese conflict, which not only has not subsided, but has recently been continued. Such a fundamental background does not allow us to count on a stable upward trend of the AUD/USD, since the behavior of the dollar index has recently been "hysterical" in nature: after a sharp weakening, an equally sharp increase follows, which, however, is also limited by the "ceiling" of 97.6 points.

Therefore, in my opinion, it is quite risky to open longs for a pair now. But sales of the AUD at the first signs of slowing down the upward impulse look quite attractive. However, there is a certain risk here, given tomorrow's releases, which are extremely important for AUD/USD traders.

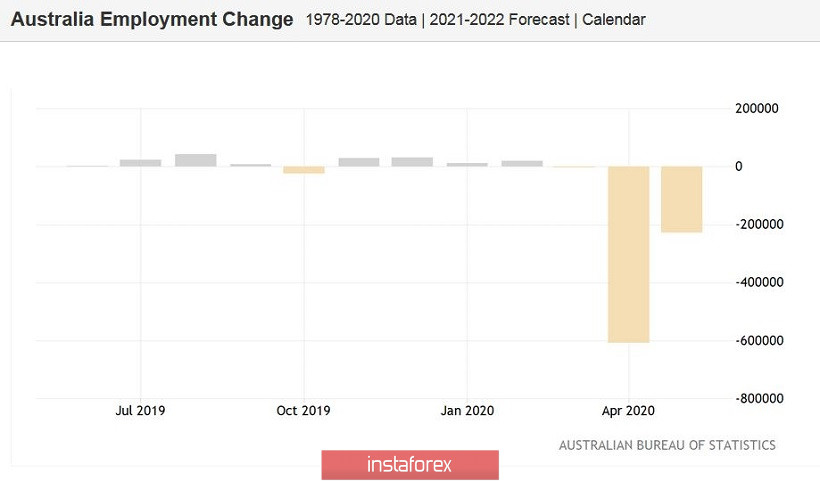

Australia's previous labor market data was a major disappointment. The unemployment rate in May jumped to 7.1% with a forecast of growth of up to 6.9%. This is a long-term anti-record: the last time the indicator was at such a high level was in 1999 (in the late 90s, unemployment in Australia reached almost 9%). The number of employees declined by 229 thousand. On the one hand, this indicator came out worse than the forecasted values (experts predicted a 100-thousandth reduction), but on the other hand, there is a positive trend, since the number of employees decreased by a record 607 thousand) in April. Salaries were not impressed either - weak signs of recovery did not change the generally negative picture. Weak wage growth was reflected in consumer activity of Australians. At the last meeting of the RBA, the regulator members complained household spending stabilized at a "new level" - Australians began to spend less on travel and entertainment (that is, the service sector), but at the same time, increased spending on household goods and food. In this regard, retail trade in food products outside supermarkets grew by 33% compared to the same week last year, and in supermarkets - by 21%.

According to general forecasts, the unemployment rate will remain almost at the May level in June, rising to 7.2%. However, this indicator is a lagging economic indicator; therefore, the main attention will be focused on the increase in the number of employed. Positive dynamics is expected here. According to experts, a little more than 100 thousand jobs were created (after 220 thousand reductions in the previous month) in June in Australia.

Traders should pay attention to the structure of this indicator. For example, in May, the negative dynamics of the growth of employed was mainly due to a decline in part-time employment. This component collapsed by almost 140 thousand. However, full employment showed a less significant decline, declining by 89 thousand. This suggests that the May decline in the labor market did not hit so much on the dynamics of wage growth, as regular positions, as a rule, offer a higher level of wages and a higher level of social security. In June, a mirror situation is expected: according to experts, the 100,000th increase in the indicator will be mainly due to the increase in part-time employment. This fact can be negatively perceived by traders.

It is also worth noting that key data on the growth of the Chinese economy for the second quarter will be published tomorrow. According to the general forecast, China's GDP will increase by 9.6% on a quarterly basis and by 2.2% on an annualized basis. The industrial production indicator should also show a positive trend, rising by almost 5%. Such results will provoke a general risk appetite in the market and will positively affect the Australian dollar, especially after the failed figures of the first quarter. But if the Chinese releases disappoint, the AUD/USD pair will decline under a wave of sales again.

Thus, in anticipation of tomorrow's events, it is quite risky to make trading decisions on a pair. The oscillating movement can swing both one way and the other. In my opinion, while the political conflict is smoldering between Australia and China, the buyers of AUD/USD will not be able to develop a stable upward trend. Therefore, it is advisable to consider any bursts of optimism as an excuse for "Aussie" sales - to the first support level of 0.6900 (the middle line of the Bollinger Bands on the daily chart, coinciding with the Kijun-sen line).

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română