Hello, dear colleagues!

Well, yesterday's assumptions about the breakout of EUR/USD up were confirmed. However, the euro bulls did not manage to complete their mission. Tuesday's trading of the main currency pair of the Forex market ended with a strong growth, and this is despite the fact that the consumer price index in the US and its base value came out better than expected by economists.

However, in my opinion, it is too early to talk about a change in the global downward trend for the euro/dollar. Such reasoning will make sense in the event of a breakdown of the psychological and technical level of 1.1500, and with mandatory fixing above this mark.

Now a little bit about the topical topic of COVID-19, which curbs the optimism of market participants and reduces investors' appetite for risk. In the world, more than 13 million people have already been infected by the insidious pandemic. The United States of America continues to maintain a sad lead in the daily number of people infected with a new type of coronavirus. Against this background, the authorities of California, where one of the focus of COVID-19 is located, decided to delay the cancellation of a number of restrictions. Moreover, the Governor of the State initiated the introduction of new restrictive measures, in particular for business. This could have disastrous consequences for the American economy, which has only just begun to recover. Let me remind you that California's GDP is about 15% of the total gross domestic product of the United States, and this is quite a serious figure. In Texas and Florida, where the pandemic is also raging, GDP is about 14%. However, these are extreme and forced measures to extinguish the focus of COVID-19 infections and avoid more serious consequences.

The European Union this week hopes to agree on all the conditions of the Eurozone economic recovery fund, which certainly supports the single European currency. Let me remind you that the summit of the heads of the European Union will be held on July 17 and 18.

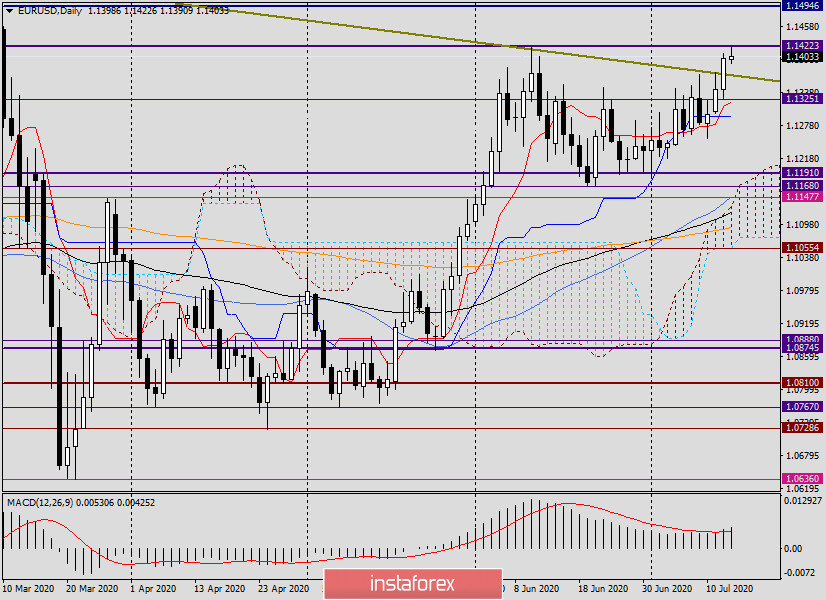

Daily

As already noted, the pair showed a good confident growth in yesterday's trading. First of all, this can be judged by the lack of a long upper shadow, which indicates the strength of the bulls in the euro. As a result of the growth, sellers' resistances at 1.1374 and 1.1383 were broken through and two more important resistances at 1.1403 and 1.1422 were tested for a breakout. Tellingly, Tuesday's trading closed at 1.1399, which may cause slight concern for the players to increase, as it shows the strength of the resistance zone of 1.1400-1.1425. Let's call it that.

At today's trading, we can assume repeated testing for a breakdown of the strong resistance of sellers at 1.1422. In this case, there are two possible options. Either this level will be passed and the trades will close higher, or the attempt to break 1.1422 will again be unsuccessful, a reversal model of candle analysis will appear, after which the pair will go for a correction, or even change the trend altogether.

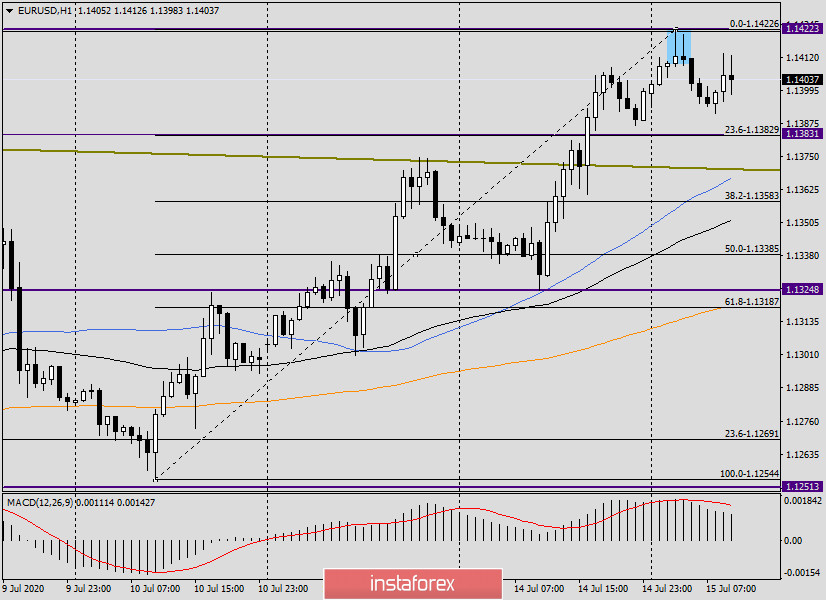

H1

If you go to the hourly chart, we see that after the appearance of two selected reversal candles, a corrective pullback is already taking place on this timeframe. Today, the pair visited 1.1423, after which it began to roll back down.

I stretched the grid of the Fibonacci tool to the rise of 1.1255-1.1423, and here special attention should be paid to the first two pullback levels: 23.6 and 38.2. Also, let's not forget about the broken resistance level of 1.137. If bullish reversal patterns appear near the indicated levels, the corrective pullback can be considered complete and we can prepare to buy the pair. This is probably the main trading recommendation for today.

Do not forget that starting from 13:30 (London time), a block of macroeconomic data will be published from the United States, where the most important report, in my opinion, will be data on industrial production. More information about today's events in the economic calendar.

I wish you success!

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română