Many are expecting the US dollar to decline, in anticipation of a fast economic recovery expected to be seen in the next 6-12 months. According to the recent survey conducted by HSBC, 46% of the respondents believe that the dollar will fall amid a reduced risk in coronavirus, while about 25% said that the dollar will grow. The rest, meanwhile, took a neutral stance on the issue.

The results of the survey are not surprising. This is because authorities have already repeatedly stated that more aggressive rates of economic recovery will be seen in the countries whose focus is not on maintaining the balance sheets of central banks.

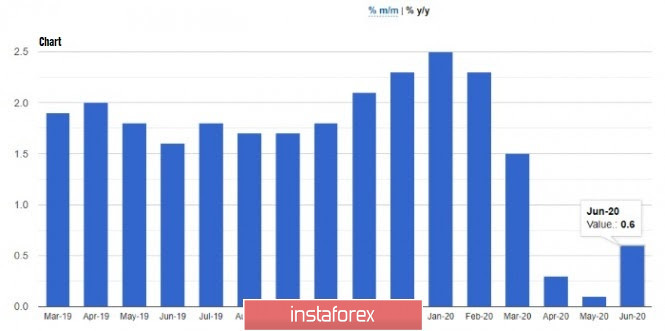

Meanwhile, with regards to the latest macroeconomic reports, the data on consumer prices in the US jumped in June this year, but if analyzed deeper, it should not be considered as a sign of a sharp acceleration in inflation. Nevertheless, according to the report published by the US Department of Labor, the CPI rose by 0.6% in June, up from the economists' forecast of 0.5%. At least half of the growth is from the increase in energy prices such as gas, which rose by 12.3% this month. Food prices also grew by 0.6%, which indicates the preservation of social distance, despite the removal of quarantine restrictions. As for core inflation, which does not take into account all the indicators mentioned above, a growth of 0.2% was recorded, slightly better than the forecast of 0.1%.

The removal of quarantine restrictions certainly revived inflation. However, the recent surge in new coronavirus cases has a serious impact on businesses, because authorities may resort again to implementing restrictions to deescalate the situation. If quarantine is introduced again in many states, consumer prices will be affected, which could hinder economic recovery.

The latest report of the NFIB also pointed this out. According to its published data, the economy has recovered due to the return of activity in the country caused by the improving expectations on future prospects and employment amid the removal of quarantine restrictions. However, there are fears that all these are premature, since a return of restrictive measures could seriously harm the indicator.

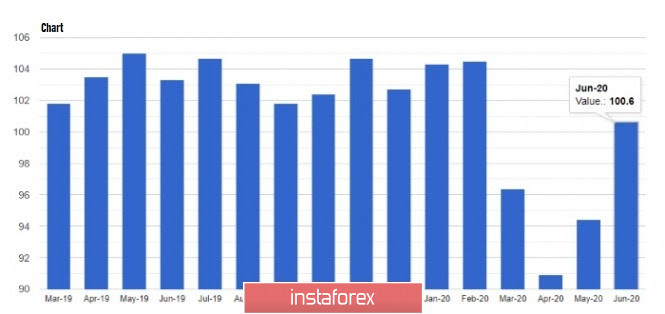

Thus, the NFIB version of the US small business optimism index jumped to 100.6 in June, while economists expected the index to reach 98.0 points. The rise in consumer spending, together with the improvement in the labor market, is gradually returning the economy to pre-crisis levels, but this is a rather long way to go, since despite strong growth in May and June, the index remains below the pre-crisis February level of 104.5.

As for the weekly reports of The Retail Economist, Goldman Sachs and Redbook, which were ignored by the market, the index of sales in US retail chains decreased by 1.2% over the week of July 5 to July 11, and declined by 9.8% compared with the same period last year. Redbook noted that the index jumped 3.0% in the first week of July, but fell by 5.5% if compared with the record last year.

Another interesting news is the decision of the European Central Bank to increase its corporate bonds purchases to € 3.3 billion. Such is carried out as part of the corporate securities acquisition program (CSPP), which aims to support the economies greatly affected by the pandemic. The ECB will also hold a meeting tomorrow, during which new changes in the monetary policy may occur. An EU summit will also take place on July 17 and 18, and there, the EU leaders will discuss the proposal of the European Commission to create a fund for economic recovery in the European Union.

Yesterday, Fed representatives also gave a number of speeches which generally said the same thing. They expressed concerns that the recent increase in employment will be short-lived, since this problem has become more and more urgent in the current situation. Because of this, new fiscal support measures are needed, moreso because the strength of economic recovery inevitably depends on it. Much has been said about the problem in consumer spending, which is being restrained because of the recent surge in coronavirus. Nevertheless, there is nothing new that is not known about, which resulted in a change of mood from bullish to bearish during the American trading session.

Thus, for the technical picture of the EUR/USD pair, the further direction of the quotes depend on a breakout from the resistance level of 1.1420, as only such a scenario will push the pair to the level of 1.1460, and then to the test of the 15th figure. However, the upcoming meeting of the ECB may weaken the bullish mood of the euro, so a more optimal point for entering the market is a correction in the support level of 1.1360, or the test of a larger low of 1.1305, where the lower border of the current upward channel passes.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română