GBP/USD

Analysis:

The British pound continues to adjust its exchange rate. In the descending wave that began on June 10, the middle part of the wave structure (B) was completed. The current bearish momentum on the last day can move the pair's quotes to the borders of the far support zone.

Forecast:

In the coming day, the most likely downward vector of price movement. In the European session, there may be a short-term price rise, no further than the resistance zone. The active phase of decline is likely at the end of the day or tomorrow.

Potential reversal zones

Resistance:

- 1.2600/1.2630

Support:

- 1.2520/1.2490

- 1.2440/1.2410

Recommendations:

Purchases of the pound should be treated with caution due to the expected small potential for probable growth. We recommend that you focus on searching for the instrument's sell signals.

AUD/USD

Analysis:

The dominant trend direction of the Australian dollar since March 19 is set by the rising wave of the daily scale. Since June 9, the price has been adjusted. The wave develops in the form of a horizontal figure "flag". The structure of this wave lacks the final part.

Forecast:

Today, the price movement is expected to continue in the price corridor formed in recent weeks. In the coming sessions, a downward vector of price movement is more likely.

Potential reversal zones

Resistance:

- 0.6960/0.6990

Support:

- 0.6890/0.6860

Recommendations:

Trading on the pair market today is possible only within the framework of the intra-session style. There are no conditions for purchases. When selling, it is more reasonable to reduce the trading lot.

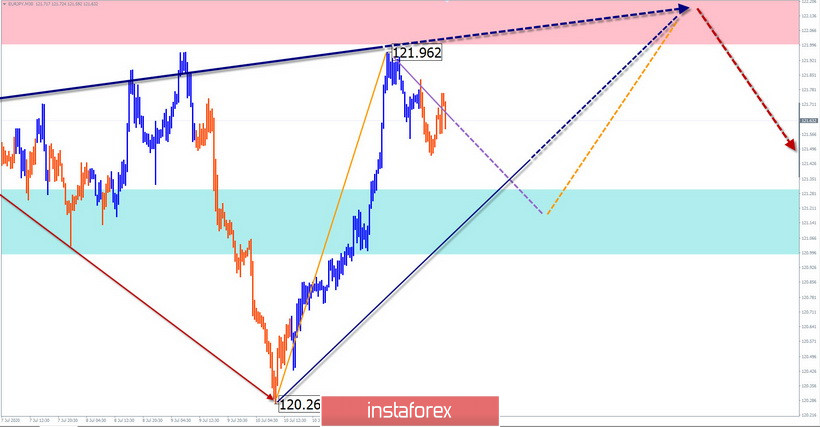

EUR/JPY

Analysis:

The current wave structure of the European cross counts down from June 5 and moves down, following the course of the dominant long-term trend. In the structure of the wave, the middle part (B) is nearing completion. There are no reversal signals on the chart yet.

Forecast:

In the coming day, we must wait for the end of the rising wave. A short-term pullback is possible in the European session. The calculated resistance is located in the area of a strong zone of a potential reversal, from which you should then wait for a change of course.

Potential reversal zones

Resistance:

- 122.00/122.30

Support:

- 121.30/121.00

Recommendations:

Trading on the pair's market is quite risky today. Transactions are possible within the framework of an internal session. The priority is to purchase. It is preferable to reduce the trading lot.

Explanation: In the simplified wave analysis (UVA), waves consist of 3 parts (A-B-C). The last incomplete wave is analyzed. The solid background of arrows shows the formed structure, and the dotted ones show the expected movements.

Note: The wave algorithm does not take into account the duration of the tool movements in time!

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română