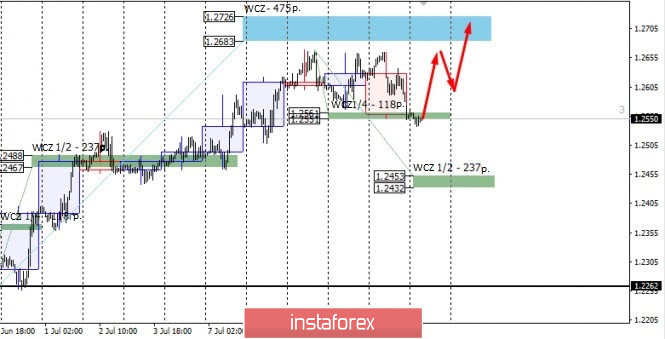

The upward model on the pair remains a medium-term momentum, however, yesterday there was a fall, which allowed us to form a pattern of "absorption" of the daily level. The probability of forming a correction model has increased to 70%. The target of the downward movement may be the WCZ 1/2 1.2453-1.2432. The test of this zone will allow you to get the most favorable prices for the purchase of the instrument.

Working within the framework of the correction model allows you to consider sales with a quick fix and transfer to breakeven after updating the daily extremes.

An alternative model will be developed if the closing of today's trading occurs above yesterday's opening level. There will be a cancellation of the option of a deep correction and purchases will again come to the fore. This model should be considered along with the correction model.

Daily control zone. A zone formed by important data from the futures market that changes several times a year.

Weekly control zone. The zone formed by important marks of the futures market, which change several times a year.

Monthly control zone. A zone that reflects the average volatility over the past year.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română