Hello!

As noted in previous articles today, at the trading on July 6-10, investors preferred such safe-haven assets as the Japanese yen and the Swiss franc to the US dollar. COVID-19 continues its deadly spread in the United States, India, and Brazil. Moreover, outbreaks of a new type of coronavirus infection have been reported in Melbourne, Tokyo, and Hong Kong. Against this background, the Japanese currency strengthened at the trading of the last five days against the US dollar by 0.25%. If you look at the economic calendar, this week, the main events for USD/JPY will be the US consumer price index and the Bank of Japan's interest rate decision. There will be a lot of other macroeconomic statistics, however, these events will be the most significant.

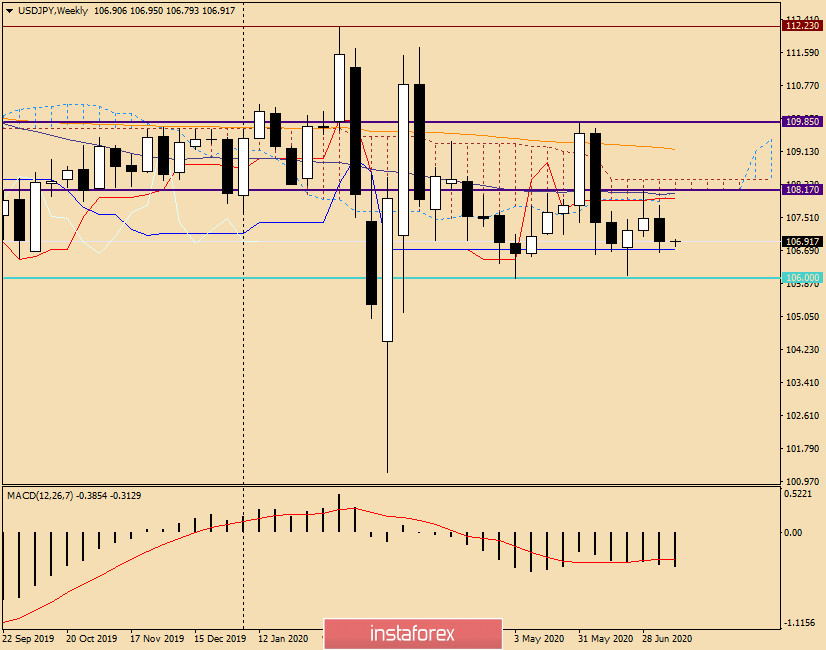

Weekly

At the trading of the last five days, the bulls on the dollar/yen set out to again feel the strong technical level of 108.00, but before reaching this mark, the quote turned to decline. I believe that the Tenkan line and the lower border of the Ichimoku indicator cloud, as well as the 50 simple moving average, played an important role as resistance. In turn, the Kijun line provided good support, which limited the decline in the dollar/yen pair.

As can be seen on the chart, the pair has been trading in the range of 108.17-106.00 for several weeks. I believe that a true exit from the designated price range can indicate the medium-term direction of the price. In the meantime, judging by the weekly chart, the probability of positioning in both directions remains. In my opinion, there is a better chance of a downward scenario. However, no one knows what attitude investors will have to the COVID-19 pandemic and what currency they will choose as a protective asset. I would also like to remind you that the dollar/yen pair is very sensitive to macroeconomic statistics from the United States, which is expected to be quite a lot this week. Do not write off the Bank of Japan's decision on rates. Although, as it seems, there are no surprises to wait for.

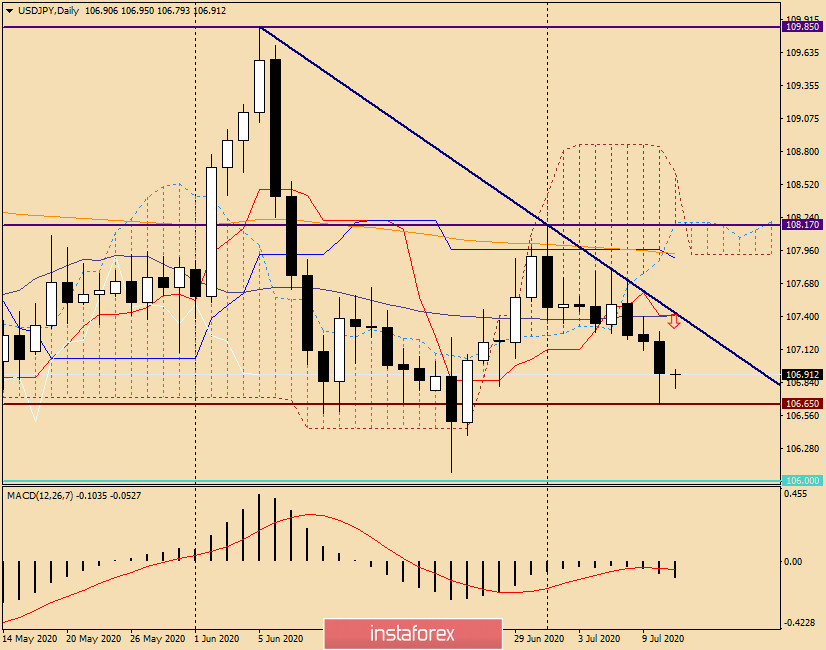

Daily

A fairly long lower shadow of the candle for July 10 may signal the market's reluctance to move further south. However, we should not exclude that this shadow appeared against the background of fixing positions before the weekend.

If the support is broken at 106.65 (the lows of July 10), it is time to expect a further decline in the price zone of 106.10-106.00, where the further fate of the pair will be decided. I venture to assume that a breakout of the significant level of 106.00 and a consolidation below it will indicate a bear market for USD/JPY. In this case, the pair risks going to much lower prices.

Resistance levels on the daily chart are 107.40 (Tenkan and 50 MA), 107.88 (Kijun line), 108.17, where the maximum values of trading on July 1 are indicated. At the same time, only the breakdown of the last mark with fixing above will indicate the primacy of the bulls for this currency pair and the potential for further growth. We must admit that this is an extremely difficult task.

Taking into account the changed market sentiment and technical picture on the considered timeframes, I recommend considering sales as the main trading idea. I suggest that we consider opening short positions on USD/JPY after rising to the price zone of 107.35-107.75 and the appearance of bearish reversal candles on the daily or lower timeframes. In the next few days, we may return to the consideration of this currency pair and, if necessary, make changes to the trading recommendations.

Good luck with trading!

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română