Hello, dear colleagues!

The last trading week was not the most successful for the US dollar. The US currency suffered losses against all major competitors, except the Canadian dollar. In particular, the main currency pair of the Forex market strengthened by 0.53%.

The situation with the COVID-19 epidemic continues to deteriorate in the United States, Brazil, and India. Some virologists believe that this is the second wave of a new type of coronavirus infection, others believe it is a continuation of the first. In the US itself, the daily record of COVID-19 infections is constantly updated, and at the end of last week, this figure was more than 60,500 infected. Against this background, the comment of the head of the Federal Reserve of Dallas, Robert Kaplan, that the use of protective masks will slow the spread of the pandemic and help the American economy recover faster, became very ridiculous. Truly - a unique idea! How did no one think of this before?!

Seriously, when the situation with COVID-19 infections worsened, the US dollar was in high demand among investors as a safe asset. However, last week, market participants gave their preference to safe-haven currencies such as the Japanese yen and the Swiss franc.

As for the news from Europe, a press conference of the President of the European Council was held in Brussels, where compromise options were presented regarding the EU budget for the next 7 years. The main point is the proposal to allocate not only loans but also subsidies to the countries most affected by the coronavirus. Also, according to the figures, funds were distributed to countries that need economic support from the consequences of COVID-19. At the end of this week, on July 17-18, the heads of the European Union countries will meet in Brussels to discuss the new proposals of the European Commission.

Well, it's time to move on to the EUR/USD price charts, and on Monday we will traditionally start with the weekly timeframe.

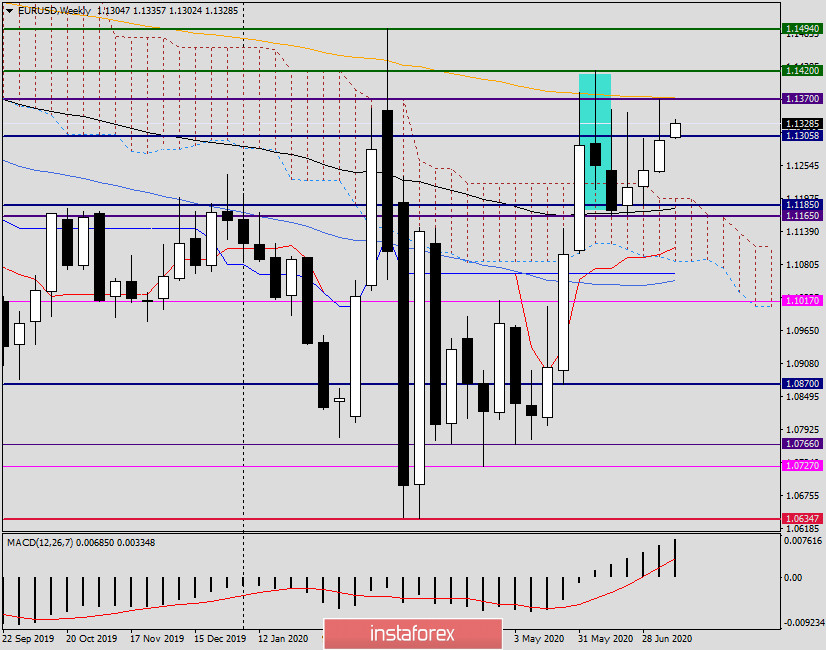

Weekly

Looking at the weekly chart, for some reason I remembered the movie "Groundhog Day". Bulls for the euro repeatedly try not just to raise the rate above 1.1300, but also to complete trading above this important mark, but constantly fail. At the same time, it is characteristic that the closing price of July 6-10 was at 1.1299 but not higher than 1.1300.

And again, the last weekly candlestick has a rather long upper shadow. This time, a strong technical level of 1.1370 and 200 exponential moving average, which is located right there, blocked the way up.

If we consider both variants of the price movement, then in the case of passing 1.1370, the next targets of the euro bulls will be resistance at 1.1422 and 1.1494. In a downward trend scenario and updating the latest lows at 1.1242, the pair risks falling into the negative technical area of 1.196-1.1165. As you can see, here are the upper border of the Ichimoku indicator cloud, two strong support levels, and the black 89 exponentials.

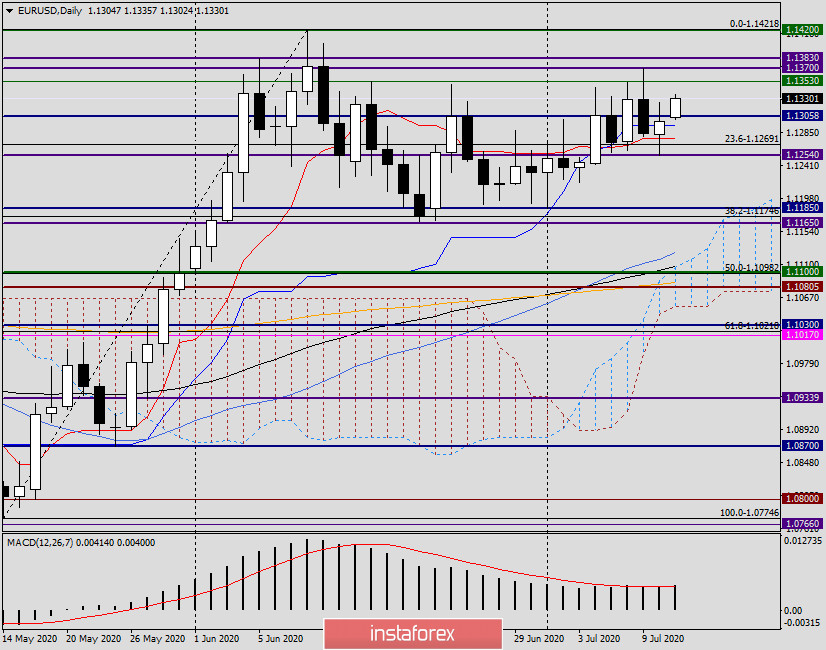

Daily

Friday's assumptions that after the candle for July 9, the euro/dollar is likely to continue to decline, were partially justified. The bears continued to put pressure on the quote, but at 1.1254 there was quite an unexpected demand for the single currency and the pair not only recovered but also managed to finish Friday's trading in positive territory.

Although the closing price of the last daily candle is higher than the Tenkan and Kijun lines, equidistant shadows do not give a clear idea of the further direction of the price movement. Based on the technical picture on the considered timeframes, it makes sense to consider both options for positioning on EUR/USD.

Sales will become relevant if the reversal patterns of candle analysis appear in the price zone of 1.1300-1.1320 at smaller time intervals. I recommend considering purchases after the pair drops to the area of 1.1277-1.1255 and the appearance of bullish candles here, which will indicate a potential increase in the quote.

In conclusion, I would like to note that the main event for EUR/USD will be the decision of the European Central Bank (ECB) and the press conference of the head of this department, Christine Lagarde, which will be held on Thursday, July 16. Also, many more macroeconomic reports from Europe and the US are expected, but they will be mentioned directly on the day of their release.

Good luck with trading!

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română