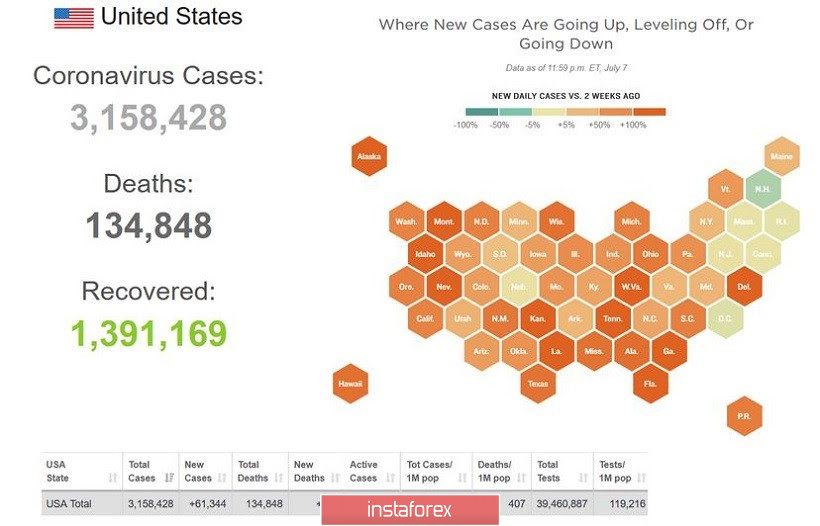

61,000: this figure crippled the dollar's position during the Asian session on Thursday. We are talking about a daily increase in the number of people infected with coronavirus in the United States. This is a new and absolute anti-record for the entire period of the pandemic. This is even higher compared to April, which was when the epidemic was at its peak, the highest increase per day was 57,000. This sad indicator has now crossed a psychologically important line, putting strong pressure on the US currency. The dollar index slumped to 96.2, reflecting greenback sell-offs across the market.

It is obvious that the situation is getting worse almost every day, and the trend itself indicates signs of a second wave of the epidemic in the country. For example, if the daily growth of infected people in the United States fluctuated in the range of 15-25,000 through June 8-24, then this indicator began to show a stable upward trend from June 24, initially exceeding 30,000 and then the 40,000 mark. More than 45,000 cases were registered in the United States every day at the very beginning of July, and then this figure exceeded the 50,000 mark (55-57,000 cases per day).

The number of COVID-19 infected increased by 61,848 people over the past day. The most cases of infection were registered in Texas at 10,199 cases. In the state of Florida, 9,989 people were sick, while 8,561 were infected in California. In addition, authorities in California and Texas also reported a record one-day increase in deaths.

The figures speak for themselves. The chief epidemiologist of the United States announced the alarm at the beginning of last week: he warned that the country "lost control" of the epidemic. According to his estimates, if the current dynamics continue, America will soon face a 100,000 per day increase in infection. And judging by the dynamics of recent days, his words sound plausible.

At the same time, US President Donald Trump still shows equanimity and some detachment from the latest trends, linking the increase in the number of cases with the increase in the number of tests performed. Moreover, he considers calls for a second lockdown in a political context as machinations of the Democrats. The fact is that the coronavirus crisis has significantly shaken Trump's position in the run-up to the presidential election, which will be held in November. According to the latest polls, Joe Biden is ahead of Trump by 8-9%. This situation forces Trump to make "politically expedient" decisions that go against the epidemiological situation in the country. For example, yesterday he said that he intends to put pressure on state governors to open schools in the fall. He did not even rule out canceling school funding if they decide to follow the quarantine restrictions. According to him, in European countries – in Germany, Denmark, Norway, Sweden and many other EU countries, schools are open "and there are no problems".

Such statements by the US president may again lead to a political crisis in the country, as it was already in the spring. At that time, many governors (and not only Democrats) refused to impose strict quarantines, while Trump threatened to force them to do so almost with the help of the army. Now the situation is mirrored: many states at the local level tighten restrictive measures, while the "center", personified by Trump, demands not to cut off the oxygen to the country's economy.

It is obvious that the increase in the number of infected people will continue to put pressure on the dollar, given the current attitude of investors to the US currency. The risk of repeated lockdown scares investors, given the inevitable catastrophic consequences. The dollar bulls have one hope for restoring their positions. According to some experts, now we are seeing "echoes" of July 4 – that is, the Independence Day of the United States. Contrary to the recommendations of doctors, many Americans did not observe social distancing on this day, marking a national holiday. The incubation period of COVID-19 is (on average) about 4-5 days, and the current spike in incidence may be related to this factor.

Therefore, the dynamics of the next few days are quite important in the context of the prospects for the US currency. If the disease rate goes down, the dollar will "return to service" - at least, it will stop its fall. Otherwise, the coronavirus factor will continue to exert strong pressure on the greenback.

If we talk about the euro-dollar pair, here we see the triumph of buyers. On the daily chart, the pair is located above the Kumo cloud of the Ichimoku indicator and above all its lines. The bullish Parade of Lines signal indicates the potential for further price growth. In addition, the pair is located on the upper line of the Bollinger Bands indicator. This also indicates bullish sentiment among traders. We can consider the 1.1422 mark as the nearest target of the upward movement – this is the local price high reached on June 10. Stop loss can be placed in the area of the first support level – this is the average line of the Bollinger Bands indicator on the same timeframe (price 1.1260).

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română