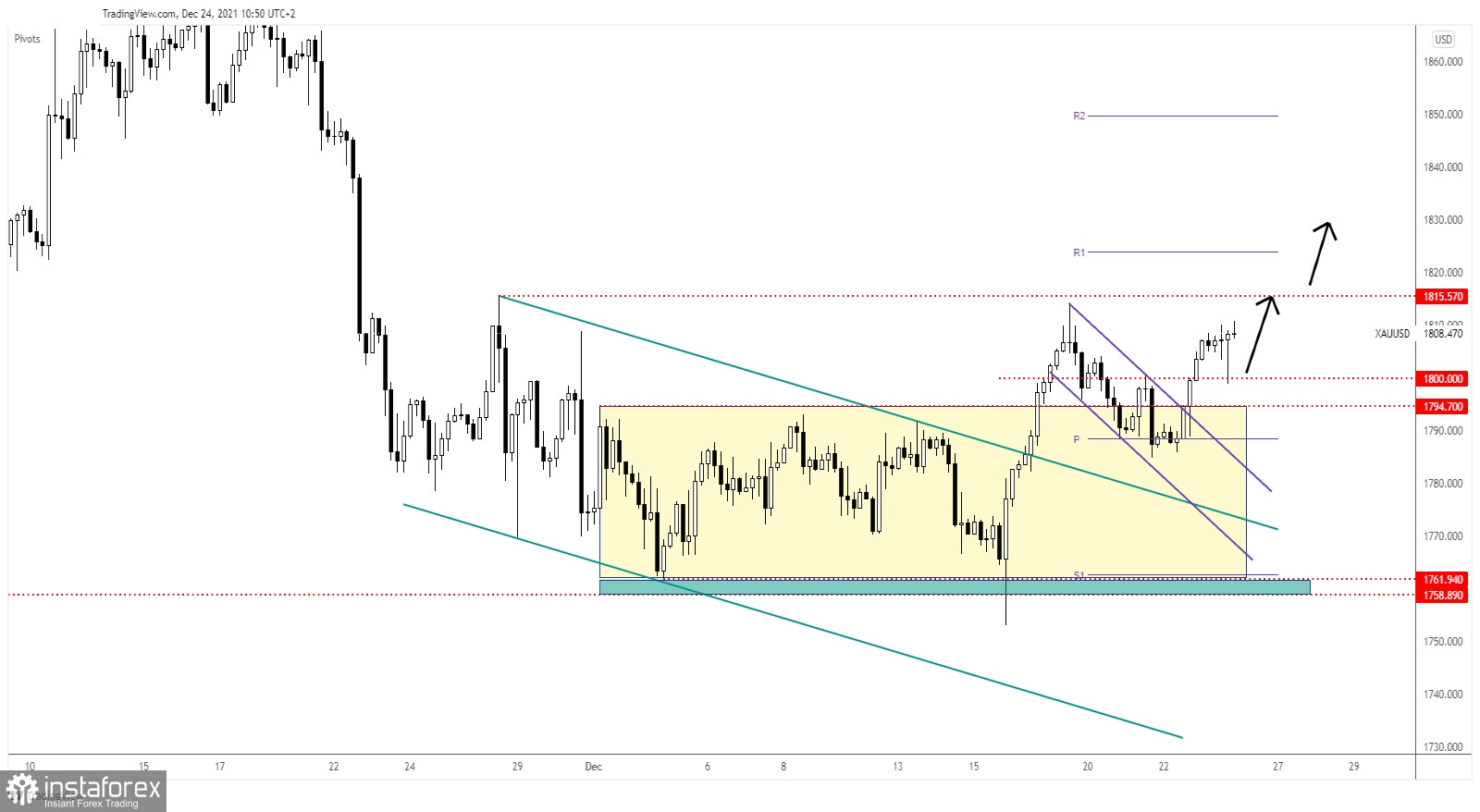

Gold is trading at 1,808.47 level at the time of writing far above yesterday's low of 1,798.91. It has increased as much as 1,810.74 today. After yesterday's rally from below 1,800 psychological level, XAU/USD remains bullish.

Still, in the short term, the price could retreat a little or it could move sideways before jumping higher. Gold rallied as DXY plunged in the short term. The US data came in mixed yesterday, so as long as USD drops, XAUUSD could approach and reach new highs.

The US Core PCE Price Index reported a 0.5% growth versus 0.4% expected, the Durable Goods Orders rose by 2.5% beating the 1.9% estimates, while the Core Durable Goods Orders increased by 0.8% versus 0.6% forecasts. In addition, the Unemployment Claims and the New Home Sales came in worse than expected in yesterday's session.

XAU/USD Seems Undecided!

As you already know from my analyses, XAU/USD was expected to come back higher after finding support on the weekly pivot point (1,788.53) and after escaping from the minor down channel.

Yesterday, it has dropped a little to retest the 1,800 level. As you can see, it has printed only a false breakdown with great separation below this level signaling strong upside pressure.

Gold Prediction!

1,815.57 is seen as the next major upside target. Gold could approach and reach even if it drops a little or if it moves sideways in the short term. As long as it stays above the 1,800, XAU/USD could resume its upwards movement. An upside continuation is expected after escaping from the down channel pattern.

A valid breakout above the 1,815.57 static resistance could activate a larger upwards movement ahead.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română