Surprisingly, in fact, all the macroeconomic data released yesterday turned out to be noticeably better than forecasts. Investors perceived European data as more significant than the US ones, which led to a noticeable strengthening of the single currency. US data could only bring a little variety into what is happening. But the only thing that was enough for them was a halt to the euro's growth.

In many ways, the rise of the single currency was caused by retail sales, which grew by 17.8% over the month. Growth was projected at 14.8%. This led to the fact that on an annualized basis, the pace of decline in retail sales slowed down from -19.6% to -5.1%. But it was expected that they would slow down only to -8.6%. So optimism is quite justified for itself, since there is a noticeable increase in consumer activity in Europe. And this is one of the key factors necessary to start economic recovery.

Retail sales (Europe):

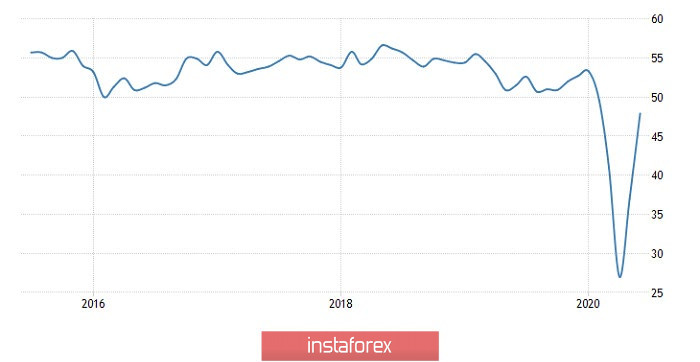

The final data on business activity indices in the United States even led to a slight rebound. But it was caused not so much by the data itself, but rather by technical factors, as the euro grew quite actively. The growth itself began long before the publication of retail sales data. So the business activity indices were just a reason for a small local correction. Although the index of business activity in the service sector increased from 37.5 to 47.9. The composite business activity index rose from 37.0 to 47.9. The preliminary estimate indicated an increase in the indices to 46.7 and 46.8, respectively.

The composite index of business activity (United States):

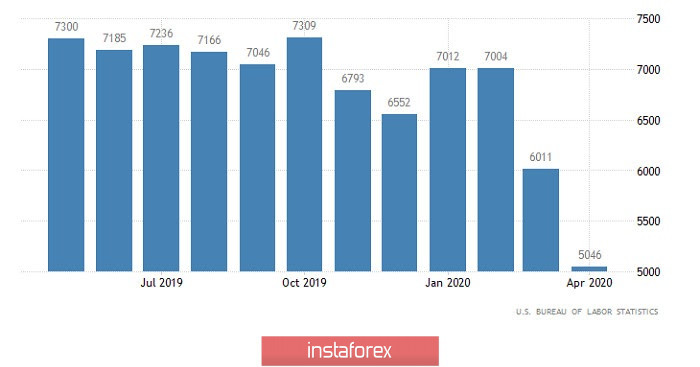

The macroeconomic calendar is essentially empty today, and only JOLTS data on open vacancies in the United States can arouse interest. However, the reduction in the number of these most open vacancies from 5,046,000 to 4,500,000 is unlikely to impress anyone. After all, when the unemployment rate is significantly reduced, it is logical that the number of open vacancies will also decrease. However, the euro still looks somewhat overbought. At least locally. So the JOLTS data may contribute to a minor correction.

Number of open vacancies JOLTS (United States):

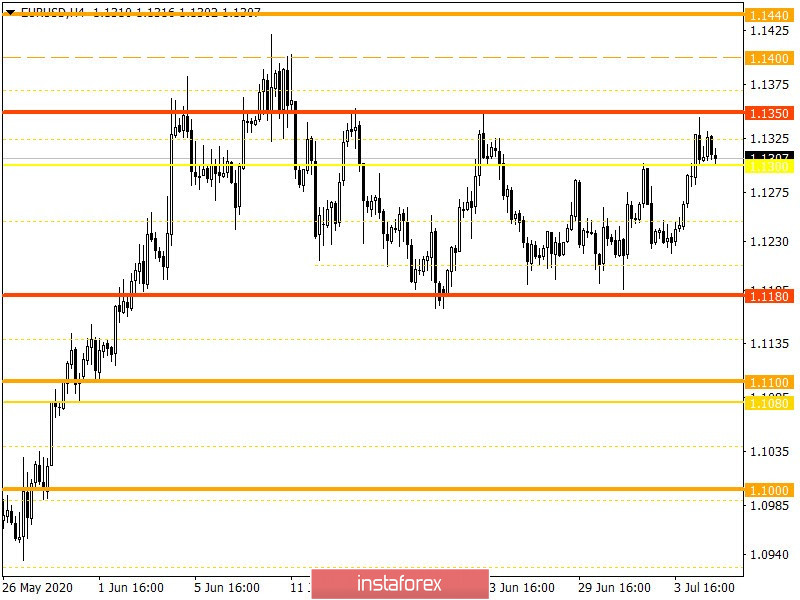

From the point of view of technical analysis, we see speculative activity, against which the quote managed to get closer to the 1.1350 mark, where the upper limit of the variable band passes 1,1180//1,1300//1,1350. In fact, once again, market participants felt the pressure of sellers, who naturally slowed down the quote and gave an impetus to short positions.

Relative to the dynamics, another acceleration of volatility is recorded, which is several times higher than the dynamics of last Friday.

Looking at the trading chart in general terms (daily period), you can see that the variable ranges are 50% composed of doji type candles, which indicates instability and fluctuations.

It can be assumed that if the price is pinned below 1.1290, a reversal turn may occur, which will direct the quote towards the values of 1.1250--1.1200--1.1190, which corresponds to the boundaries of the range.

An alternative scenario is considered if the price is pinned higher than 1.1350, which will mean a breakout of the range.

From the point of view of a comprehensive indicator analysis, we see that the indicators of technical instruments on hourly and daily periods signal a purchase, by focusing the price between 1.1300/1.1350 values.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română