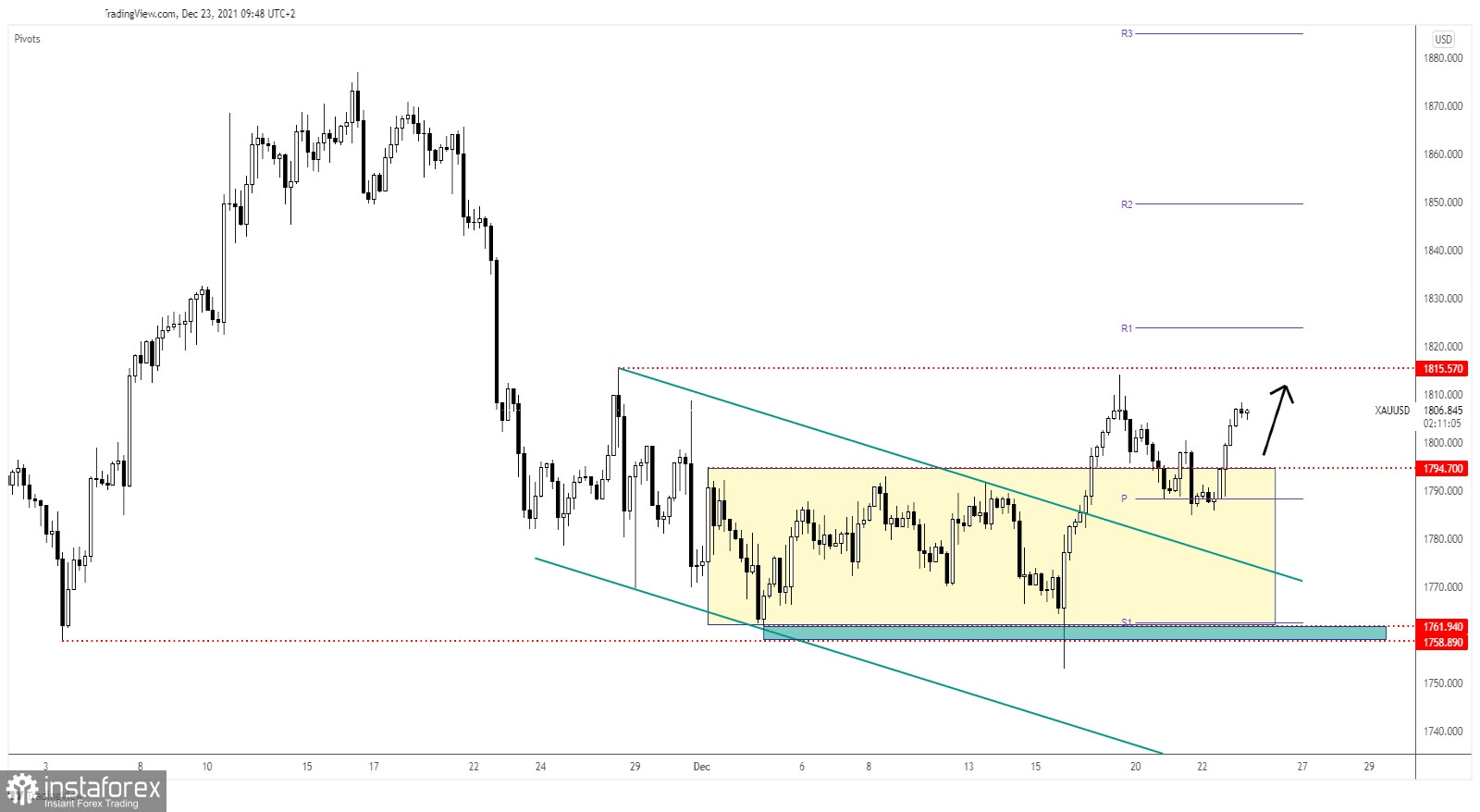

The price of gold rallied confirming that the corrective phase is over. In the short term, XAU/USD dropped a little after its previous swing higher. I've told you in my previous analyses that Gold could register only a temporary decline before resuming its upwards movement.

XAU/USD rallied as the Dollar Index plunged in yesterday's session despite the fact that the US Final GDP and the CB Consumer Confidence reported better than expected data. Today, the US is to release high-impact data, the economic figures will have a significant impact on the XAU/USD. Better than expected US data could boost the USD and could weaken Gold. Don't forget that the Canadian GDP report could have a significant impact as well.

XAU/USD Correction Is Over!

The price of gold decreased a little after failing to reach the 1,815.57 static resistance. It reached the weekly pivot point (1,788.44) where it found support. Then, it rallied ignoring the 1,794.70 obstacle.

In the short term, we cannot exclude a minor retreat after its amazing rally. It could come back to test and retest the 1,800 psychological level before jumping higher. The levle of 1,815 stands as an upside obstacle, as a target. A major upward movement could be activated by a valid breakout above 1,815.57.

XAU/USD Outlook!

After the current rally, the price of gold could retreat a little or it could move sideways trying to accumulate more bullish energy before jumping higher. A valid breakout above the 1,815.57 static resistance could activate an upside continuation. In the short term, we had a long opportunity after the rate failed to stabilize below the weekly pivot point.

Now, we'll have to wait for a retreat or for a valid breakout above 1,815 before considering going long.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română