The US ore market report for June came out as a whole in accordance with forecasts and should be recognized as strong - 4.8 million new jobs were created (forecast 3.0 million), unemployment declined from 13.3% to 11.1% (forecast 12.3%), while wage growth is slightly worse than forecast - 5% yoy against 6.6% a month earlier.

Despite the fact that a record number of new jobs were created in June, the reaction of the markets was quite restrained. A slight strengthening of the dollar after the announcement of the results ended on Monday morning with the resumption of its weakening across the entire spectrum of the market. Political factors seem to come to the fore, but politics, as we know, is just a concentrated reflection of the economy. A deep political crisis is brewing in the United States.

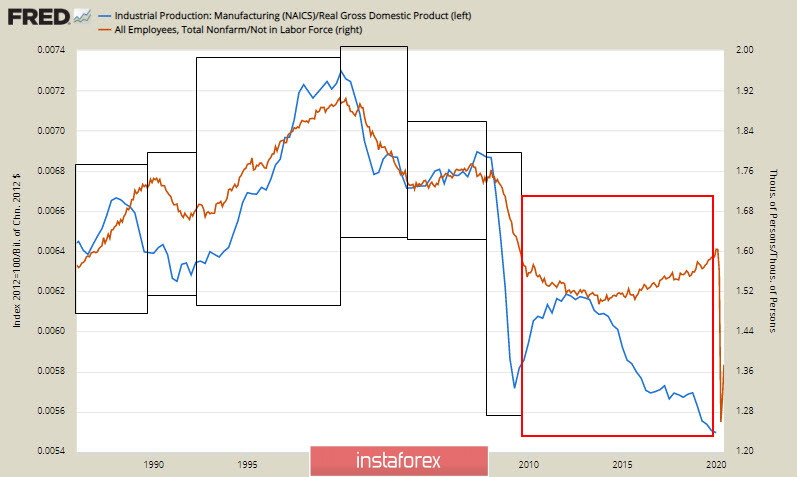

Looking at the graph below, it can be seen how over the course of several decades, two indicators, namely the share of industrial production in the structure of GDP and the new jobs created by the US economy, were closely correlated. Economic growth has always been accompanied by an increase in the number of new jobs for relatively unemployed (falling out of the workforce), and, conversely, periods of recession have also worsened the employment situation.

This continued until 2009, when the recovery from the financial crisis led to the formation of an inverse correlation – the labor market was recovering against the background of the degradation of the real economy.

The last 10 years have been the ideal of the so-called postmodern model of the economy, in which the real economy can degrade, "but it doesn't mean anything", because the service sector is growing, and with it, the population's incomes that provide demand, employment and the expansion of the tax base.

The pandemic showed that the stability of such a system is extremely low and the record increase in unemployment in the United States in April-May is not force majeure, after which growth will resume with a vengeance, but merely bringing the labor market in line with realities. Right now, the labor market corresponds to the level of US economic development, its industrial potential, which means that tens of millions of unemployed are not temporary, they are forever.

In his message on July 4, President Trump announced his intention to put an end to unrest in the country, which the media perceived as preparation for the Civil War. The election campaign takes on the character of a civil confrontation, and the riots look like the beginning of a coup attempt, and Trump, obviously, perceives them.

The US is entering a difficult period in its history, and the dollar will experience additional pressure under these conditions. Thus, we should expect a gradual increase in demand for protective assets, primarily for gold.

EUR/USD

ECB President, Christine Lagarde, speaking at an online forum in AIX-EN-Provence, France, announced the approach of deep changes in the global economy. The new reality requires new measures, and according to Bloomberg, the ECB is planning a rift over how the asset purchase program should be implemented in relation to weaker countries. The rules require linking the volume of buybacks to the size of the economy, but Italy stands alone in this row, which irritates other "small" countries.

The Sentix Investor Confidence Index will be released today, and this is the only significant economic publication this week. If the CFTC report shows investors' interest in the euro, the EUR/USD will continue to rise to the June maximum of 1.1421. The consolidation period ends, and the exit from the range is likely to go up. Testing the nearest target 1.1340/50, is possible today.

GBP/USD

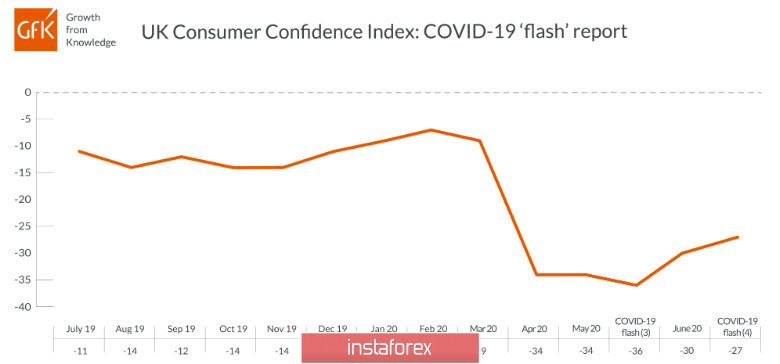

Gfk's consumer confidence index continues to grow slowly from a recent historic low of -36p, rising to -27p in June.

At the same time, growth is very weak. A natural pullback after lifting restrictive measures, can be interrupted at any moment and the overall assessment of the economic situation remains at a very low level.

The pound still lacks its own impulse for growth, and only the weakness of the dollar prevents it from going below the border of 1.22 range. A shift to the upper boundary of 1.27 in the next couple of days looks a little more likely, however, any attempt to grow will be unstable and will lead to a new pullback.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română