The GBP/USD pair rallied despite the fact that the United Kingdom data came in worse than expected. The price rallied as the USD was punished by the DXY's drop. The Dollar Index failed to take out the 96.64 level and at the moment of writing it was traded at 96.10. The massive drop weakened the greenback which dropped versus all its rivals.

The UK Final GDP reported a 1.1% growth versus 1.3% expected. At the same time, the Current Account dropped from -13.5B to -24.4B far below -15.8B expected, while the Revised Business Investment dropped by 2.5% whereas specialists expected a 0.4% growth.

Surprisingly or not, the USD dropped despite the US Final GDP, Final GDP Price Index, and the CB Consumer Confidence came in better than expected earlier.

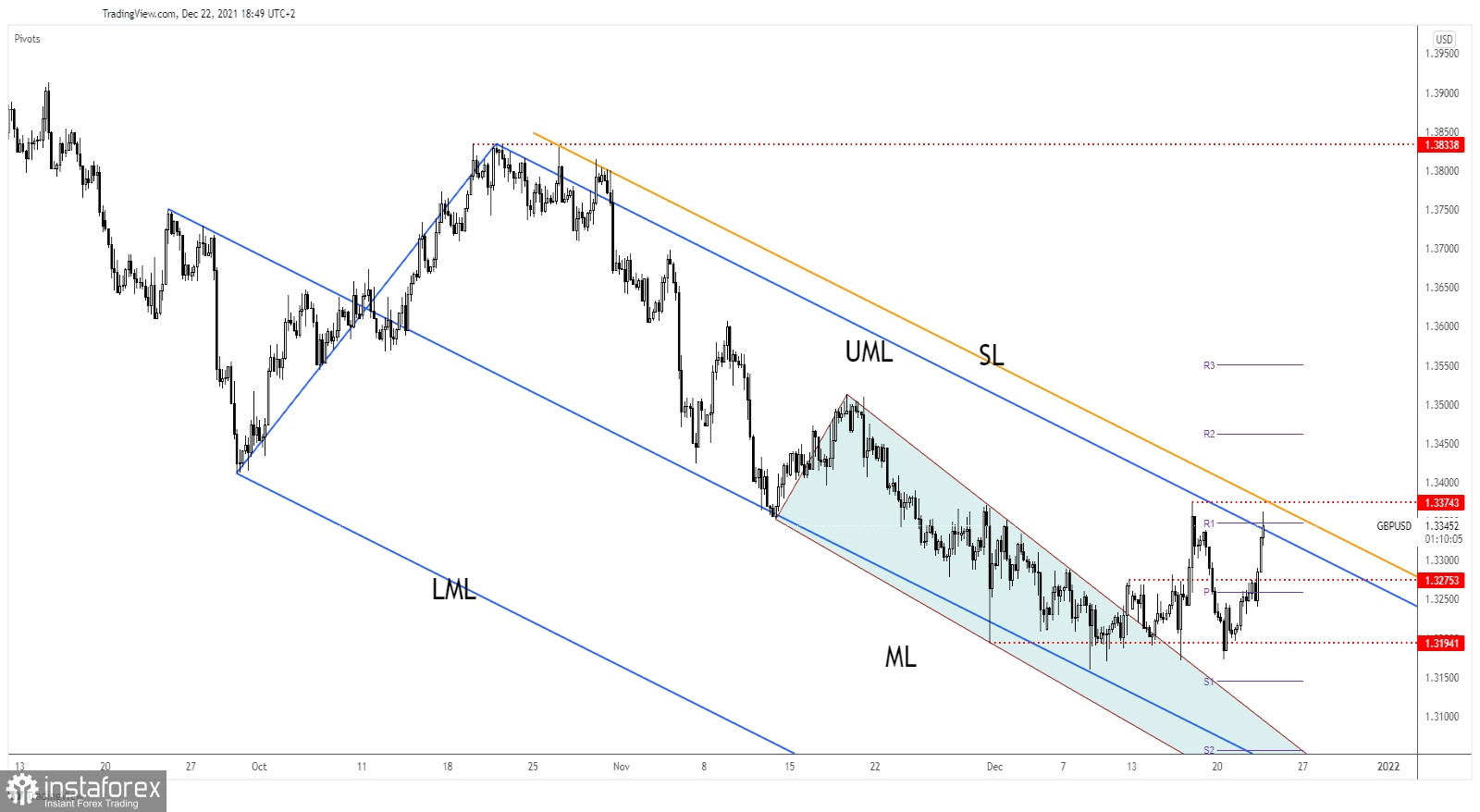

GBP/USD almost to hit resistance

GBP/USD found support on the 1.32 psychological level again. Now, it has reached the Descending Pitchfork's upper median line (UML) and the weekly R1 (1.3348) which are seen as upside obstacles. The outside sliding line (SL) and the 1.3374 are seen as upside obstacles as well.

It remains to see how it will react around these levels. In my opinion, only a valid breakout above the 1.3374 and above the sliding line may activate a larger upwards movement. A bearish pattern here may announce a new leg down.

GBP/USD outlook

After its aggressive rally, we cannot exclude a temporary decline. A larger leg higher, a bullish reversal may be activated by a valid breakout above 1.3374 and above the outside sliding line. We have a confluence area at the intersection between these two levels.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română