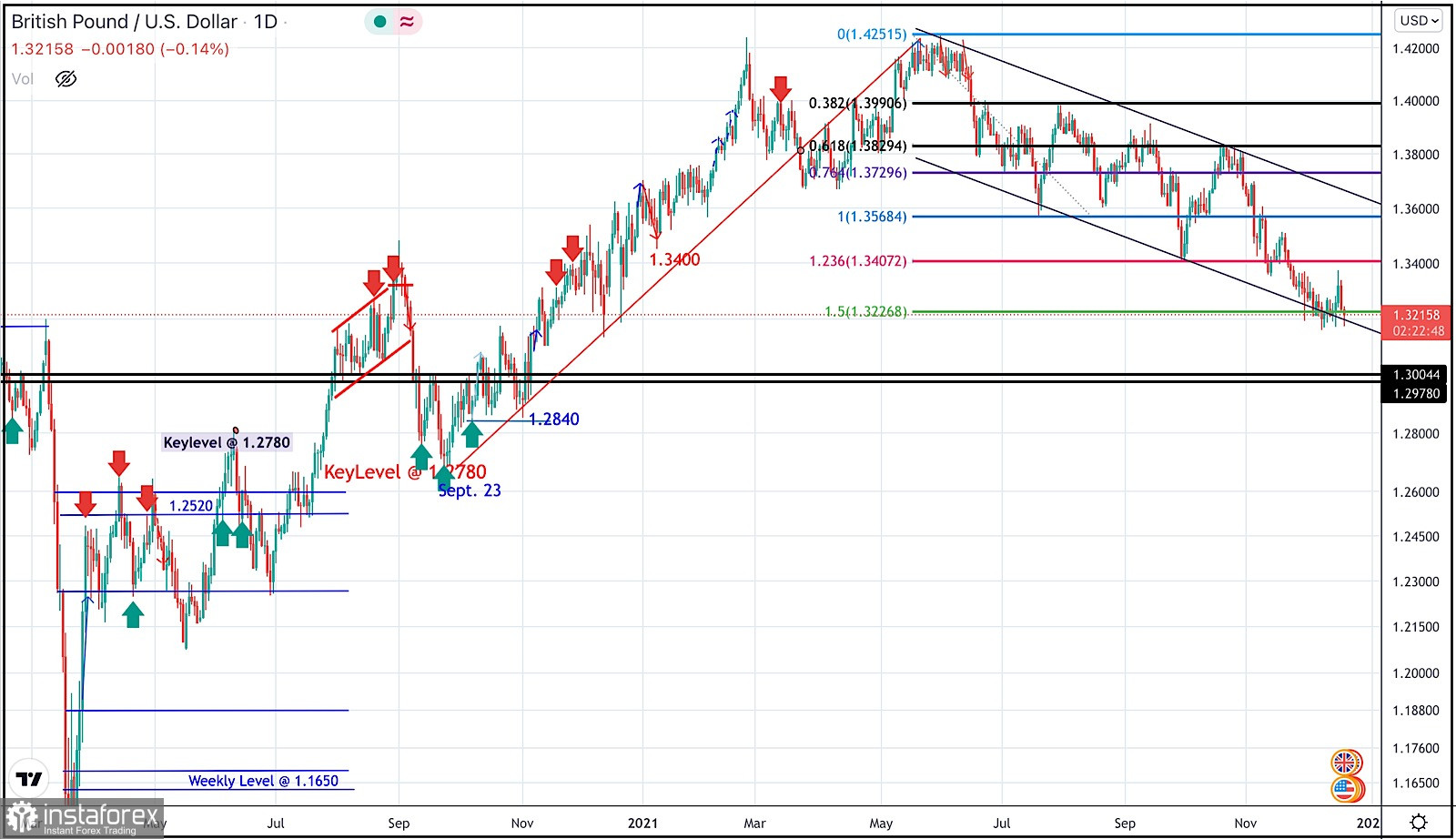

The GBPUSD pair has been moving sideways with some bearish tendency while bearish breakout below 1.3600 was needed to enhance further bearish decline.

Bearish breakout below 1.3680 enabled further bearish decline towards 1.3400 which corresponded to 123% Fibonacci Level of the most recent bearish movement.

This was a good entry level for a corrective bullish pullback towards 1.3650 and 1.3720 which was temporarily bypassed.

Shortly after, the pair was testing the resistance zone around 1.3830 where bearish pressure originiated into the market.

Currently, the intermediate-term outlook remains bearish as long as the pair maintains its movement within the depicted channel below 1.3400.

More bearish extension was expected towards 1.3220 where the lower limit of the current movement channel came to meet with Fibonacci level.

However, Conservative traders should be looking for BUY trades around these price levels after significant bullish recovery has originated around 1.3220.

Hence, the current price levels should constitute a valid Entry Point for BUYERS with projected targets around 1.3600

On the other hand, the price level of 1.3570 stands as a key-resistance to be watched either for bearish reversal or a continuation pattern upon any upcoming visit.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română