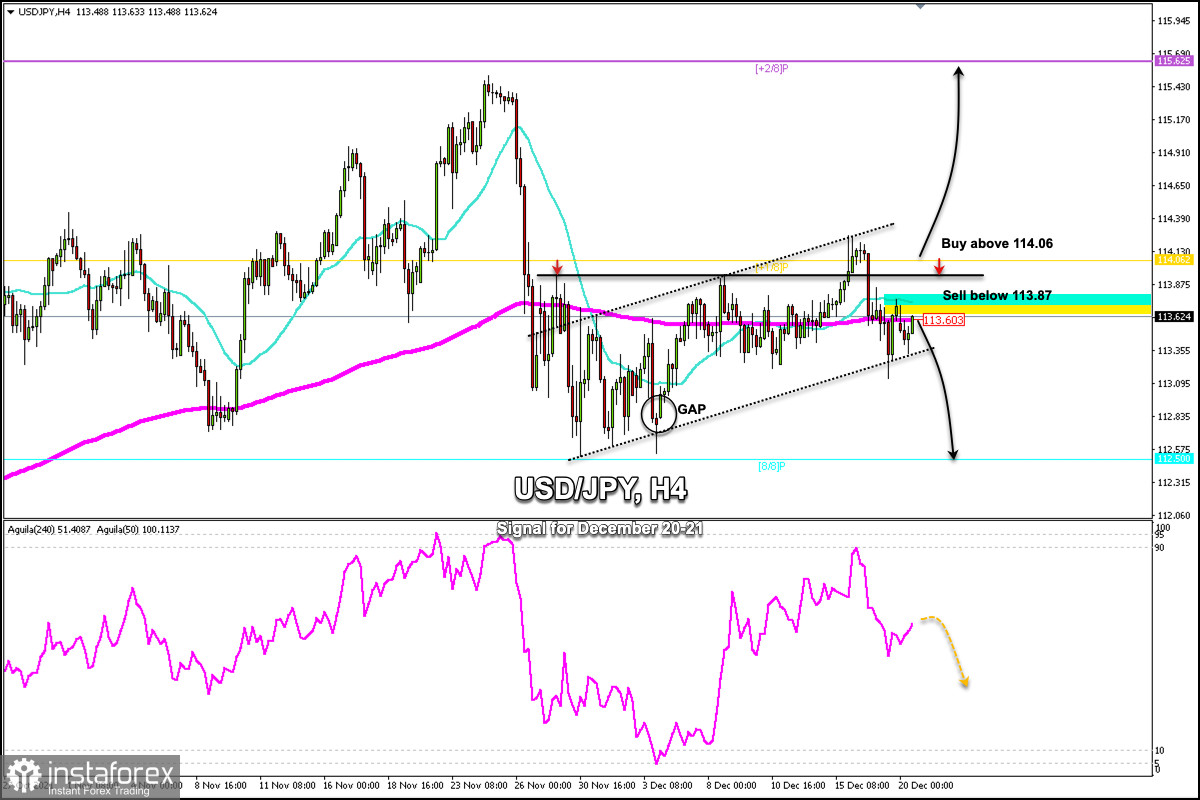

Since November 26, USD / JPY has been trading below the strong resistance of +1/8 Murray located at 114.06. Every attempt to break it has been unsuccessful. The pair is now approaching the 200 EMA and it is likely to face this resistance again. If it fails to break above the level of 114.00, the yen is likely to resume its downward movement.

The 200 EMA and the 21 SMA (113.60) have become strong resistance for the Japanese yen. So, we should expect it to trade below this zone and it could be an opportunity to sell, targeting 112.77.

A sharp breakout and a daily close above 114.06 could weaken the Japanese currency and the pair may quickly reach the resistance of +2/8 Murray located at 115.30.

The catalyst for the yen to exceed 114.00 could be the result of the approval of the budget of 317,000 million dollars by the parliament of Japan, which will include cash payments for families with children, to support the economy.

On December 3, USD / JPY left a bullish GAP at 112.77. So far, this gap has not been covered and as the yen is trading below 113.60 (200 EMA). It is likely to be under bearish pressure and drop to 112.77 and 8/8 Murray at 112.50.

Our forecast in the next few hours for the yen is a consolidation below 113.87. As long as USD/JPY is trading below this zone, we will have an opportunity to sell with the target at 113.09 and 112.50 (8/8).

The market sentiment report for today, December 20, shows that there are 64.18% of operators who are selling the USD / JPY pair. This data provides a bullish sign in the long term. We could expect a decline to 112.50 (8/8). Then, the price may again resume its upward movement with the target at 114.06 (-1/8) and 115.62 (+2/8).

Support and Resistance Levels for December 20 - 21, 2021

Resistance (3) 114.25

Resistance (2) 113.98

Resistance (1) 113.70

----------------------------

Support (1) 113.27

Support (2) 112.84

Support (3) 112.55

***********************************************************

A trading tip for USD/JPY on December 20 - 21, 2021

Sell below 113.87 or 113.63 (200 EMA) with take profit at 112.77 (GAP) and 112.50 (8/8), stop loss above 114.20.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română