The USD/CAD pair rallied in the short term as the Dollar Index has managed to recover after its last downside movement. The USD has taken full control as the Federal Reverse is expected to hike its rate next year.

Today, the US Leading Index could report a 0.9% growth but I don't think that it will have an impact on the USD/CAD pair. In the short term, the sentiment could be changed only by the Canadian retail sales data which will be released tomorrow. The Retail Sales indicator is expected to register a 1.0% growth versus a 0.6% drop in the previous reporting period, while the Core Retail Sales could report a 1.7% growth.

USD/CAD Strongly Bullish!

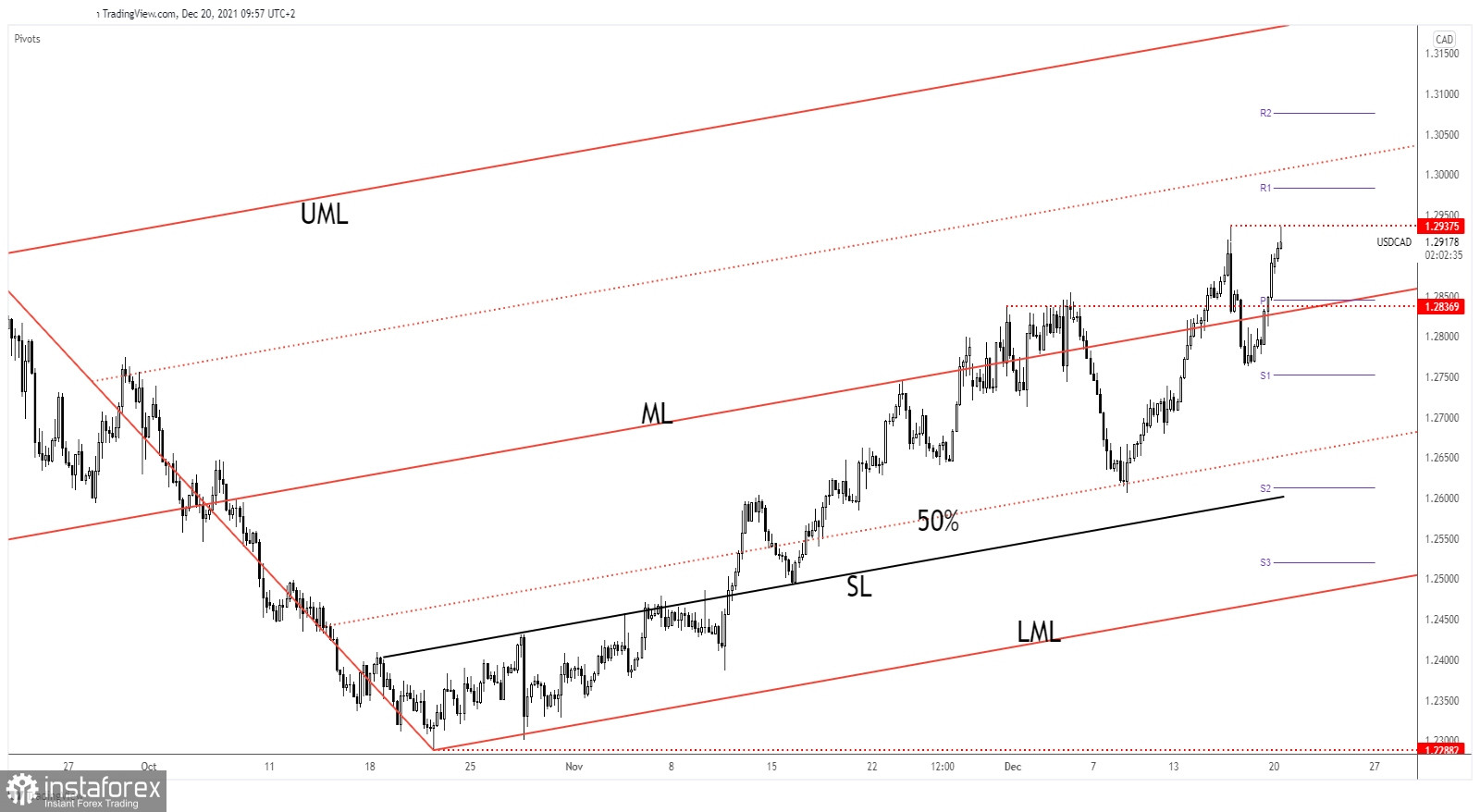

USD/CAD challenges the 1.2937 former high which stands as a static resistance. In the short term, it has decreased a little, but it has failed to stabilize under the ascending pitchfork's median line (ML).

Making a valid breakout above the 1,2937 may signal further growth towards the weekly R1 (1.2983) and towards 1.3 psychological level. Technically, after the current rally, we cannot exclude a temporary decline if the Canadian retail sales will come in better than expected.

USD/CAD Prediction!

A minor retreat could bring new long opportunities. Also, jumping, closing, and consolidation above the 1.2937 former high could be seen as a buying opportunity. In the short term, on the lower timeframes, USD/CAD could move sideways below 1.2937 and above 1.29 signaling an imminent upside breakout.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română