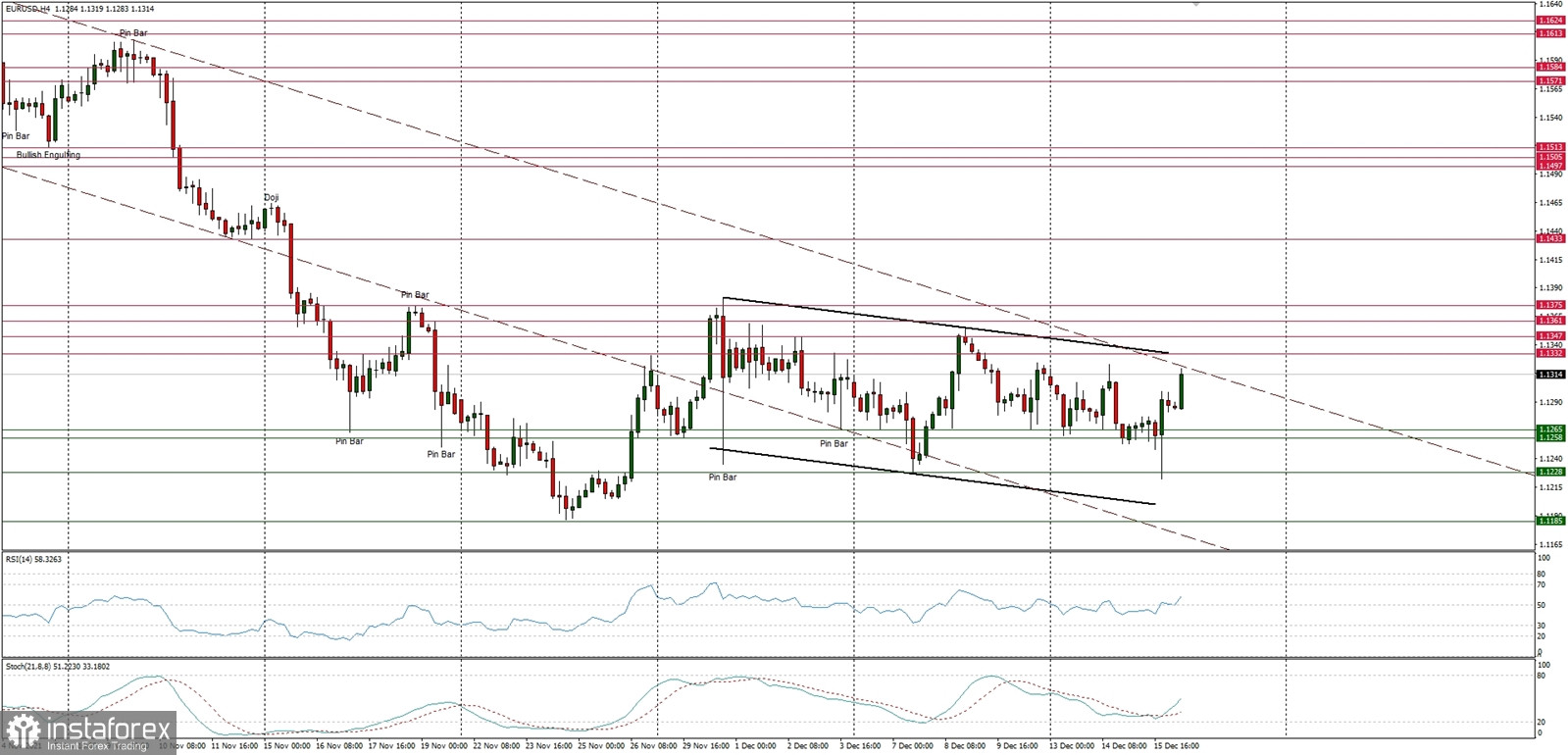

Technical Market Outlook

The EUR/USD pair volatility has increased ahead of ECB interest rate decision today. It is quite clear on the H4 time frame chart that the market tries to break out from the narrow range located between the levels of 1.1258 - 1.1332. This zone is right in the middle of the channel as well. Please keep an eye on the level of 1.1258, this is the line in sand for bulls in the short-term. Any violation of this level would likely result in a sell-off acceleration towards the level of 1.1228 and 1.1185 again. Only a sustained breakout above the 1.1332 - 1.1375, key short-term supply zone, would have change the outlook to more bullish the nearest future.

Weekly Pivot Points:

WR3 - 1.1504

WR2 - 1.1423

WR1 - 1.1371

Weekly Pivot - 1.1302

WS1 - 1.1231

WS2 - 1.1155

WS3 - 1.1080

Trading Outlook:

The market is in control by bears that pushed the price way below the level of 1.1501 and 1.1360, which was the lowest level since November 2020. The next important long-term target for bears is seen at the level of 1.1166. The up trend can be continued towards the next long-term target located at the level of 1.2350 (high from 06.01.2021) only if bullish cycle scenario is confirmed by breakout above the level of 1.1909 and 1.2000.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română