After the US Federal Reserve's meeting, which was the focus of the market at the end of the week, the passions around the EUR/USD pair calmed down a bit. Both the interest rate of the Federal Reserve and monetary policy has predictably remained at the same level, which allowed the American and European currencies to maintain balance. However, experts pay attention to a number of risks in the dynamics of the EUR/USD pair.

One of these surprises may be a sharp rise in the euro, especially when risk appetite increases. Investors who prefer risky assets are invested in emerging markets currencies, as well as in the Euro area's currency of payment. Recently, the actions of the Franco-German alliance and the Eurogroup, aimed at financing the economies of the eurozone, the most affected by the devastating consequences of the COVID-19 pandemic, have contributed to the popularity of the Eurocurrency.

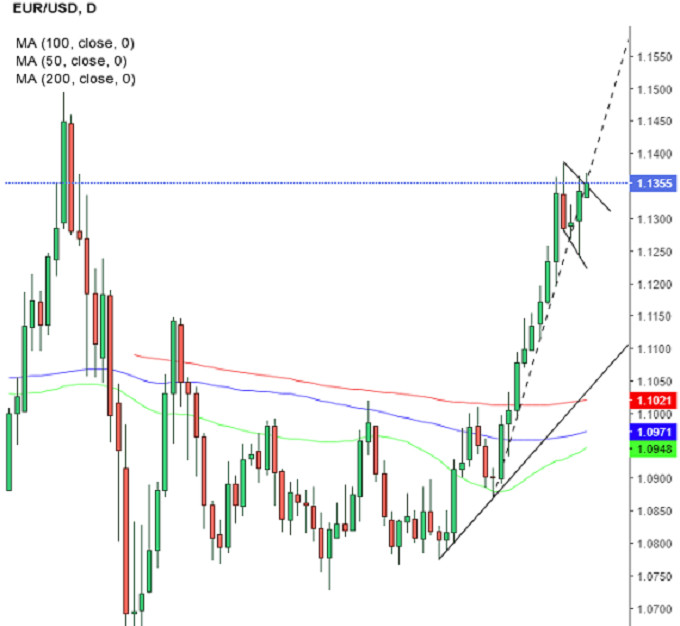

Currency strategists at Nordea Bank are confident in the continued growth of the single currency. They recommend long positions in relation to the EUR/USD pair. According to bank analysts, the nearest goal of the long is 1.1670. According to experts, this forecast indicates a good chance of a pair to return to levels above 1.2000. Currently, the EUR/USD pair is far from these marks: on Thursday morning, June 11, the pair was around the level of 1.1339 - 1.1340. Later, the EUR/USD pair moved in the range of 1.1353 - 1.1355.

A small dollar pullback contributes to the high probability of a rise in the European currency. Experts believe that one of the factors of pressure on the USD is the expansion of stimulus measures by the Federal Reserve, aimed at the early recovery of the American economy, which was shaken by the coronavirus. On the one hand, this can support the dollar, on the other, it can lead to sales of risky assets. For the euro, on the contrary, the ECB's efforts to increase cash injections have become a positive factor.

In this situation, analysts recommend using a short-term reduction of the EUR/USD pair for profitable purchases, however, as in Nordea Bank, they focus on long positions. According to market strategists, the expanse for "bears" on the EUR/USD pair can only come after a fundamental change in market sentiment, when the selling majority reverses and believes in the further growth of the US-Euro pair. However, such a sharp change in the trend is unlikely now.

According to analysts, the US currency is more prone to unpredictable dynamics. It is currently supported by capital inflows from the US monetary authorities. The dollar was actively moving up for several days before the Fed meeting, but the rally of the EUR/USD pair was restrained by some uncertainty about the actions of the regulator. Recall, at the end of the meeting, the Federal Reserve decided to maintain the current federal funding rate in the range of 0-0.25%. The regulator does not consider the possibility of raising rates until 2022, economists emphasize. According to a statement by Jerome Powell, the head of the Fed, he is ready to adhere to the chosen monetary stimulus policy, injecting as much money into the economy as is needed to restore the US labor market, which the coronavirus hit the hardest.

After the meeting of the Federal Reserve, the dollar weakened a bit, losing some of the European position. However, experts say that the dollar is still the main currency in the market. Moreover, the long-term prospects of the eurocurrency paired with the US currency still remain weak. Considering the dynamics of the euro from a technical point of view, analysts pay attention to its attempts to form a "shooting star". Experts consider this a "bearish" signal for EUR, which can lead to the formation of a downward trend. The advantage for a single currency may be the appearance of another figure – the so-called"falling flag". Experts are afraid of increasing negative trends in relation to the Euro, which is now set to win and tries to rise.

According to analysts, the confrontation between US and European currencies will continue in the near future. Despite the fact that the euro shows growth prospects in the short and medium-term, the US dollar can take the lead anytime. Now, the dollar is slightly weak, but experts believe that this is a temporary retreat, a grouping before a rapid jump. Analysts concluded that an unpredictable dollar can do a simple warm-up before a long run, dragging its European competitor into another rally.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română