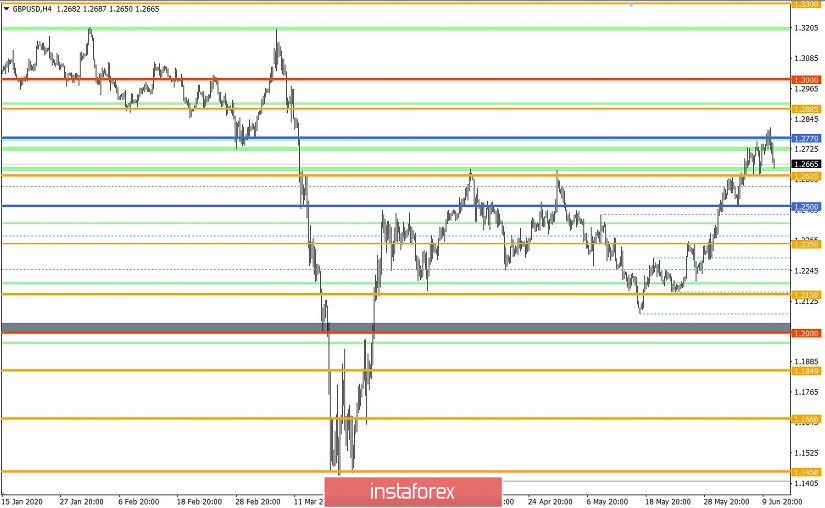

From the point of view of a comprehensive analysis, you can see the price touching the control level, and now let's talk about the details.

The last trading day had a high concentration of trading forces within the control level of 1.2770, where the quotes still managed to consolidate above a given coordinate, but after that, there were consolidations of long positions. In fact, market participants are still considering the level of 1.2770 as resistance, although testing it for strength.

An attempt to consolidate the price above the level of 1.2770 on a four-hour period [candle from 9:00 UTC+00 on 06/10/20] indicates that the level lends itself to pressure from buyers, where breakdown is not excluded with a subsequent price approach, unless, of course, buyers lose their strength with corrective movement.

Regarding the theory of development, everything is in a shaky formation. There are clear signals of a change in the clock component at first glance, where there will be a shift of the ranges 1.2150 // 1.2350 // 1.2620 ----> 1.2770 // 1 , 3000 // 1.3300. At the same time, there is a high speculative coefficient of trading positions, which signals a local market sentiment. In this case, in order for the ranges to change, which, in principle, is possible if we refer to the laws of the past, market participants need to regroup their trading forces, forming a corrective move or widespread stagnation in the market. Otherwise, the situation with the inertial move, strengthening the forces of speculative positions, will come to an end.

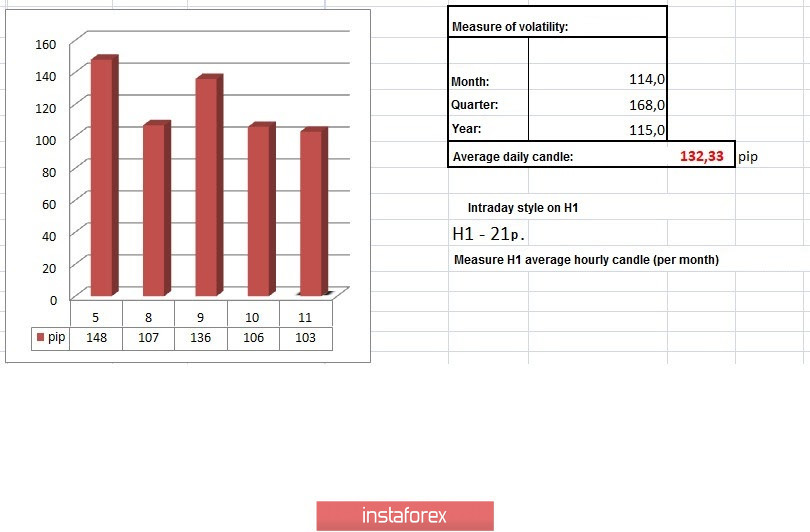

In terms of volatility, it may seem that we are seeing a slowdown relative to the dynamics of past days, but this is not so. Daily activity still has an indicator above 100 points, which indicates a continuing process of acceleration.

As discussed in the previous review, traders were expecting a rebound from the level of 1.2770, which is probably why there were such huge consolidations of long positions that did not allow the continuation of the upward move in this period.

Considering the trading chart in general terms, the daily period, it is worth highlighting high activity, but upon careful examination, you can see that the price is simply returning to the original amplitude.

The news background of the past day contained inflation data in the United States, where it recorded a decline from 0.3% to 0.1%, which turned out to be even worse than the forecast of 0.2%.

The main event of the day can rightfully be considered a meeting of the Federal Committee for Open Market Operations, where the rate was left at the same level, 0-0.25%, which, in principle, is not surprising. The most interesting was ahead of us. So, according to the head of the Fed, Jerome Powell, the regulator expects the rate to remain at this level in 2020 - 2022, and we will not discuss additional quantitative easing in the near future.

"The ongoing public health crisis will greatly affect economic activity, employment and inflation in the short-term and create significant economic risks in the medium-term. In the light of these events, the committee decided to maintain the target range of the federal funds rate at the level of 0 - 0.25%," the message on the Fed website says.

The reaction of the market to the results of the meeting was expressed in local price jumps, but then a downward direction was chosen in favor of strengthening the US dollar.

In terms of the general informational background, we have a surge in activity on the Brexit topic again. So the main negotiator from the European Union, Michel Barnier, said that the British side refuses to seriously engage with the EU in the four main areas of dialogue within the framework of Brexit.

In this case, Barnier had in mind issues related to the economy and trade, competition, fisheries, and legal cooperation.

Finally, the chief negotiator from the EU said that Britain wants a lot, as if it is a member of the EU.

"The truth is that in many areas, the UK requires much more than Canada, Japan or many other trading partners. The British are keen to maintain the benefits of a member state without restriction. It strives to choose the most attractive elements of a single market without any obligations," said Michel Barnier.

Today, in terms of the economic calendar, we have data on the labor market in the United States, where weekly unemployment claims will be published. So, the number of initial applications should be reduced from 1,877,000 to 1,500,000, and repeated applications should be reduced from 21,489,000 to 19,890,000. Expectations are pretty good, although performance is still very high.

Further development

Analyzing the current trading chart, it can be seen that the US dollar was rapidly strengthening, winning back most of the jump from the level of 1.2620 during the Pacific and Asian sessions. In fact, we have another round between the levels of 1.2620 / 1.2770, only now in a downward direction. The situation is very difficult, since buyers are still in the market, which means that the pressure between the levels will remain for some time.

We can assume that the quote will try to get closer to the level of 1.2620 again, where it is worthwhile to carefully analyze the behavior of market participants and consolidation points, since you should not exclude the price rebound with a reverse move to 1.2770. The main strategy will be the tactics of working on the breakdown of established boundaries, where it will be clear that the market is moving to a new range of fluctuations of 1.2770 // 1.3000 // 1.3300 or the correction will get a second chance.

Based on the above information, we derive trading recommendations:

- Buy positions are considered in case of a price rebound from the level of 1.2620, in the direction of 1.2750. The main positions will be after the price consolidates above 1.2800, with a local fluctuation within 1.2770/1.2800 for a four-hour period.

- Sales positions are considered in the direction of the level of 1.2620. There will be subsequent transactions after the price consolidates below the level of 1.2600, with the prospect of a movement to 1.2500.

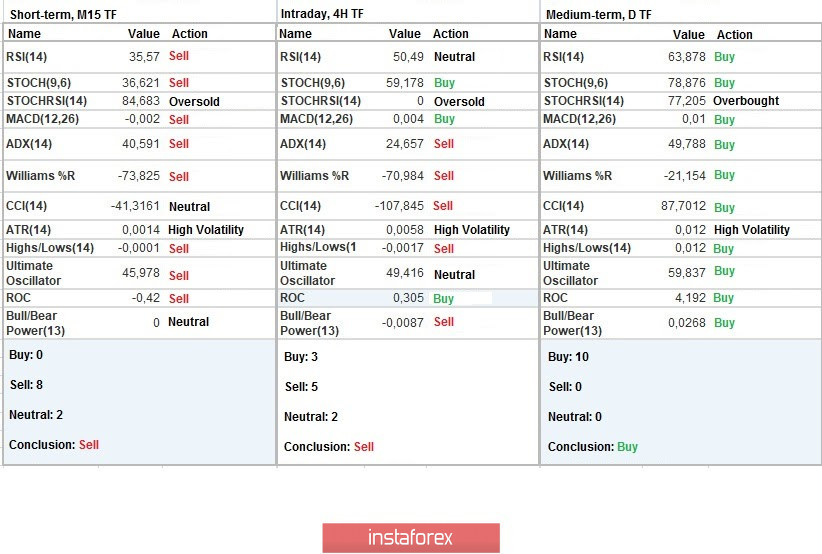

Indicator analysis

Analyzing a different sector of time frames (TFs), we see that technical instruments have changed the indicator from hourly to downward due to the next approximation of the price to the level of 1.2620 with respect to hourly intervals. The daily periods run on inertia, signaling a purchase.

Volatility per week / Measurement of volatility: Month; Quarter; Year

Measurement of volatility reflects the average daily fluctuation, calculated for the Month / Quarter / Year.

(June 11 was built taking into account the time of publication of the article)

The current time volatility is 103 points, which is already at the level of acceleration. It can be assumed that the activity will continue to develop, where we can see a high volatility in the event of a breakdown of the level of 1.2620.

Key levels

Resistance zones: 1.2770 **; 1.2885 *; 1.3000; 1.3170 **; 1.3300 **; 1.3600; 1.3850; 1.4000 ***; 1.4350 **.

Support Areas: 1.2620; 1.2500; 1.2350 **; 1.2250; 1.2150 **; 1.2000 *** (1.1957); 1.1850; 1.1660; 1.1450 (1.1411); 1.1300; 1.1000; 1.0800; 1.0500; 1.0000.

* Periodic level

** Range Level

*** Psychological level

**** The article is built on the principle of conducting a transaction, with daily adjustment

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română