All those who anticipated that the Federal Reserve could lower the refinancing rate, only points a finger in the direction of Jerome Powell's statements that interest rates are not expected to increase until 2022 of the year. They say that the head of the Federal Reserve system spoke only about raising the refinancing rate, which means that it may well be lowered. However, Jerome Powell did not say anything about lowering interest rates, gently avoiding this topic. Moreover, no quantitative easing is planned. It has already been carried out by allocating almost $ 2 trillion to the United States Government. These funds are now being spent on saving the US economy from complete collapse. So the Federal Reserve intends to look at how incompetenly officials use this grand amount of money, and only in case of their phenomenal inactivity can the regulator think about the possibility of additional infusions. And in many ways, it was the injection of this huge amount of money that was the reason for the weakening of the dollar, which we have contemplated over the past three weeks. However, there is such a strange assumption that the Federal Reserve will not give more money. After all, after 2008,when the Federal Reserve system was just throwing money from helicopters, it became quite obvious that the endless infusion of money does not do much. And the effectiveness of negative interest rates still needs to be proved. But there are big problems with this, since their beneficial effect exists only in theory, but in fact no one has yet seen it. In other words, if the European Central Bank is only expanding its stimulus measures, the Federal Reserve is planning to sit and do nothing really over the next two years. Just observe the situation. This will lead to a gradual increase in the supply of the single European currency, which should return everything to normal, and the dollar will continue to strengthen, which only began strengthening seriously just in 2008. Thus, we can say that the words of Jerome Powell may be the beginning of the end of the local trend for the weakening of the dollar.

A few hours before the announcement of the results of the meeting of the Federal Committee on Open Market Operations and the subsequent presentation by Jerome Powell, supporters of the idea of lowering interest rates and a new quantitative easing received a serious argument. Inflation in the United States has slowed from 0.3% to 0.1%. Moreover, inflation slows down faster than expected, as they predicted a decline to 0.2%. So the United States is quite confidently moving towards deflation. It is for this very reason that Jerome Powell said that interest rates are not expected to rise.

Inflation (United States):

Now, let's return to the trends. It is worth noting that the trend is still quite positive, despite the incredibly terrifying situation in the American labor market. This is indicated by the dynamics of applications for unemployment benefits. So, the number of initial applications may decline from 1,877 thousand to 1,500 thousand. This, of course, is still once in seven or even eight more than usual, but this should still become the lowest value in the last twelve weeks. That is, from the very beginning of all this mess. The number of repeated applications should be reduced from 21,487 thousand to 19,890 thousand. Again, this is almost ten times more than in the usual situation. Nevertheless, the expected result should be the lowest in the last six weeks. So the dynamics in the labor market look encouraging. Although the state of the labor market itself is still a concern.

Repeated Unemployment Claims (United States):

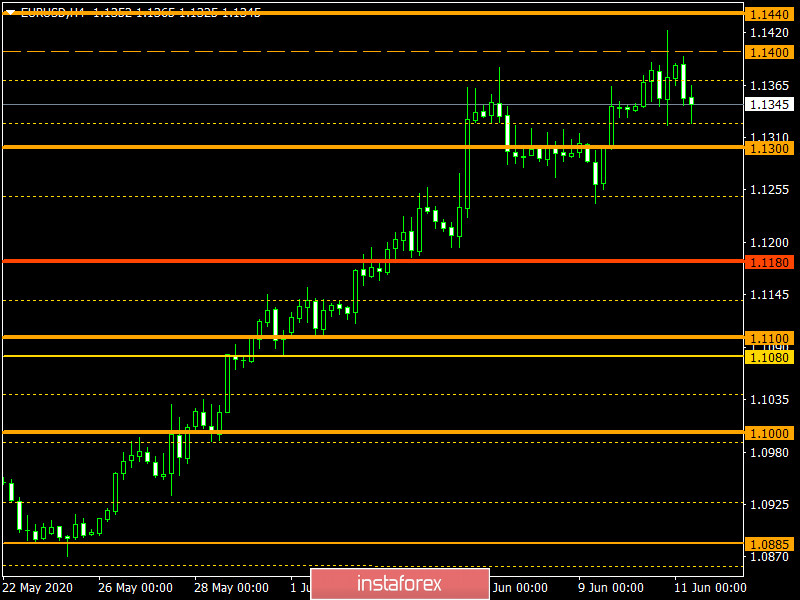

The euro/dollar currency pair showed high activity by the end of last day, where the quote locally managed to reach the level of 1.1422, but after which the stops closed and we saw a rapid downward move. It can be assumed that if the price consolidates below the level of 1.1320, the decline will resume in the direction of the level of 1.1300. After that, it is necessary to analyze the behavior of quotes relative to the level, since the correctional movement standing on the scale has not yet been on the market.

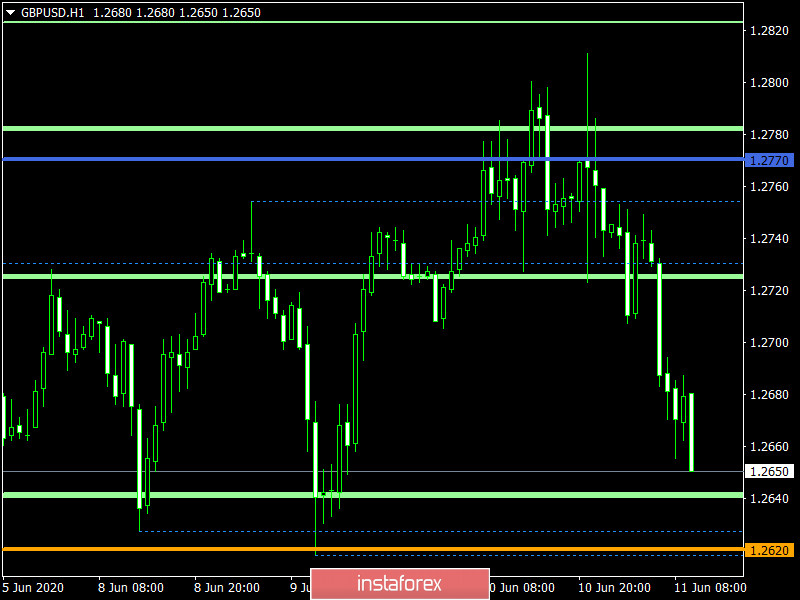

The pound/dollar currency pair managed to rebound the range level of 1.2770, where the quote quickly declined, working out most of the move from the level of 1.2620. It can be assumed that market participants targets the level of 1.2620, where a local slowdown can be expected with subsequent work according to the breakout/rebound method.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română