The Federal Reserve, as expected, left the refinancing rate unchanged. In addition, there was no talk of any additional quantitative easing. The US central bank will closely monitor the development of events, and make further decisions based on what effect the already taken stimulus measures will have. However, Jerome Powell said interest rates were not expected to be raised until 2022. Although he said only about the increase, most likely this applies to the entire monetary policy as a whole. So interest rates will remain unchanged over the next couple of years. The only thing that can change is the expansion of incentive measures. After all, the government has already allocated nearly two trillion. dollars that the Fed has provided. So if these funds are not enough, then the regulator will probably find some other way to inject additional money into the economy. But this is still out of the question.

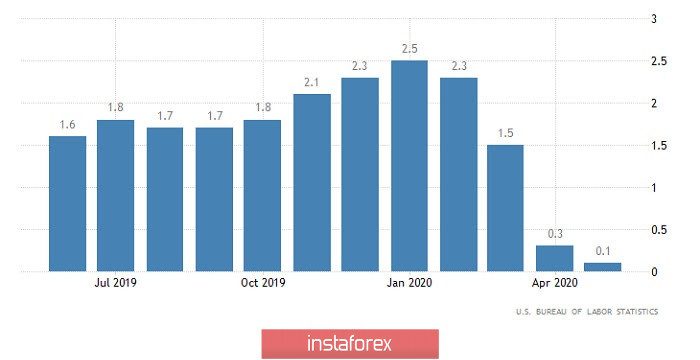

However, the pace of the slowdown in US inflation is going quicker than expected. It decreased from 0.3% to 0.1%, and not to 0.2% as predicted. In other words, the United States, like Europe, is steadily slipping into deflation. And most likely, this is precisely what hindered the dollar from carrying out a full correction.

Inflation (United States):

Nevertheless, the dollar clearly looks much more attractive than the single European currency. Unlike the European Central Bank, the Fed does not take measures to mitigate monetary policy. In addition, despite the catastrophic situation in the labor market, the dynamics are drawn relatively well. So, the number of initial applications for unemployment benefits should decrease from 1,877,000 to 1,500,000. The number of repeated applications may be reduced from 21,487,000 to 19,890,000, which should become the lowest value in the last six weeks. So the dynamics are positive, and inspire at least some optimism.

Repeated Unemployment Claims (United States):

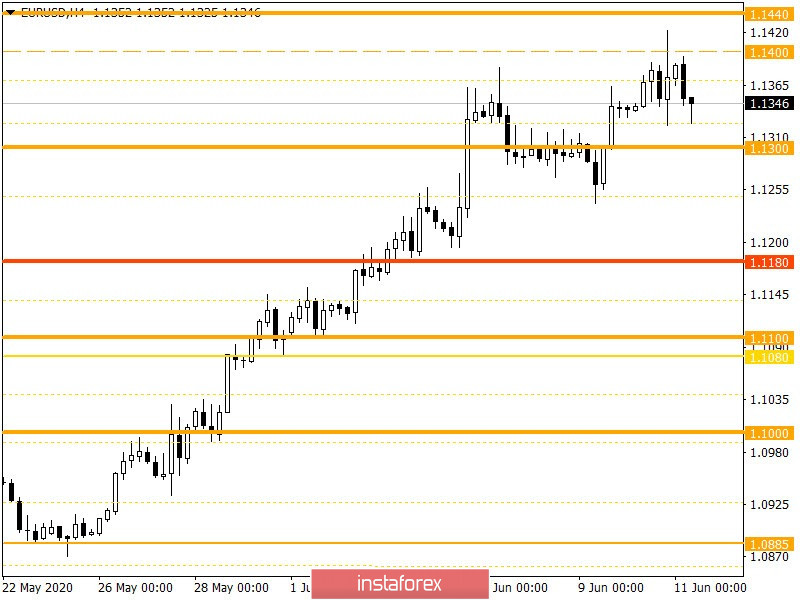

From the point of view of technical analysis, we have high activity associated with the last meeting, where the quote managed to show dynamics of 100 points in less than half an hour, eventually knocking down stops for both sellers and buyers. It is worth noting that, in the wake of speculative activity, the quote locally updated its highs, hitting the 1.1422 mark, thereby bringing us closer and closer to the area where trading forces interact at 1.1440/1.1500.

Based on a number of technical and fundamental factors, the quote ultimately unfolded with the rapid strengthening of the US dollar.

In terms of a general review of the trading chart, the daily period, it is worth highlighting the rapid inertial move of May 26, where the European currency gained more than 500 points, which was a signal of a change in market ticks.

It can be assumed that amid tremendous overbought, as well as the convergence of prices with the area where trading forces interact at 1.1440/1.1500, sellers will try to take advantage of the situation, locally releasing the quote. The prospect of a move in this case will look like a stepwise move, where relative to the price taking points, the scope of a possible correction will be clear.

Specifying all of the above into trading signals:

Sales positions have already been sent towards a variable level of 1.1300, where a temporary slowdown is possible, but if the price marks lower than 1.1290, a sequential descent in the direction of 1.1250-1.1200 can be expected.

From the point of view of a comprehensive indicator analysis, we see that indicators of technical instruments relative to hourly and daily periods still signal a purchase, but there are already shifts, which can lead to a change in signals at hourly intervals.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română