On Wednesday, all market attention was focused on Fed's final decision on monetary policy and its economic forecasts for the second half of the year and the next three years, which left a corresponding mark on the dynamics of world markets in general and the currency market in particular.

Investors believed that the regulator would not take any extreme measures in relation to the current soft monetary rate and would follow it until the US economy showed a sign of a steady growth rate. However, despite such positive expectations, stock indices in Europe and the USA showed a correctional decline before the publication of the bank's communique and its economic forecasts for the second half of this year, as well as the speeches of its leader J. Powell. This could be explained only by the fact that market participants still allowed, on the one hand, the Central Bank to intervene in the dynamics of government bond prices, and on the other, on the background of a likely rapid recovery of the country's economy with a promising start to reduce stimulus measures.

In the published plan, the Fed predicts that the federal funds rate will remain until 2022 in the range of 0.0% -0.25% with a long-term rate of 2.5%. The Bank believes that this year's GDP will decline to 6.5%, but it will amount to 5.0% and 3.5% already in 2021 and 2022, and 1.8% in 2023, respectively. The employment level will move from 9.3% this year to 2023 with a decline first in 2021 to 6.5%, then to 5.5% and 4.1% in the next two years. Inflation will gradually rise from 1.0%, then 1.5% to 1.7%.

Powell noted the existing problems in the economy in his commentary, the risks of the second wave of the coronavirus pandemic, but at the same time, signaled that increased economic growth in the country should be expected in the second half of the year.

In turn, markets reacted to the Fed's decision, its forecasts and Powell's speech by the negative dynamics of stock indices and commodity assets. This can be explained by the desire to fix the previously received profit and only then on the correctional decline to start buying again.

The currency market consolidated with a slight weakening of the dollar in anticipation of speaking at a press conference by J. Powell. But then, following the results of his speech, the dollar began to receive support. We do not expect this to change the trend. Most likely, we are facing a small correction, and amid some new positive messages, the rally in the stock markets, supported by the resumption of the dollar's decline, will continue.

Also on Wednesday, market players turned their attention to the publication of consumer inflation data in the United States. According to the presented consensus forecast, the consumer price index in annual terms was supposed to add 0.2% in May against the growth of 0.3% in April, and its monthly value should decline by 0.1 against the fall by 0.8% a month earlier. However, the values of the indicators were worse than expected. On an annualized basis, the consumer price index grew by only 0.1%, while the indicator showed an expected value of -0.1% in May. But what is noticeably more important is that the basic consumer price index in May was the same as in April -0.1%, and its annual value increased less than the forecast of 1.3%, only 1.2% compared to the April value of 1.4%.

The currency market practically did not respond to these statistics, although it should be noted that if the values were above expectations, then this would most likely lead to a local increase in the dollar before the result of the Fed meeting. This would lead to increased speculation about a possible increase in inflationary pressure, which could become a reason for adjusting the current soft monetary rate of the Federal Reserve, which is really frightening both in the bank and in the financial markets.

We believe that the Fed's decision to leave the current monetary policy course will have a beneficial effect on the demand for stocks of companies and will give them a new impulse for their growth. In this situation, of course, one should not expect an increase in the exchange rate of the US currency, which will be restrained, on the one hand, by the resumption of demand for stocks of companies, and on the other, by low yields on government bonds of the US Treasury.

Forecast of the day:

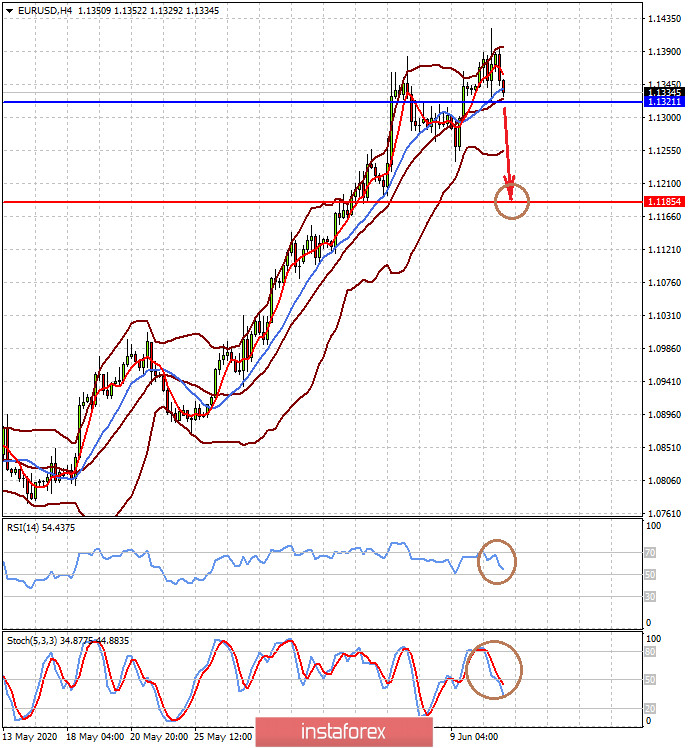

The EUR/USD pair is trading above the level of 1.1320. A decline below this level will lead to a corrective decline of the pair to 1.1185 if there is no new positive news on the markets by the end of the week.

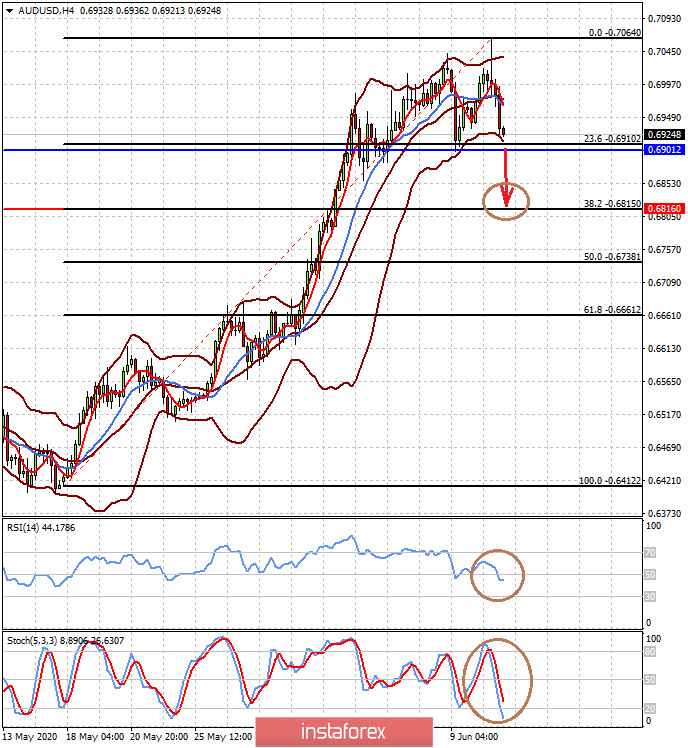

The AUD/USD pair corrected by 23% Fibonacci after reaching a local maximum. The negativity for it is the price decline for commodity and raw material assets in the wake of a correction in the markets, as well as political tensions with China, which is an important economic partner for the country. A decline in price below the level of 0.6900 will lead to a correctional fall of 38% in Fibonacci, to 0.6815.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română