Crypto Industry News:

The Russian central bank continues its strict policy on the cryptocurrency industry, officially banning mutual funds from investing in cryptocurrencies such as Bitcoin.

The Bank of Russia has published an official statement on the regulation of investment opportunities by investment funds.

Despite the increase in the number of assets available for investment by mutual funds, the document prohibits fund managers from buying cryptocurrencies as well as "financial instruments whose value depends on the prices of digital assets."

The statement emphasized that mutual funds are not allowed to provide cryptocurrency exposure to both qualified and non-qualified investors.

The Bank of Russia previously recommended asset managers to exclude cryptocurrencies from exposure to mutual funds in July 2021. According to a report by the local news agency RBC, there were no Russian mutual funds with exposure to cryptocurrencies, even though there had been no formal prohibition so far.

Technical Market Outlook

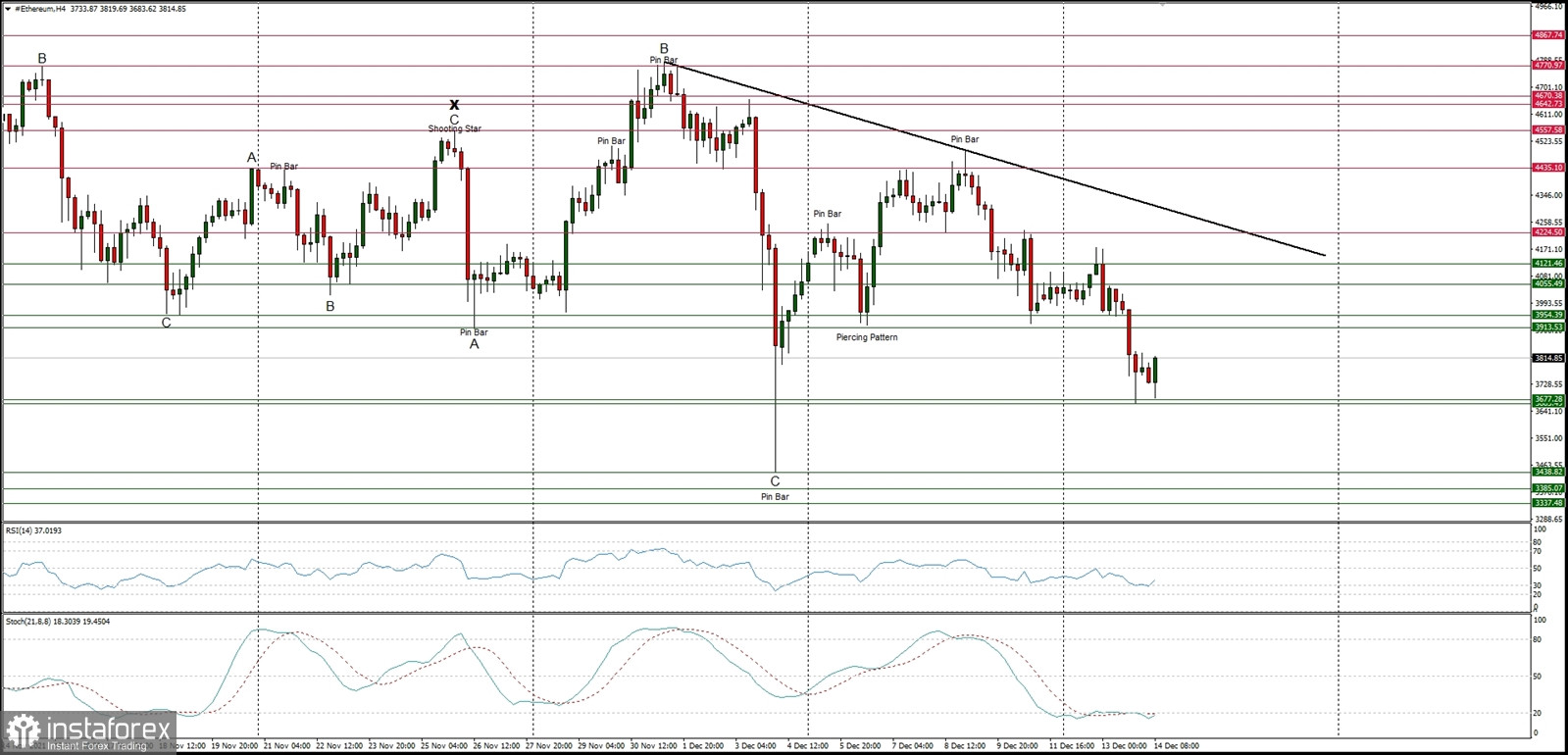

The ETH/USD pair has made another lower low at the level of $3,666 as the bears approach the key short-term technical support. In a case of a further move down, the next target is seen at the swing low at the level of $3,438. Moreover, in order to extend the bounce, bulls need to test and break through the short-term trend line resistance located at the level of $4,300 and head towards the level of $4,435. Despite the extremely oversold market conditions at the H4 time frame, the bears are still on control of the market.

Weekly Pivot Points:

WR3 - $4,978

WR2 - $4,721

WR1 - $4,397

Weekly Pivot - $4,163

WS1 - $3,831

WS2 - $3,582

WS3 - $3,258

Trading Outlook:

The ABCxABC complex corrective cycle might be terminated, so the next long-term target for ETH is seen at the level of $5,000. Nevertheless, in order to continue the long-term up trend, the price can not close below the technical support at the level of $2,906. The level of $1,728 (61% Fibonacci retracement of the last big impulsive wave up) is still the key long-term technical support for bulls. The level of $3,677 is the key mid-term technical support for bulls.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română